- United States

- /

- Consumer Durables

- /

- NYSE:PHM

How Does Pulte’s 4.9% Weekly Jump Shape Its Value Outlook for 2025?

Reviewed by Bailey Pemberton

If you are trying to figure out whether to make PulteGroup part of your portfolio, you are definitely not alone. The stock has caught plenty of attention after a rollercoaster year and some fresh price movements. In just the past week, PulteGroup jumped 4.9%, working off steady momentum that has led to a 27.8% gain year-to-date. That kind of performance is hard to ignore, especially when we zoom out and see an eye-popping 252.1% return over the last three years. Of course, the stock has cooled slightly over the past twelve months, down 0.5%, but that minor pullback helped reset expectations and may have shifted the risk landscape in investors’ favor.

What is really interesting, though, is not just how the market has responded; it is how the company actually stacks up on fundamental value. PulteGroup currently earns a valuation score of 5 out of 6 according to our undervaluation checks, suggesting it may be underappreciated in more ways than one. For a company with nearly 200% five-year gains and a track record of riding through market waves, that is worth a closer look.

Let us unpack exactly how that score comes together by looking at different ways analysts measure value, and then, maybe even more important, consider what those numbers might be missing. There is a more insightful approach to understanding valuation, and we will get there by the end of the article.

Approach 1: PulteGroup Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a way to estimate a company's intrinsic value by projecting its future cash flows and then discounting those amounts back to today's dollars. This approach aims to answer the question: what is PulteGroup actually worth if you add up all the cash it is expected to make over the coming years, adjusted for the time value of money?

Currently, PulteGroup generates $1.33 billion in free cash flow. Analysts forecast steady performance, with cash flows projected to grow year by year and reaching nearly $3.6 billion in 2035 based on both analyst forecasts and extrapolation. These estimates, while subject to change, provide a clear picture that the company could continue to generate substantial value well into the next decade.

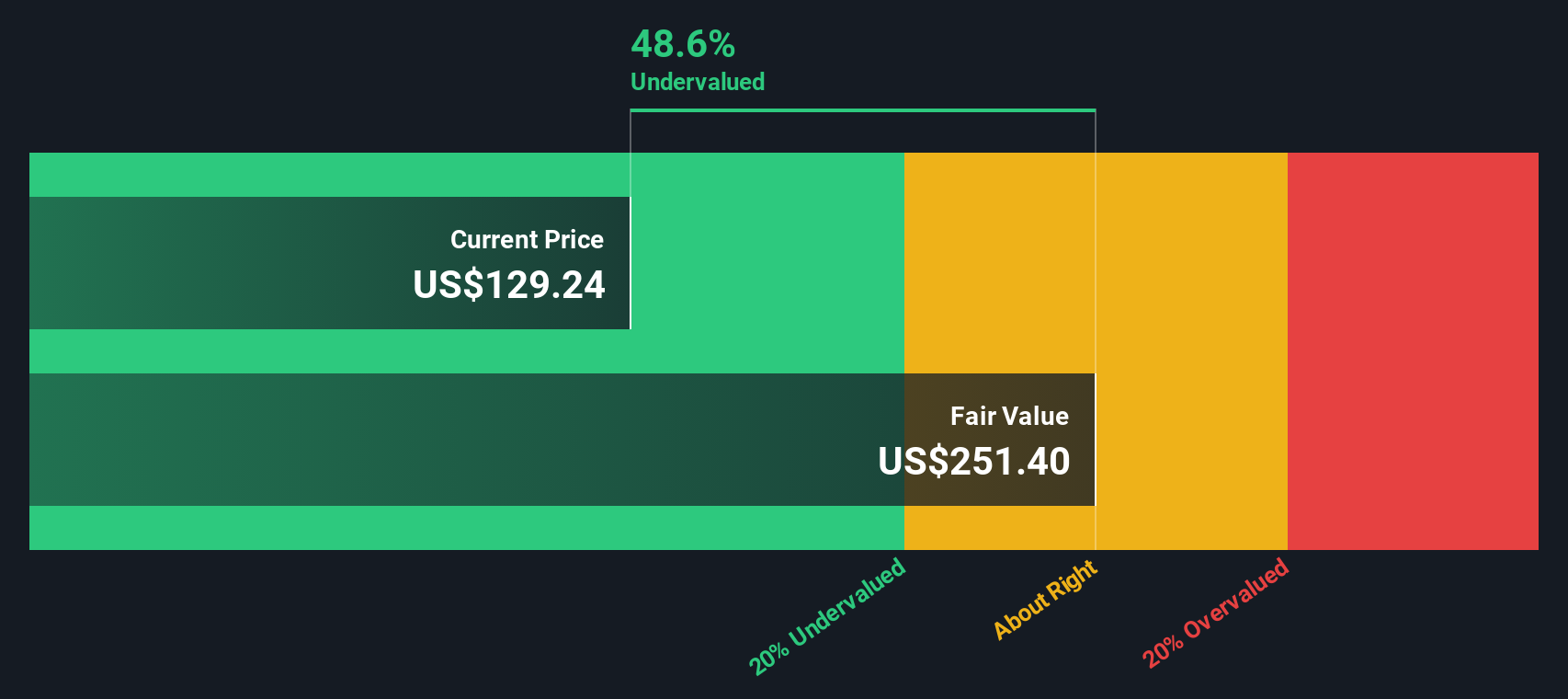

Based on the DCF model, PulteGroup's estimated intrinsic value comes in at $250.26 per share. Compared to the current share price, this figure implies the stock is trading at a 45.0% discount, suggesting significant undervaluation by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PulteGroup is undervalued by 45.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: PulteGroup Price vs Earnings (P/E)

For profitable companies like PulteGroup, the Price-to-Earnings (P/E) ratio is a go-to valuation metric because it allows investors to compare what they are paying for each dollar of earnings. A reasonable P/E gives insight into how the market values the company's current profitability in the context of its growth prospects and risks. In general, higher growth expectations or lower risk tend to justify a higher P/E, while slower growth or elevated risk might pull it downward.

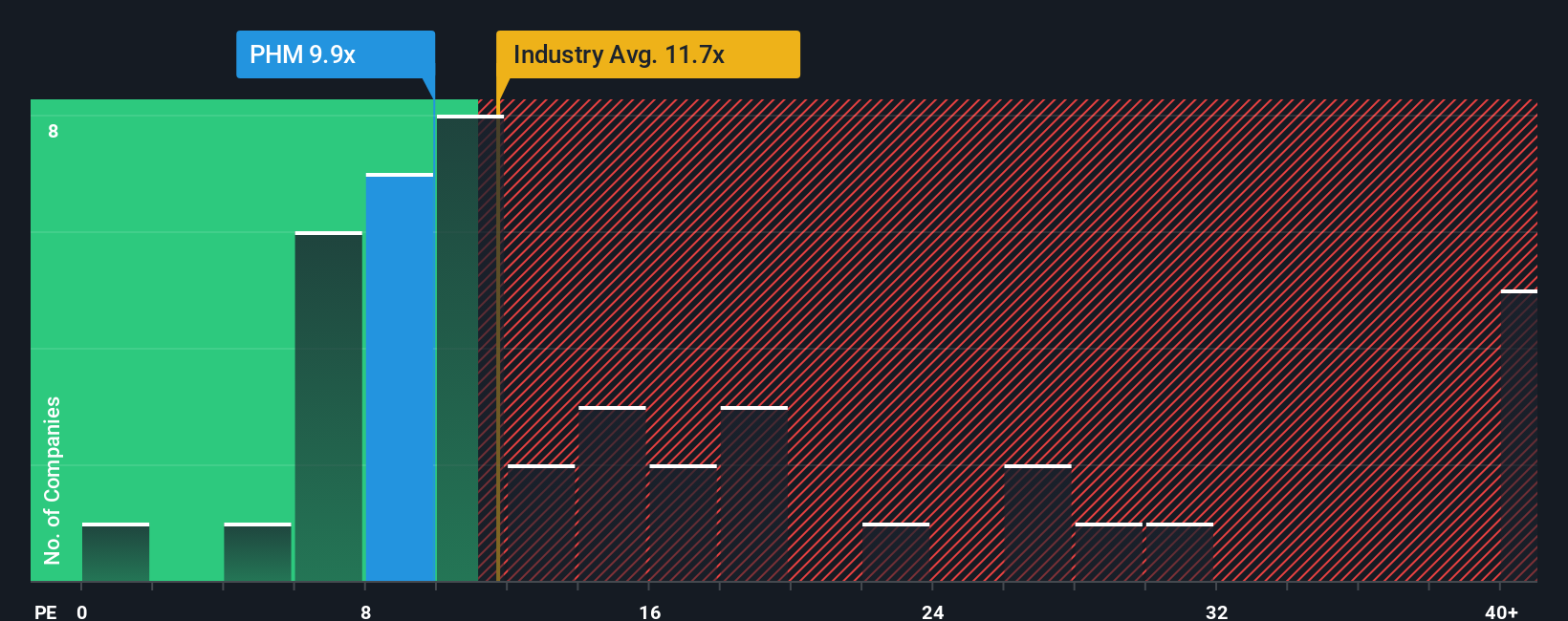

PulteGroup's current P/E ratio sits at 9.9x. To put that in perspective, the average for companies in the Consumer Durables industry is 11.7x, and the average among peers is 12.8x. That alone suggests the stock trades at a noticeable discount to comparable companies.

However, determining what is truly fair takes a deeper look. That is where Simply Wall St’s Fair Ratio comes in. This proprietary metric estimates the ideal P/E for a company by assessing not just industry comparisons, but also earnings growth, profit margins, market capitalization, and specific risks. By including these extra factors, the Fair Ratio shapes a more personalized benchmark for the stock than peers or industry averages alone.

Right now, PulteGroup’s Fair Ratio is calculated at 14.9x. Comparing this to the actual P/E of 9.9x highlights a significant gap, indicating the market may be undervaluing the company’s current and future earnings potential based on its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PulteGroup Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story—your perspective on what matters most for a company like PulteGroup—including your beliefs about its fair value and your expectations for future revenue, earnings, and margins. Narratives let you build a bridge between the facts and figures and your own investment thesis by connecting what you think is happening in the business with what those numbers mean for the stock price.

Narratives are easy to create and share right on Simply Wall St's Community page, where millions of investors can craft, adjust, and compare their views in real time. Instead of just relying on standard ratios, Narratives empower you to see how changes in news, earnings, or other data automatically update your fair value estimate, helping you decide when to buy or sell by comparing the Fair Value to today’s price.

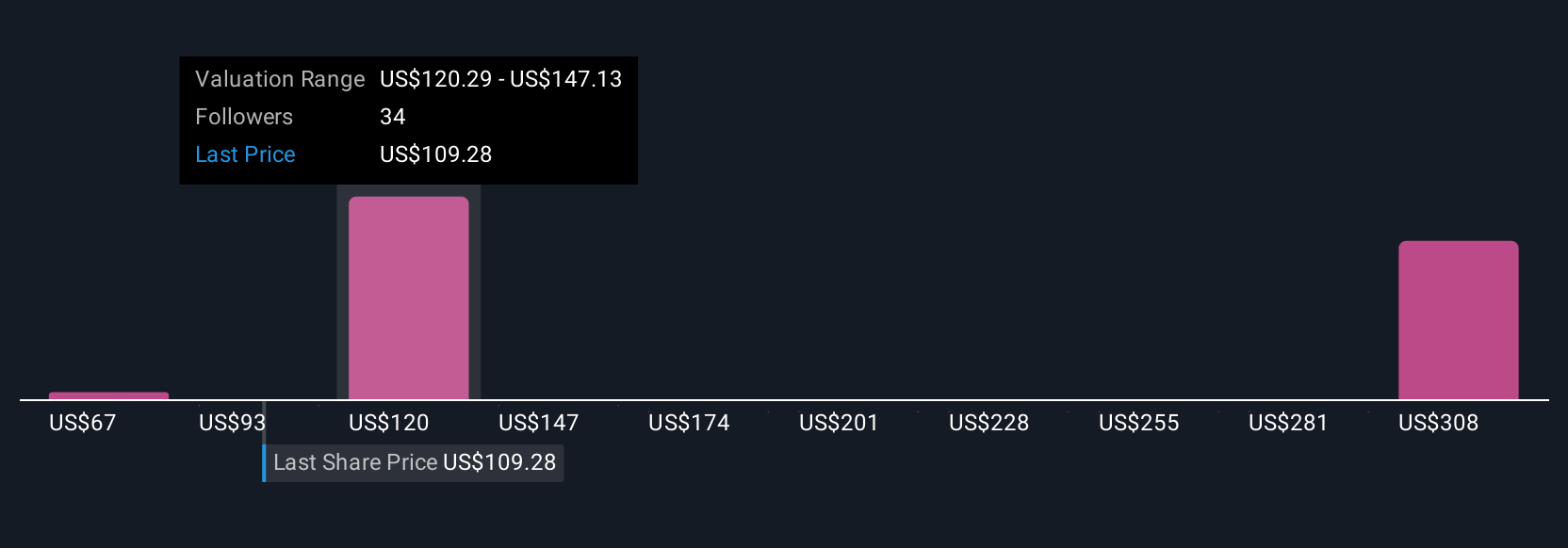

For example, some investors may believe PulteGroup will benefit from strong demand for active adult communities and Sunbelt migration, supporting a price target as high as $163.00. Others focus on risks like affordability and margin pressures, resulting in a much lower target of $98.00. With Narratives, you can easily see and test your view alongside others, giving you a dynamic and transparent edge in decision making.

Do you think there's more to the story for PulteGroup? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHM

PulteGroup

Through its subsidiaries, engages in the homebuilding business in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives