- United States

- /

- Luxury

- /

- NYSE:ONON

On Holding (NYSE:ONON): Assessing Valuation Following Analyst Downgrades and Renewed Growth Concerns

Reviewed by Simply Wall St

Recent analyst updates on On Holding (ONON) have sparked conversation, as BWG Global downgraded its view and other firms highlighted challenges such as slowing growth and margin pressure. Concerns about tariffs and currency impacts are also weighing on sentiment.

See our latest analysis for On Holding.

On Holding’s share price has taken a hit lately, sliding more than 15% over the past month and down nearly 35% year-to-date as investors process margin and growth concerns from recent analyst downgrades. Despite this momentum shift, the three-year total shareholder return remains impressive at over 119%, which reflects the company’s rapid rise since going public.

If recent volatility has you rethinking your strategy, now is the perfect time to expand your perspective by exploring fast growing stocks with high insider ownership.

With shares trading well below analyst price targets and the company still showing solid revenue and profit growth, investors are left wondering if On Holding is undervalued after recent declines, or if future growth is already factored into the price.

Most Popular Narrative: 42.1% Undervalued

With On Holding’s narrative fair value coming in well above the last close, the stock’s selloff has not dampened optimism among analysts tracking its long-term financial trajectory.

The company's ability to launch and quickly scale new product franchises (nine now >5% of revenue), expand beyond running into tennis, trail, lifestyle, and fast-growing apparel, demonstrates successful product innovation and diversification, supporting both average selling price increases and higher future revenue per customer.

This narrative’s impressive outlook hinges on bold financial projections. Analysts are betting on record-breaking earnings, margin expansion, and rapid top-line growth over the next few years. Discover which assumptions are fueling such a striking valuation gap and uncover the details that could change your perspective on ONON’s future.

Result: Fair Value of $62.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on premium pricing and rapid expansion into new markets could expose On Holding to slowed growth or margin pressure if consumer demand shifts.

Find out about the key risks to this On Holding narrative.

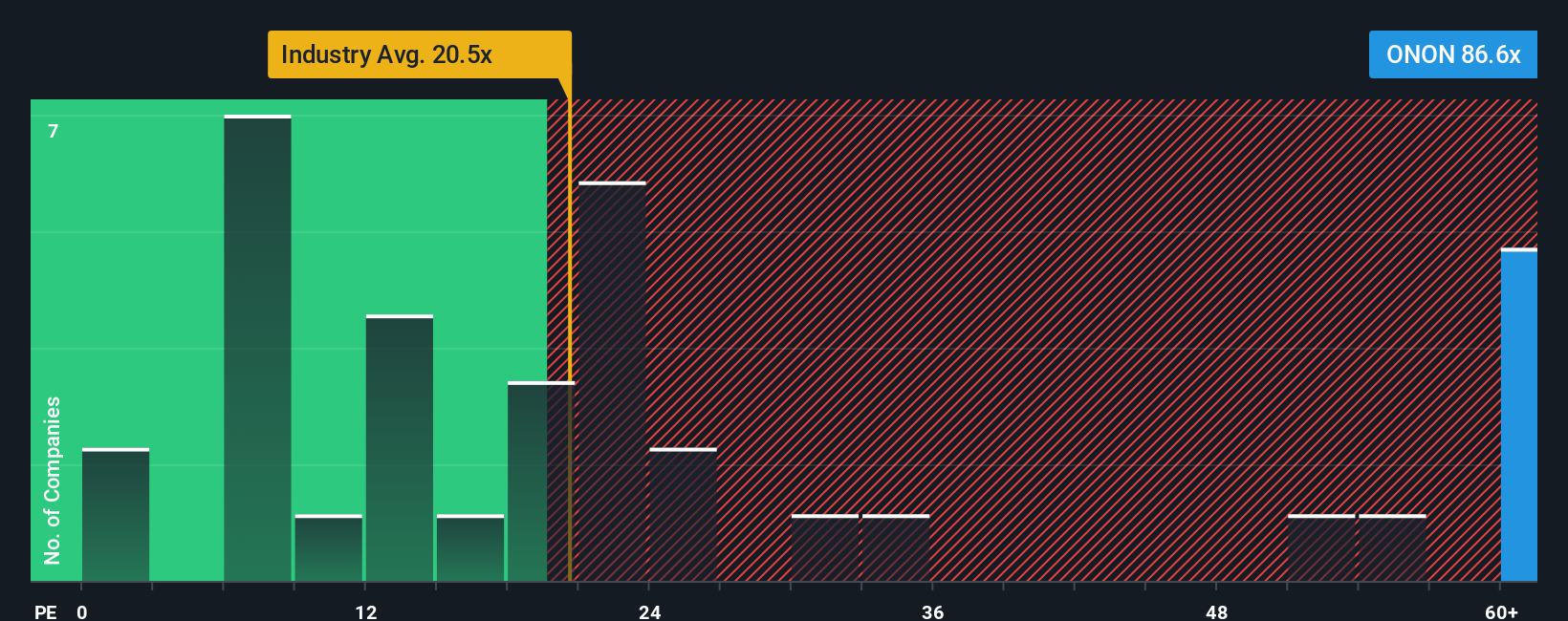

Another View: Price-to-Earnings versus the Market

Looking from a different angle, On Holding is trading at a price-to-earnings ratio of 70.2x, which is far above the US Luxury industry average of 19.6x and the peer average of 21.2x. Compared to the fair ratio of 28.5x, this suggests investors are paying a large premium for future growth. Is this optimism a sign of opportunity, or does it set a high bar for future performance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own On Holding Narrative

If you see things differently or want to dig into the details on your own terms, you can craft a personal take in just a few minutes. Do it your way.

A great starting point for your On Holding research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t wait for the market to come to you. Put the odds in your favor by checking out other stocks targeting tomorrow’s trends and long-term growth on Simply Wall Street:

- Unlock income potential when you access these 20 dividend stocks with yields > 3% with yields above 3% that can strengthen your portfolio’s cash flow.

- Get ahead of market hype by reviewing these 26 AI penny stocks where artificial intelligence fuels innovation and opportunity in emerging sectors.

- Ride the next wave of digital transformation as you assess these 81 cryptocurrency and blockchain stocks at the forefront of blockchain and cryptocurrency advancement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONON

On Holding

Engages in the development and distribution of sports products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives