- United States

- /

- Luxury

- /

- NYSE:ONON

On Holding (NYSE:ONON): Assessing Valuation After Strong Q3 Growth and Upgraded Sales Guidance

Reviewed by Simply Wall St

On Holding (NYSE:ONON) caught investors' attention after delivering substantial third quarter gains in both sales and net income, and then boosting its full-year sales outlook. Both developments have placed the company under the spotlight.

See our latest analysis for On Holding.

Momentum around On Holding has cooled in recent months, with the share price down 25.45% year-to-date and the one-year total shareholder return at -28.99%. While third quarter results and raised guidance briefly sparked enthusiasm, the price reaction suggests investors remain cautious. The company’s long-term story remains compelling, as shown by its 123.5% total return over the past three years.

If you’re thinking about where to spot the next big mover, broaden your search and discover fast growing stocks with high insider ownership

With strong revenue growth but a faltering share price, investors now face a key question: is On Holding undervalued following recent underperformance, or is the market already factoring in another phase of rapid expansion?

Most Popular Narrative: 32.7% Undervalued

On Holding's latest fair value estimate from the most widely followed narrative sits noticeably higher than its last close price, setting up a compelling debate over just how much growth the market has priced in.

The acceleration in DTC (Direct-to-Consumer) and e-commerce channels, with DTC reaching new highs (41.1% of sales in Q2 and up 54% YoY), gives On more control over brand, pricing, and customer data while increasing gross and EBITDA margins. This operational catalyst is likely to further expand profitability as DTC continues its mix shift.

Curious what bold leaps in profitability are driving this valuation? The secret behind these numbers is a set of ambitious revenue and margin assumptions rarely seen in the industry. Want to know which key growth forecasts created this valuation gap? Dive in and see what makes these projections so audacious and hotly debated.

Result: Fair Value of $61.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on premium pricing and intensified competition could challenge On Holding's growth story. This may result in future margin pressure or sales slowdowns.

Find out about the key risks to this On Holding narrative.

Another View: The Multiples Contradiction

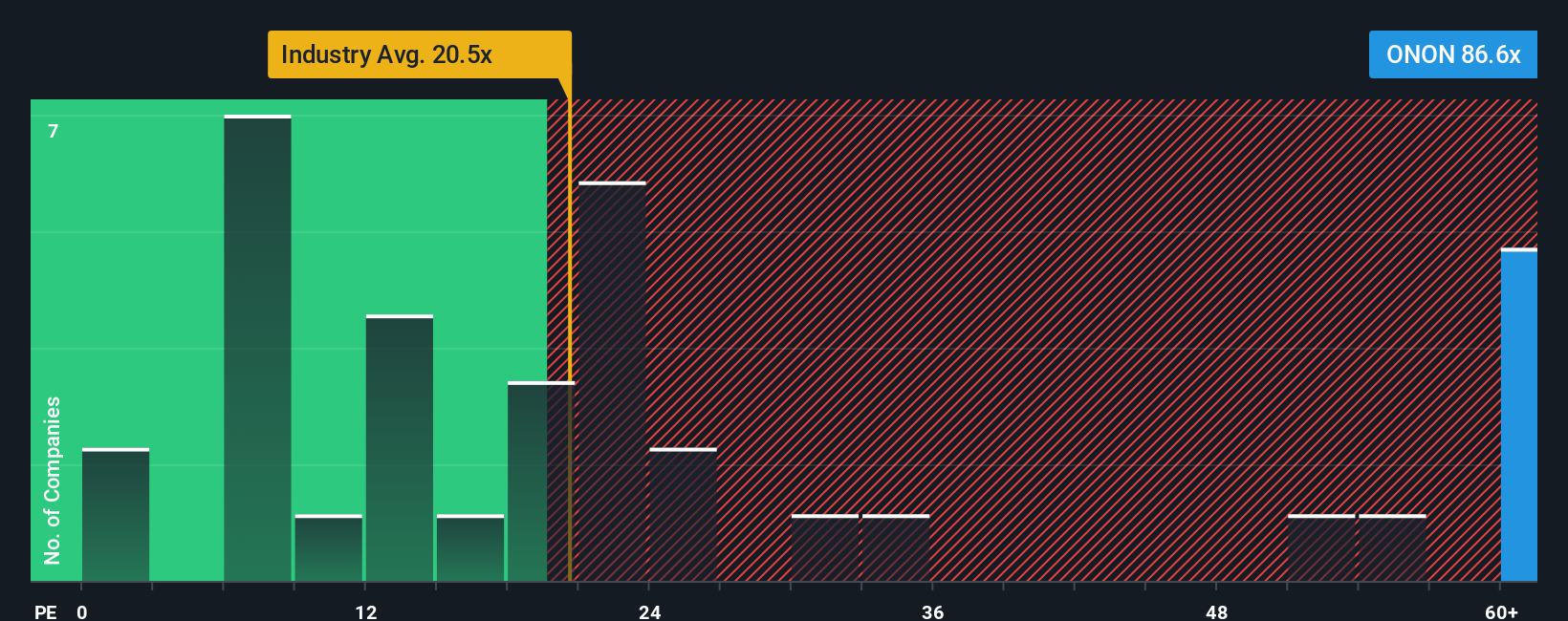

While fair value estimates suggest On Holding is undervalued, a closer look at its current price-to-earnings ratio tells a different story. At 48.6x earnings, the stock trades well above peers (27x) and the broader industry (19.7x). It is also significantly higher than its fair ratio of 26.7x. Such a premium hints at elevated expectations that increase downside risk if growth falters. Should investors trust the crowd’s appetite for future growth, or is caution the better part of valor?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own On Holding Narrative

If you see things differently or want to dig deeper, you can analyze the numbers firsthand and craft your own take in just a few minutes, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding On Holding.

Looking for More Investment Ideas?

Smart investors never stop seeking the next opportunity. Acting now could mean being ahead of the curve. Use these hand-picked routes to search for standout stocks before others catch on.

- Target rapid wealth-building by spotting hidden value with these 917 undervalued stocks based on cash flows, uncovering strong companies trading below their intrinsic worth.

- Capitalize on tech-driven breakthroughs by tapping into these 25 AI penny stocks and see which innovators are pushing artificial intelligence to new heights.

- Secure steady income streams and potential capital gains by reviewing these 17 dividend stocks with yields > 3%, packed with stocks offering yields greater than 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONON

On Holding

Engages in the development and distribution of sports products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives