- United States

- /

- Software

- /

- NasdaqGS:AVPT

Niagen Bioscience And Two Other High Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, but over the past 12 months, it has risen by 17%, with earnings forecast to grow by 15% annually. In this context of steady growth, stocks like Niagen Bioscience and others with high insider ownership can be appealing as they often indicate confidence from those closest to the company in its potential for future success.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 24.6% | 75.8% |

| Victory Capital Holdings (VCTR) | 10.1% | 32.4% |

| Super Micro Computer (SMCI) | 13.9% | 36.3% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| Niu Technologies (NIU) | 37.2% | 88.1% |

| FTC Solar (FTCI) | 23.1% | 62.5% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.4% |

| Atour Lifestyle Holdings (ATAT) | 22.9% | 23.5% |

| Astera Labs (ALAB) | 12.8% | 45.6% |

| ARS Pharmaceuticals (SPRY) | 14.3% | 63.1% |

Let's review some notable picks from our screened stocks.

Niagen Bioscience (NAGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Niagen Bioscience, Inc. is a bioscience company focused on developing healthy aging products with a market cap of $764.90 million.

Operations: The company's revenue is primarily derived from Consumer Products at $80.92 million, followed by Ingredients at $23.90 million, and Analytical Reference Standards and Services at $3.11 million.

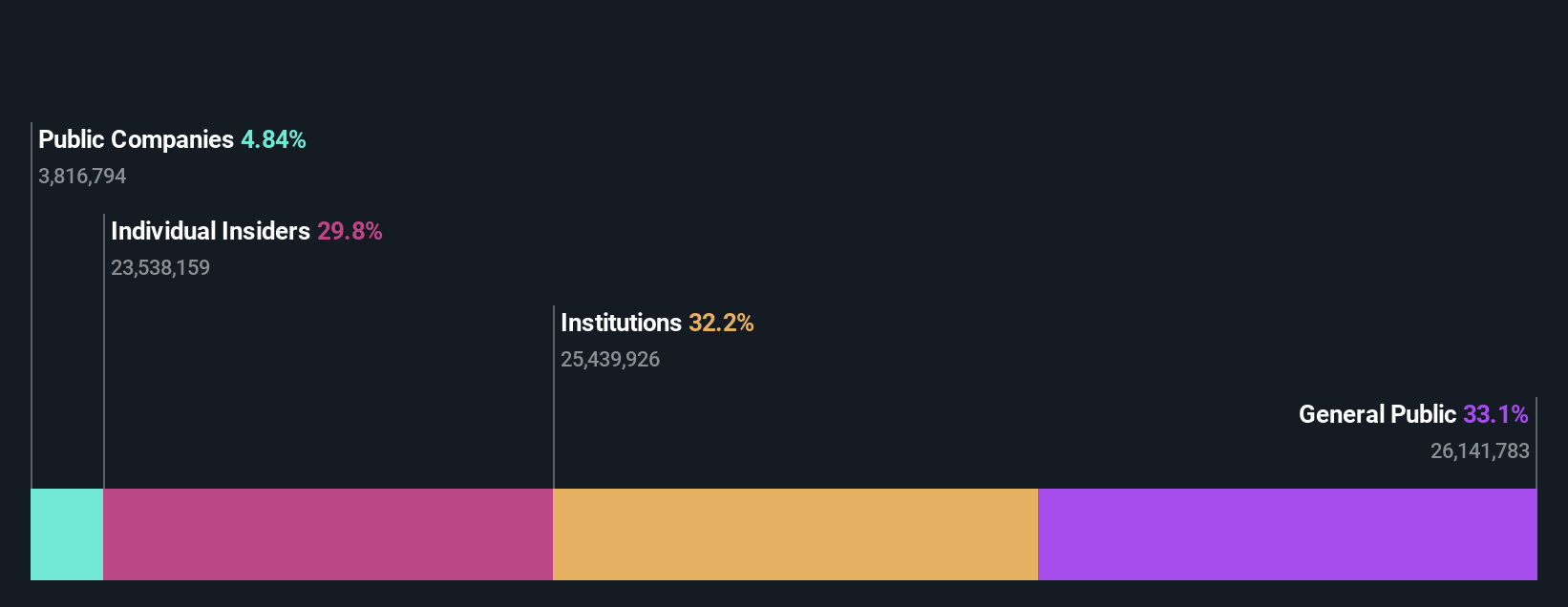

Insider Ownership: 29.8%

Revenue Growth Forecast: 17.8% p.a.

Niagen Bioscience is experiencing robust revenue and earnings growth, with forecasts indicating earnings could grow 27.6% annually, outpacing the US market. Recent developments include a strategic license agreement for Parkinson's Disease treatment and product expansions into luxury hospitality settings like Equinox Hotels. The company has also raised its revenue outlook for 2025 due to strong NAD+ market performance. Despite trading below estimated fair value, insider ownership remains significant, aligning interests with shareholders.

- Click here and access our complete growth analysis report to understand the dynamics of Niagen Bioscience.

- Our expertly prepared valuation report Niagen Bioscience implies its share price may be lower than expected.

AvePoint (AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AvePoint, Inc. offers a cloud-native data management software platform across various regions including North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of $3.89 billion.

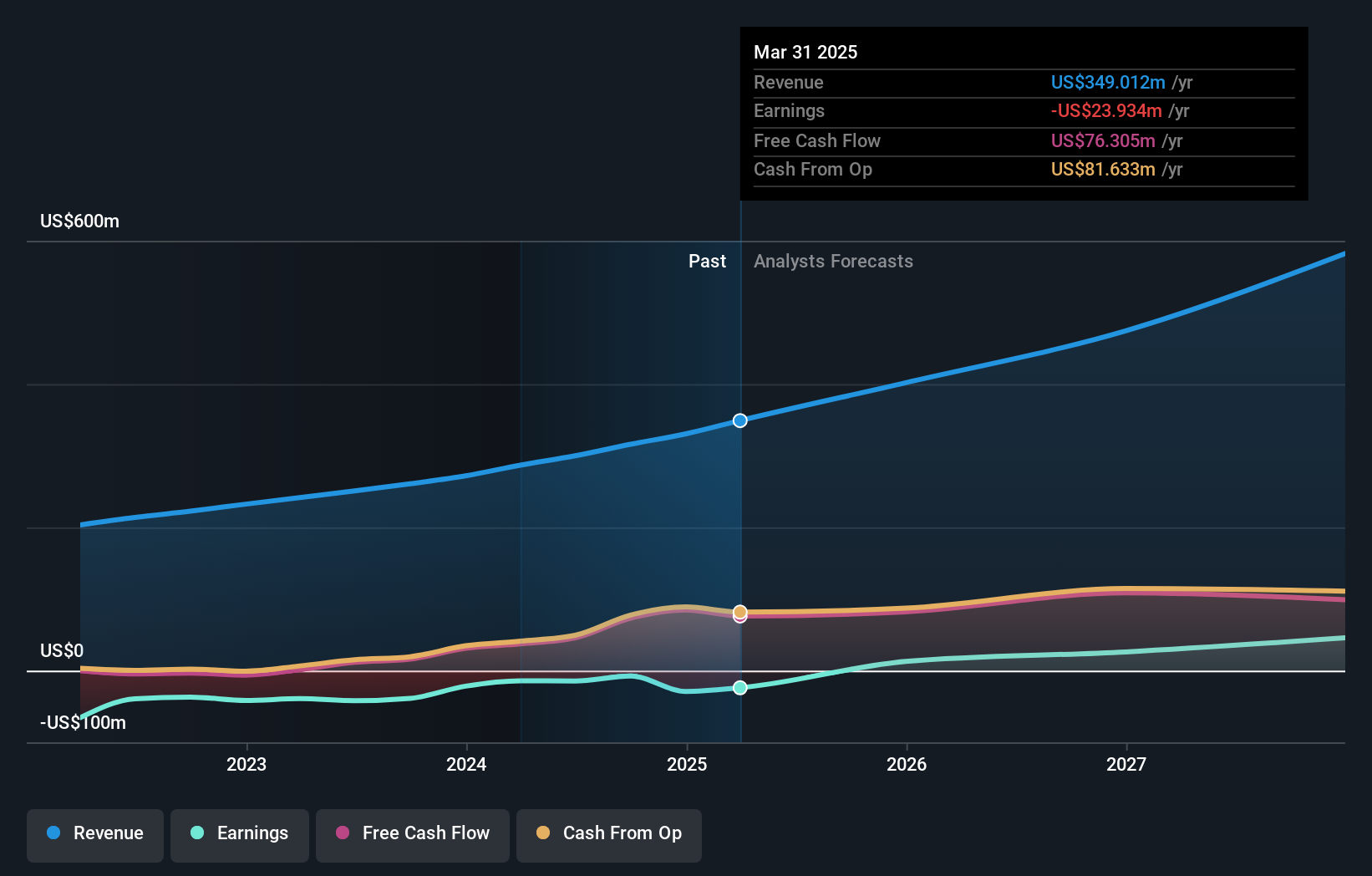

Operations: The company's revenue is primarily generated from its Software & Programming segment, amounting to $349.01 million.

Insider Ownership: 33%

Revenue Growth Forecast: 18.1% p.a.

AvePoint demonstrates strong growth potential, with revenue forecasted to grow at 18.1% annually, surpassing the US market average. Recent product updates enhance cost optimization and data resilience, appealing to organizations seeking efficiency and security. Despite being dropped from key indices, AvePoint's earnings have improved significantly year-over-year. Insider selling has been notable recently; however, insider ownership remains high, aligning management interests with shareholders amidst strategic platform enhancements and expanding market opportunities for managed service providers (MSPs).

- Take a closer look at AvePoint's potential here in our earnings growth report.

- Our expertly prepared valuation report AvePoint implies its share price may be too high.

On Holding (ONON)

Simply Wall St Growth Rating: ★★★★★☆

Overview: On Holding AG develops and distributes sports products globally, with a market capitalization of approximately $16.50 billion.

Operations: The company generates revenue from its athletic footwear segment, amounting to CHF 2.54 billion.

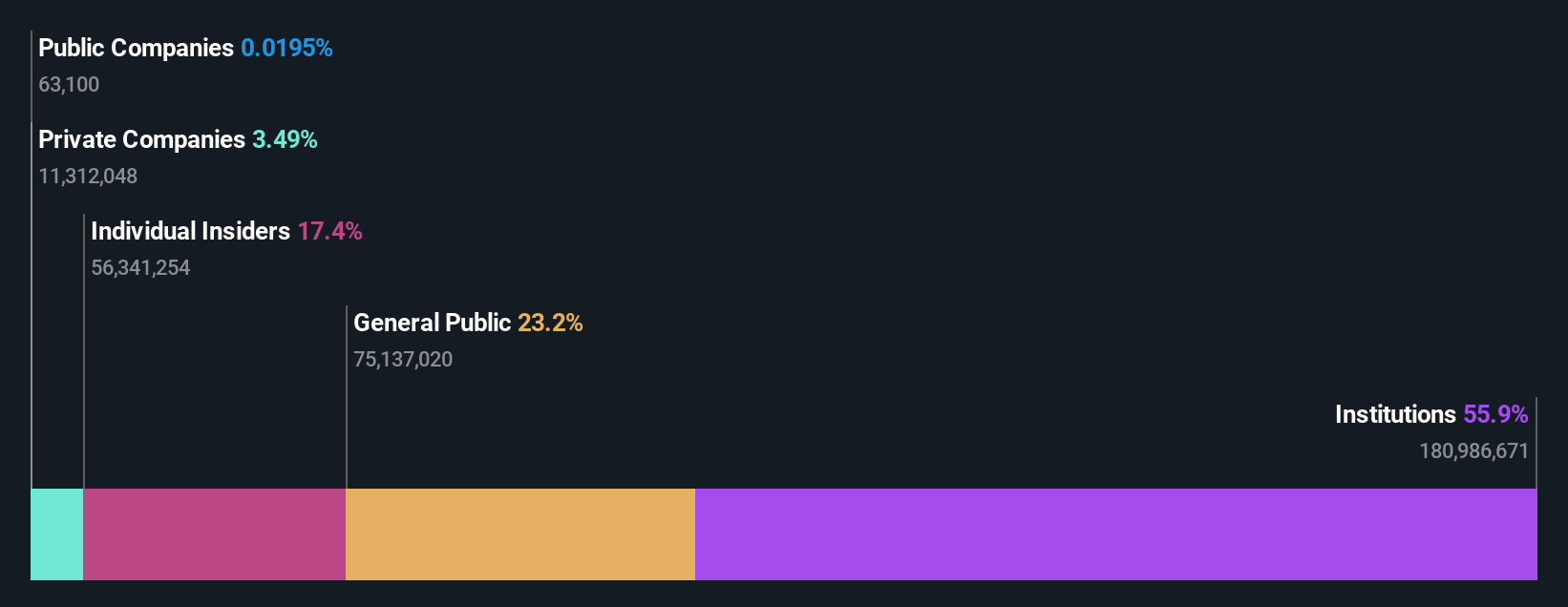

Insider Ownership: 17.4%

Revenue Growth Forecast: 17.7% p.a.

On Holding demonstrates strong growth potential, with earnings forecasted to grow at 22.7% annually, outpacing the US market. Recent inclusion in multiple Russell indices highlights its growing market presence. Despite a decline in net income for Q1 2025, revenue rose significantly year-over-year. The addition of Helena Helmersson to the board strengthens leadership with her extensive fashion industry experience. High insider ownership aligns management interests with shareholders, supporting strategic initiatives and sustained demand across global markets.

- Dive into the specifics of On Holding here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that On Holding is priced higher than what may be justified by its financials.

Make It Happen

- Delve into our full catalog of 187 Fast Growing US Companies With High Insider Ownership here.

- Want To Explore Some Alternatives? Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives