- United States

- /

- Software

- /

- NasdaqGS:CYBR

3 High-Value Stocks Estimated To Be Trading At Discounts Of 17.3% To 40.7%

Reviewed by Simply Wall St

As global markets navigate through volatility and mixed economic signals, investors are increasingly looking for opportunities to capitalize on undervalued stocks. Despite recent market turbulence, identifying high-value stocks trading at significant discounts can offer substantial long-term benefits.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LaserBond (ASX:LBL) | A$0.685 | A$1.37 | 49.9% |

| Swissquote Group Holding (SWX:SQN) | CHF296.00 | CHF591.48 | 50% |

| Owens Corning (NYSE:OC) | US$158.54 | US$316.74 | 49.9% |

| Jiangsu Hualan New Pharmaceutical MaterialLtd (SZSE:301093) | CN¥18.74 | CN¥37.41 | 49.9% |

| Elders (ASX:ELD) | A$9.06 | A$18.11 | 50% |

| ABL Group (OB:ABL) | NOK11.70 | NOK23.37 | 49.9% |

| Banca Sistema (BIT:BST) | €1.426 | €2.85 | 49.9% |

| Trisul (BOVESPA:TRIS3) | R$4.71 | R$9.40 | 49.9% |

| Defence Tech Holding (BIT:DTH) | €3.54 | €7.08 | 50% |

| PACS Group (NYSE:PACS) | US$38.21 | US$76.32 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

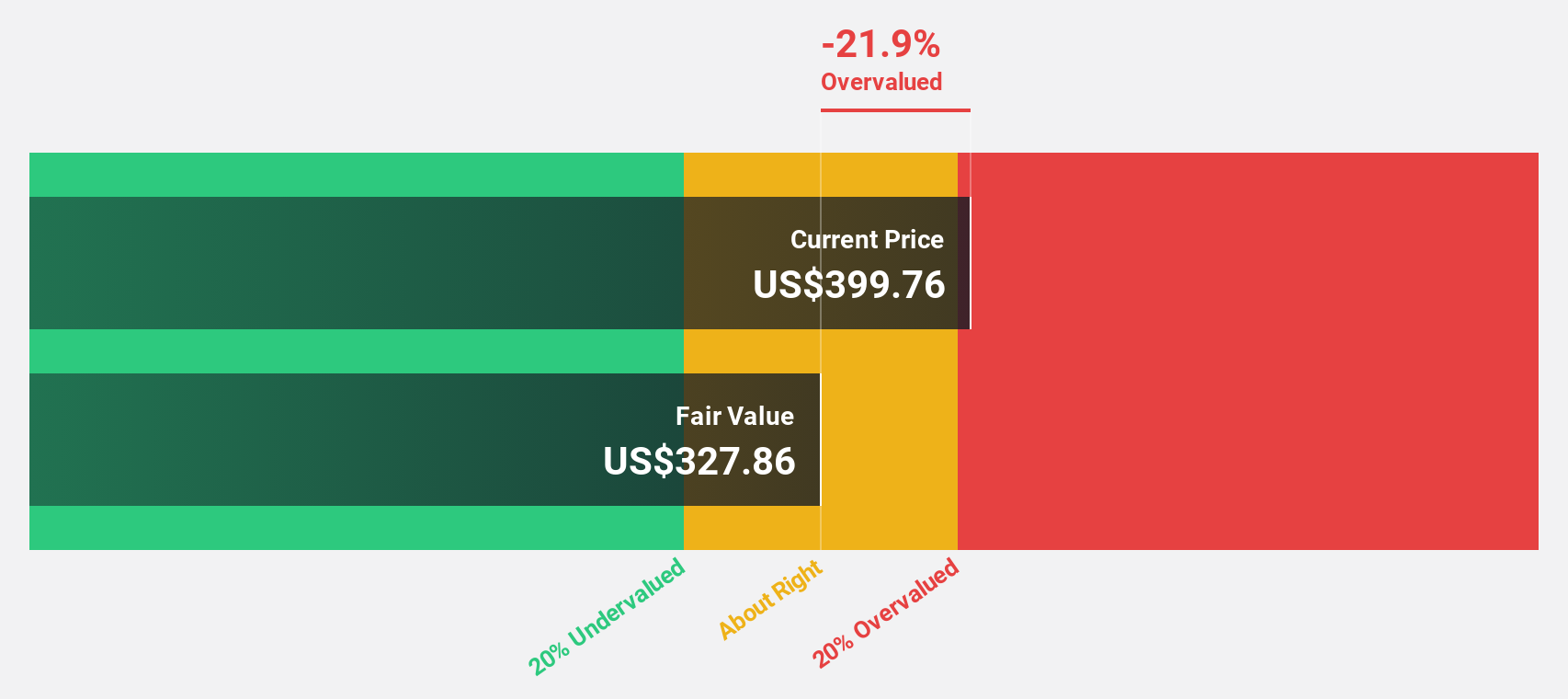

CyberArk Software (NasdaqGS:CYBR)

Overview: CyberArk Software Ltd. develops, markets, and sells software-based identity security solutions and services globally, with a market cap of $11.72 billion.

Operations: The company's revenue segment primarily consists of Security Software & Services, generating $860.60 million.

Estimated Discount To Fair Value: 40.7%

CyberArk Software, trading at US$275.55, is significantly undervalued based on discounted cash flow analysis, with an estimated fair value of US$464.82. The company reported strong Q2 2024 results with revenue up to US$224.71 million and a reduced net loss of US$12.92 million year-over-year. Recent client wins like SAP ECS and raised financial guidance for 2024 underscore its robust growth potential and improving profitability outlook over the next three years.

- Insights from our recent growth report point to a promising forecast for CyberArk Software's business outlook.

- Dive into the specifics of CyberArk Software here with our thorough financial health report.

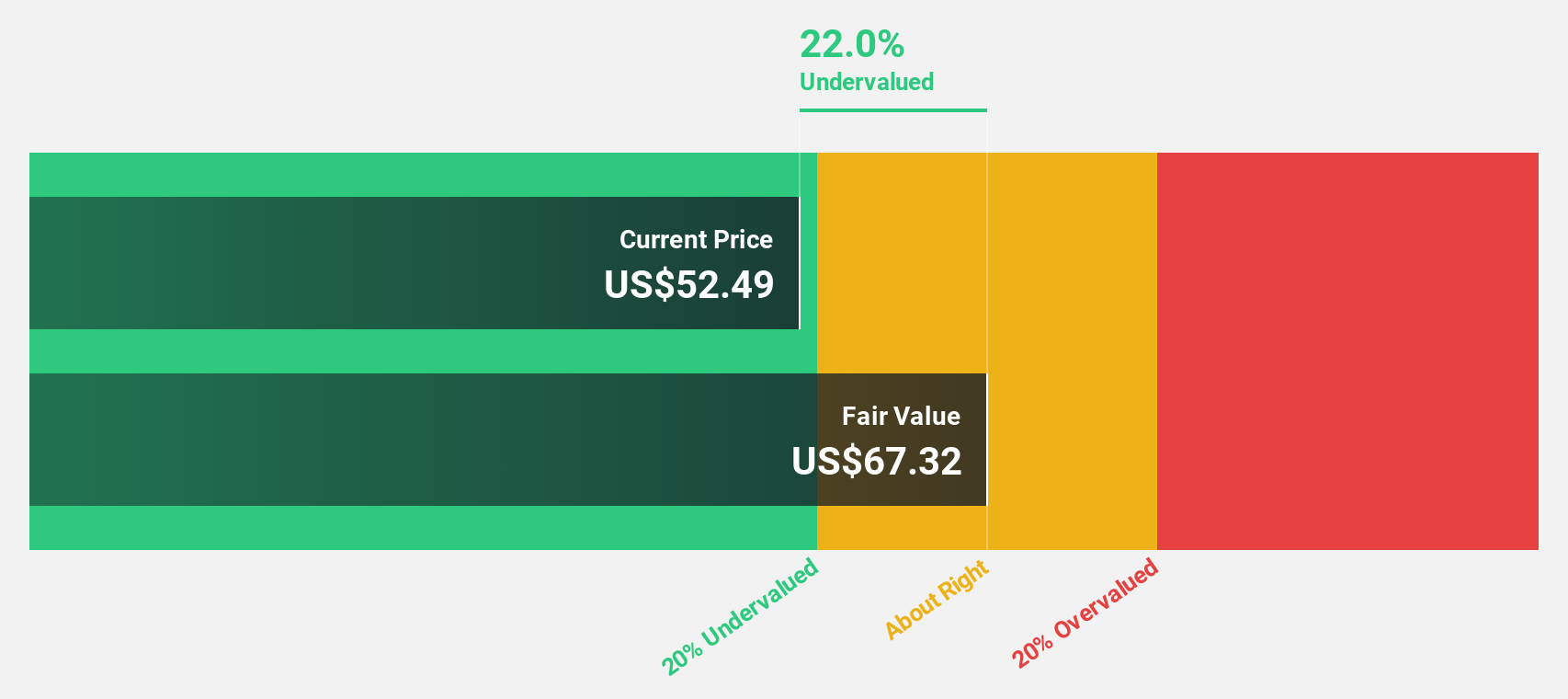

On Holding (NYSE:ONON)

Overview: On Holding AG develops and distributes sports products globally, with a market cap of $13.21 billion.

Operations: On Holding AG's revenue segments (in millions of CHF) are derived from footwear, apparel, and accessories.

Estimated Discount To Fair Value: 17.3%

On Holding, trading at US$40.56, is undervalued based on discounted cash flow analysis with an estimated fair value of US$49.06. Recent Q2 2024 earnings showed impressive growth, with sales reaching CHF 567.7 million and net income rising to CHF 30.8 million from CHF 3.3 million a year ago. Forecasts indicate significant annual earnings and revenue growth above market averages, bolstered by innovative sustainable products like the Cloudeasy Cyclon shoe collaboration with Loop Industries.

- According our earnings growth report, there's an indication that On Holding might be ready to expand.

- Get an in-depth perspective on On Holding's balance sheet by reading our health report here.

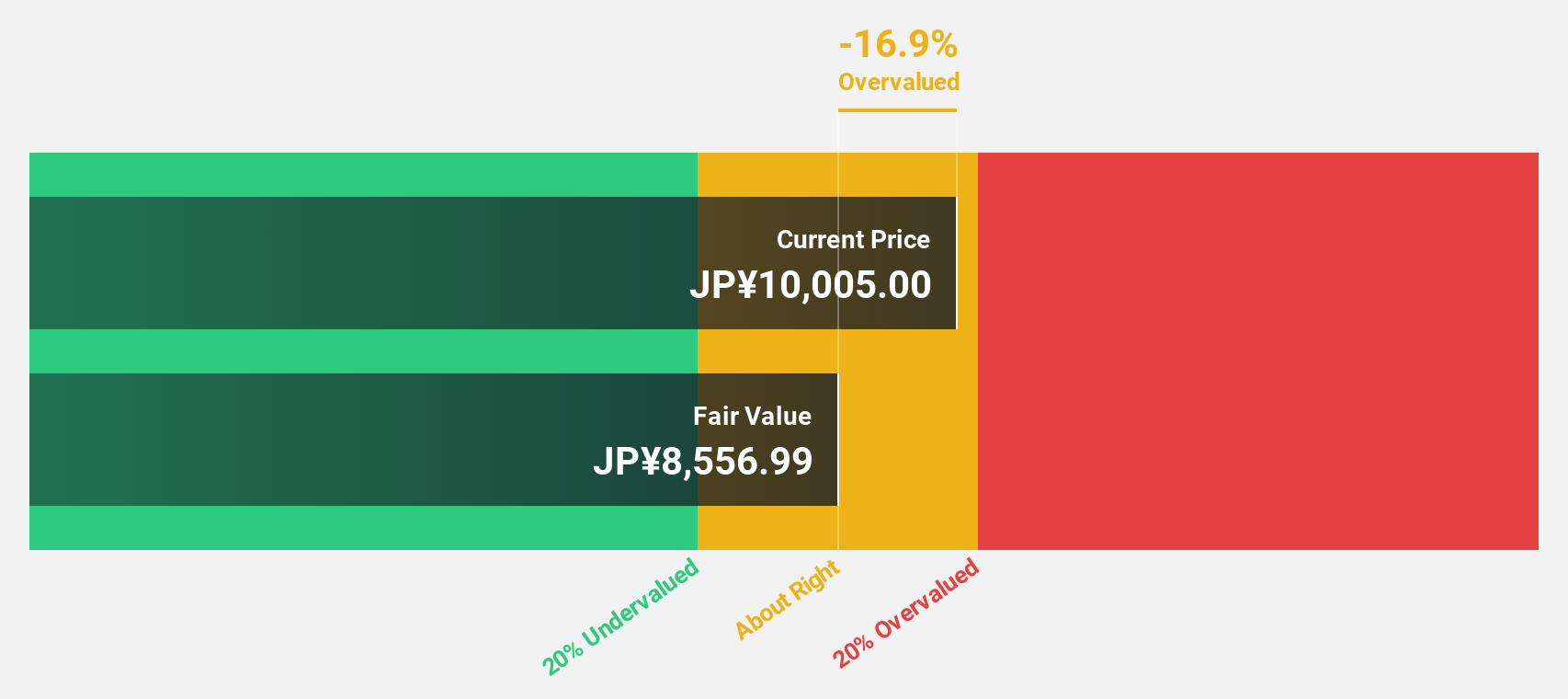

Trend Micro (TSE:4704)

Overview: Trend Micro Incorporated develops and sells security-related software for computers and related services in Japan and internationally, with a market cap of ¥1.07 trillion.

Operations: Revenue segments (in millions of ¥): Japan: ¥84.17 billion, Europe: ¥63.59 billion, Americas: ¥70.46 billion, Asia Pacific: ¥126.28 billion

Estimated Discount To Fair Value: 31.7%

Trend Micro, trading at ¥8200, is undervalued by more than 31% based on discounted cash flow analysis with a fair value estimate of ¥12012.97. Despite lower profit margins this year (6.4%) compared to last year (11.2%), the company's earnings are forecast to grow significantly at 22% annually over the next three years, outpacing the JP market's growth rate of 8.6%. Recent M&A rumors and strategic partnerships in AI security further highlight its potential for value appreciation.

- Upon reviewing our latest growth report, Trend Micro's projected financial performance appears quite optimistic.

- Take a closer look at Trend Micro's balance sheet health here in our report.

Seize The Opportunity

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 921 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYBR

CyberArk Software

Develops, markets, and sells software-based identity security solutions and services in the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet with reasonable growth potential.