- United States

- /

- Consumer Durables

- /

- NYSE:NVR

Where Does NVR Stand After Its Recent Share Price Slide in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with NVR stock right now? You are not alone. The homebuilder’s shares have been on a wild ride, leaving investors to wonder whether it's a fresh opportunity or a signal to tread carefully. Over the last week, NVR slipped by 0.3%, and in the past month, it’s down 5.1%. That sounds like uncertainty, but remember, over the last three years, the stock has delivered an impressive gain of 92.4% and is still up 82.2% over five years. Even so, NVR is lagging year-to-date with just a 1.0% gain and down 14.4% for the past twelve months, which may reflect shifting expectations about the housing market and broader economic outlook.

Some investors are pointing to industry-wide trends, like cooling demand and incremental shifts in mortgage rates, as reasons for recent weakness. Yet long-term holders likely remember the massive recovery and growth that followed earlier housing market headwinds. Amid the current movements, many are asking: is NVR undervalued, or has the stock gotten ahead of itself?

Looking at several key valuation checks, NVR currently scores a zero out of six, suggesting the stock is not undervalued on any of the typical measures analysts watch closely. However, there is much more to valuation than any single score can convey. Next, we will take a closer look at the different valuation approaches and what they reveal. In addition, we will explore an even better way to assess NVR's true worth before you make your next decision.

NVR scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

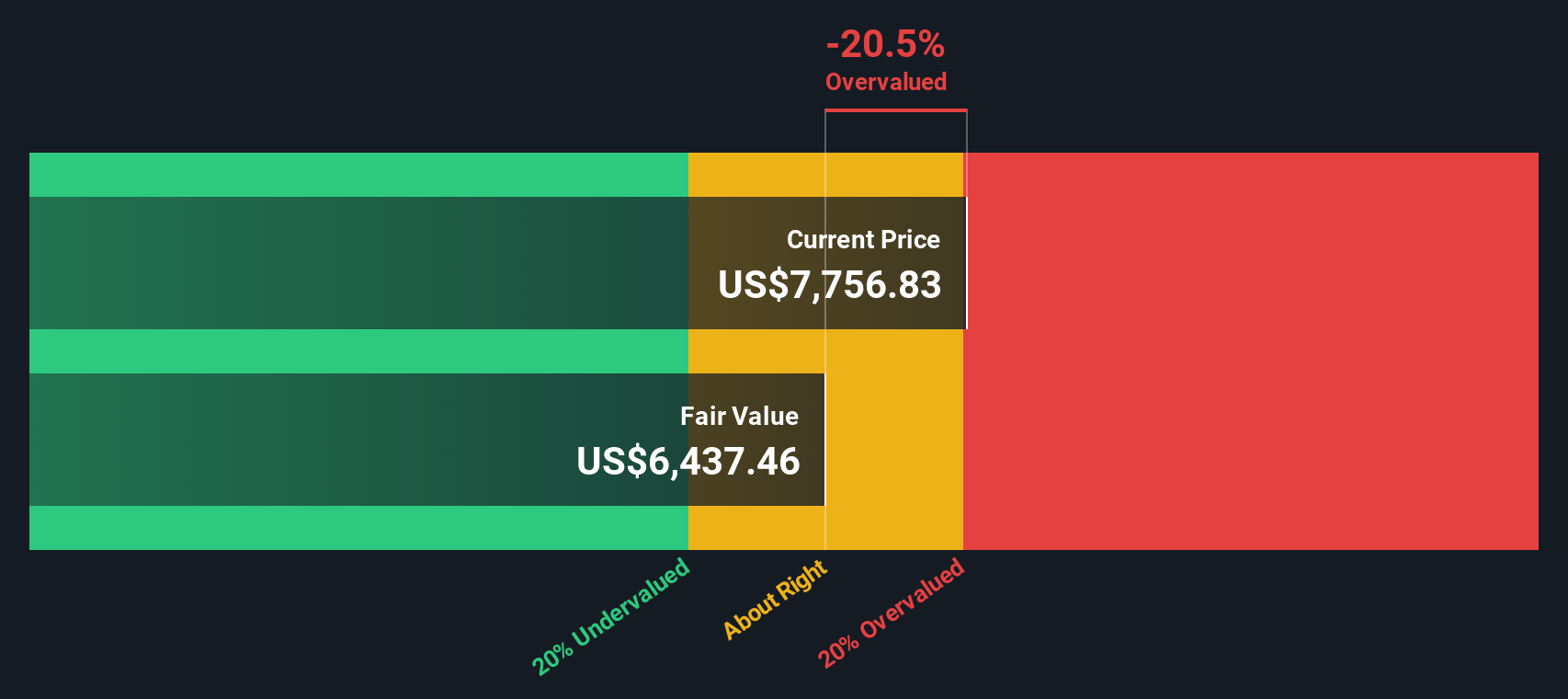

Approach 1: NVR Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This helps investors understand what NVR could be worth based on fundamental business performance rather than just current market sentiment.

For NVR, the latest reported Free Cash Flow stands at $1.21 Billion. Analyst forecasts suggest cash flows will moderate over time, with projections indicating Free Cash Flow of $1.12 Billion in 2026 and further model-driven extrapolations bringing this figure to about $1.23 Billion by 2035. These projections are referenced on a year-by-year basis. Only the first five years are directly informed by analyst estimates, and subsequent years are modeled out by Simply Wall St.

After discounting all of these future cash flows back to present value, the DCF analysis produces an intrinsic value of $6,408 per share. Comparing this to the current share price, NVR is trading roughly 25.9% above the fair value mark. This implies the stock is overvalued based on these long-term cash flow expectations.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NVR may be overvalued by 25.9%. Find undervalued stocks or create your own screener to find better value opportunities.

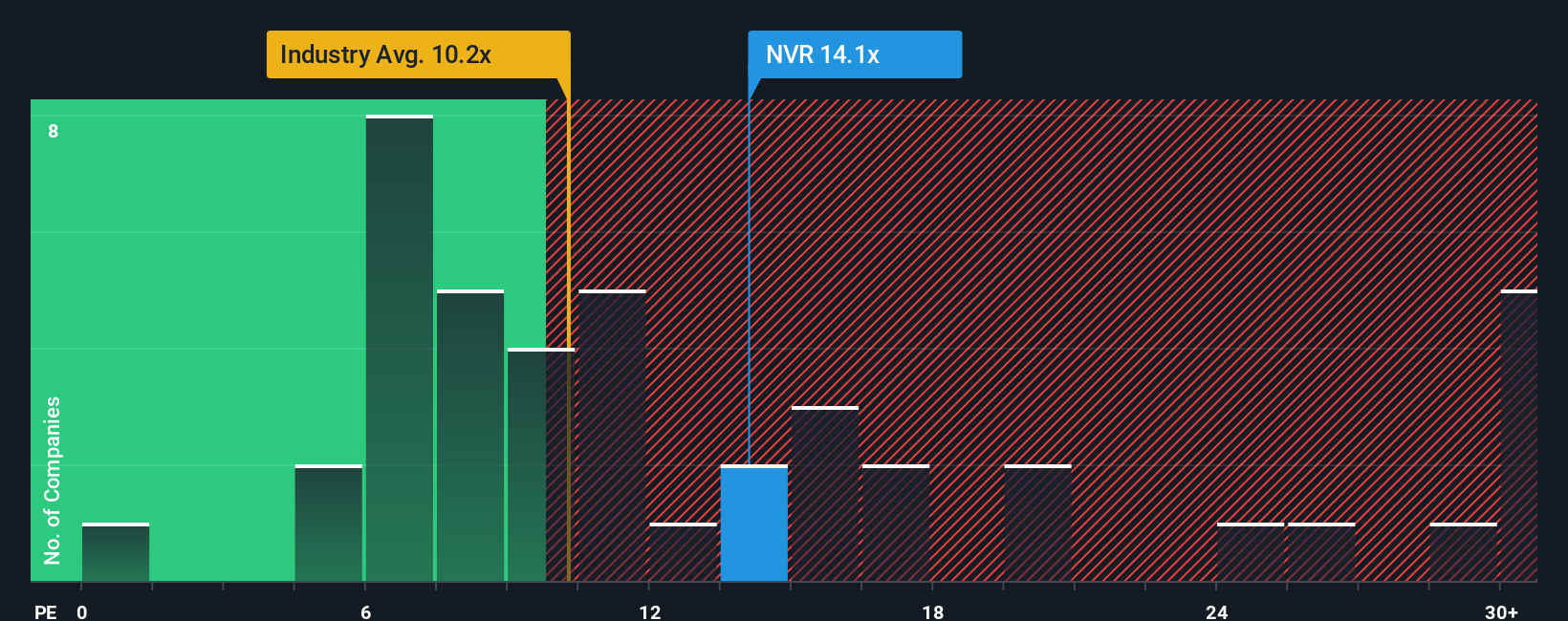

Approach 2: NVR Price vs Earnings

When analyzing profitable companies like NVR, the Price-to-Earnings (PE) ratio is a widely accepted measure of valuation. The PE ratio helps investors understand how much they are paying for each dollar of current earnings, making it a practical tool for assessing established, consistently profitable businesses. Companies with stronger growth prospects or lower risk profiles generally deserve a higher PE ratio, while those facing risks or lower growth see a lesser "normal" multiple.

NVR’s current PE ratio sits at 15.2x. To put this in context, peers in the Consumer Durables industry average 12.6x, while the broader industry comes in at 11.2x. While this may suggest NVR trades at a premium compared to its peers and sector, such a gap can sometimes be justified by the company’s specific growth outlook, profitability, or business model.

Simply Wall St’s Fair Ratio provides a more comprehensive perspective by adjusting for factors like NVR’s expected earnings growth, profit margins, industry positioning, market capitalization, and company-specific risks. This "Fair Ratio" stands at 12.87x, slightly below NVR’s actual multiple. Because the gap between NVR’s current PE and its fair PE estimate is less than 0.10, the stock’s valuation appears to be in line with what the fundamentals support rather than clearly overvalued or undervalued.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NVR Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story behind the numbers, a unique perspective that connects your assumptions about NVR’s future revenue, earnings, and profit margins to a calculated fair value. Rather than only looking at static models or broad ratios, Narratives let you link NVR’s qualitative story, such as expected market shifts, management strategy, or industry trends, directly to financial forecasts and valuation outcomes.

Narratives are easy to create and use on Simply Wall St’s Community page, where millions of investors share, compare, and refine their own investment stories. With Narratives, you can assess whether NVR is a buy or sell by comparing your Fair Value estimate to the latest price. Since Narratives update instantly with new information or earnings releases, your outlook remains current and actionable. For example, one investor might see NVR’s fair value as especially low if they are cautious about housing demand, while another expects future outperformance and a much higher fair value, showing just how dynamic these stories can be.

Do you think there's more to the story for NVR? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NVR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVR

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion