- United States

- /

- Consumer Durables

- /

- NYSE:NTZ

Natuzzi's (NYSE:NTZ) Wonderful 641% Share Price Increase Shows How Capitalism Can Build Wealth

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. While not every stock performs well, when investors win, they can win big. For example, the Natuzzi S.p.A. (NYSE:NTZ) share price rocketed moonwards 641% in just one year. Also pleasing for shareholders was the 169% gain in the last three months. Looking back further, the stock price is 72% higher than it was three years ago.

It really delights us to see such great share price performance for investors.

View our latest analysis for Natuzzi

Given that Natuzzi didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Natuzzi actually shrunk its revenue over the last year, with a reduction of 18%. This is in stark contrast to the splendorous stock price, which has rocketed 641% since this time a year ago. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. To us, a gain like this looks like speculation, but there might be historical trends to back it up.

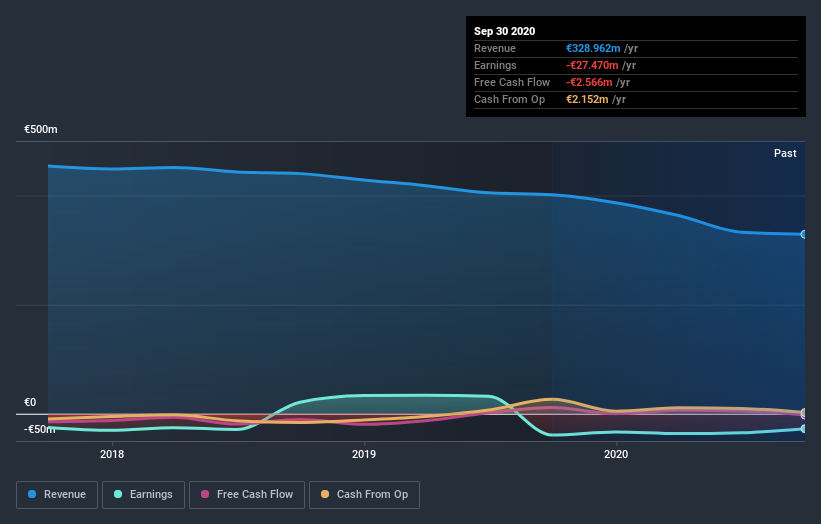

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Natuzzi's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Natuzzi has rewarded shareholders with a total shareholder return of 641% in the last twelve months. That gain is better than the annual TSR over five years, which is 14%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Natuzzi better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Natuzzi (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

We will like Natuzzi better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Natuzzi, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Natuzzi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:NTZ

Natuzzi

Engages in the design, manufacture, and marketing of leather and fabric upholstered furniture.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026