- United States

- /

- Luxury

- /

- NYSE:NKE

Why NIKE (NKE) Is Down 8.7% After Margin Pressures and Cash Flow Concerns Spark Investor Unease

Reviewed by Sasha Jovanovic

- In the past week, Nike experienced its seventh consecutive session of losses amid ongoing weaknesses in margins and declining cash flows, even as the broader market performed well. This trend highlights a noteworthy disconnect between analyst optimism about long-term prospects and investors' immediate reactions to operational challenges.

- Some probability and volatility models have indicated that Nike's current stock state could present an informational arbitrage opportunity, suggesting the potential for differentiated approaches under present conditions.

- We'll examine how heightened investor focus on Nike's earnings pressures and cash flow trends may reshape the company's investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

NIKE Investment Narrative Recap

To hold Nike through its current volatility, you need to believe in the brand’s global staying power, innovation leadership, and long-term growth potential even as near-term headwinds weigh on margins and cash flows. The latest losing streak hasn’t materially shifted the immediate focus: analysts and investors remain locked onto earnings pressures, with margin recovery and improved cash generation as the main catalyst, while sluggish sales in key markets are the biggest risk right now.

Of the various announcements, Nike’s most recent earnings report is directly relevant. Despite sales growth year-over-year, net income and profit margins have fallen, reinforcing existing concerns about the company’s ability to restore profitability in the short term and raising the stakes for upcoming earnings cycles as a barometer for progress on the most important catalysts.

Yet, investors should be alert: while brand strength remains an anchor, the risk of continued revenue declines in North America and Greater China is a key factor…

Read the full narrative on NIKE (it's free!)

NIKE's narrative projects $50.7 billion in revenue and $4.4 billion in earnings by 2028. This requires 3.1% yearly revenue growth and a $1.2 billion increase in earnings from $3.2 billion today.

Uncover how NIKE's forecasts yield a $83.27 fair value, a 33% upside to its current price.

Exploring Other Perspectives

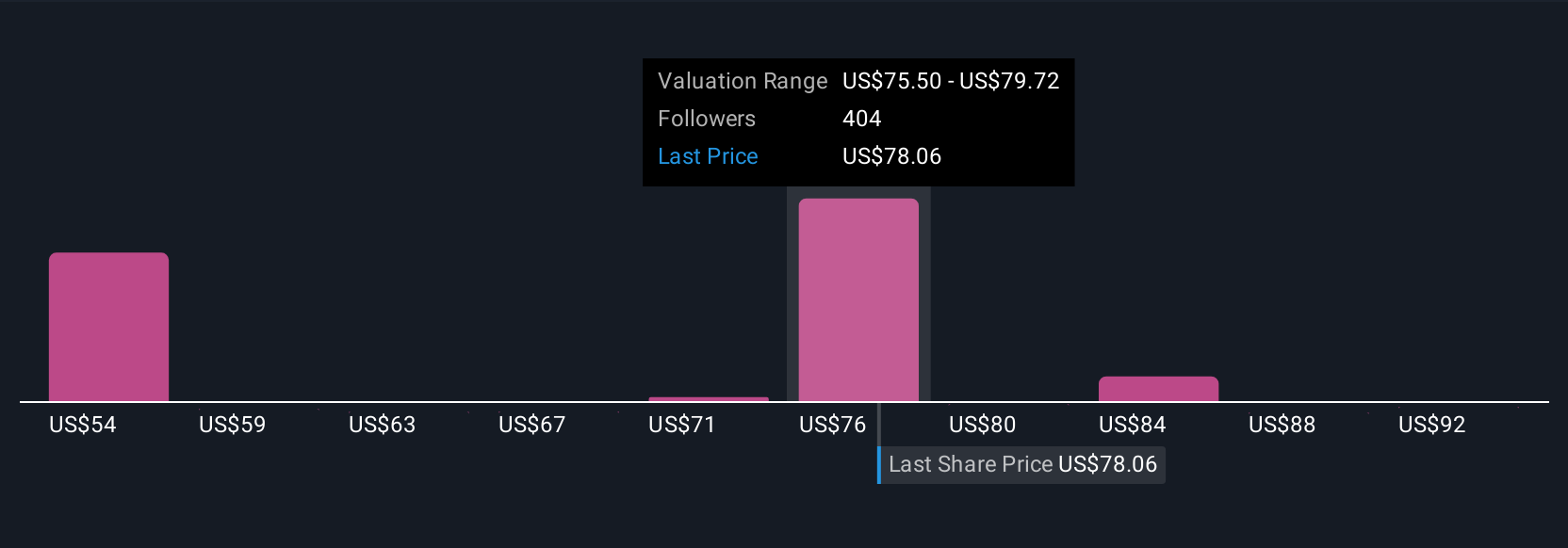

Simply Wall St Community members provided 42 fair value estimates for Nike, ranging from US$58.49 to US$96.60 per share. Earnings setbacks and margin pressures could drive even greater divergence in these future assessments, so explore multiple points of view when considering your own outlook.

Explore 42 other fair value estimates on NIKE - why the stock might be worth as much as 54% more than the current price!

Build Your Own NIKE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NIKE research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NIKE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NIKE's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NKE

NIKE

Designs, develops, markets, and sells athletic and casual footwear, apparel, equipment, accessories, and services for men, women, and kids in North America, Europe, the Middle East, Africa, Greater China, the Asia Pacific, and Latin America.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives