- United States

- /

- Luxury

- /

- NYSE:NKE

Has NIKE’s Share Price Drop After Weak Guidance Created a Fresh Opportunity for 2025?

Reviewed by Bailey Pemberton

Thinking about whether to stick with NIKE or make a move? You are not alone. Plenty of investors have been weighing their options as this iconic brand’s shares continue to slide. Over the last year, NIKE’s stock price has fallen by 15.5%, and it is down nearly 44% over five years. Even just this year, NIKE has not found its footing, with an 8.6% drop year-to-date. Such a steady downward trend can shake even the most loyal holders. Many are left to wonder whether there is a turning point ahead or if the price is just reflecting a new reality for the company.

Broader market shifts have influenced NIKE as well. Investors seem more cautious amid rising competition and changing consumer buying habits. While some wonder if the pullback reveals an undervalued gem, the numbers suggest a different story. In fact, NIKE currently scores 0 out of 6 on our valuation checklist. This means the company does not pass a single measure for being undervalued by traditional standards. But does that tell the whole story?

Let us break down the standard valuation approaches, see what the data is really saying, and explore whether there is a more insightful way to think about NIKE’s worth at today’s prices.

NIKE scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NIKE Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its expected future cash flows and discounting them back to today’s dollars. This helps investors determine what the business is really worth.

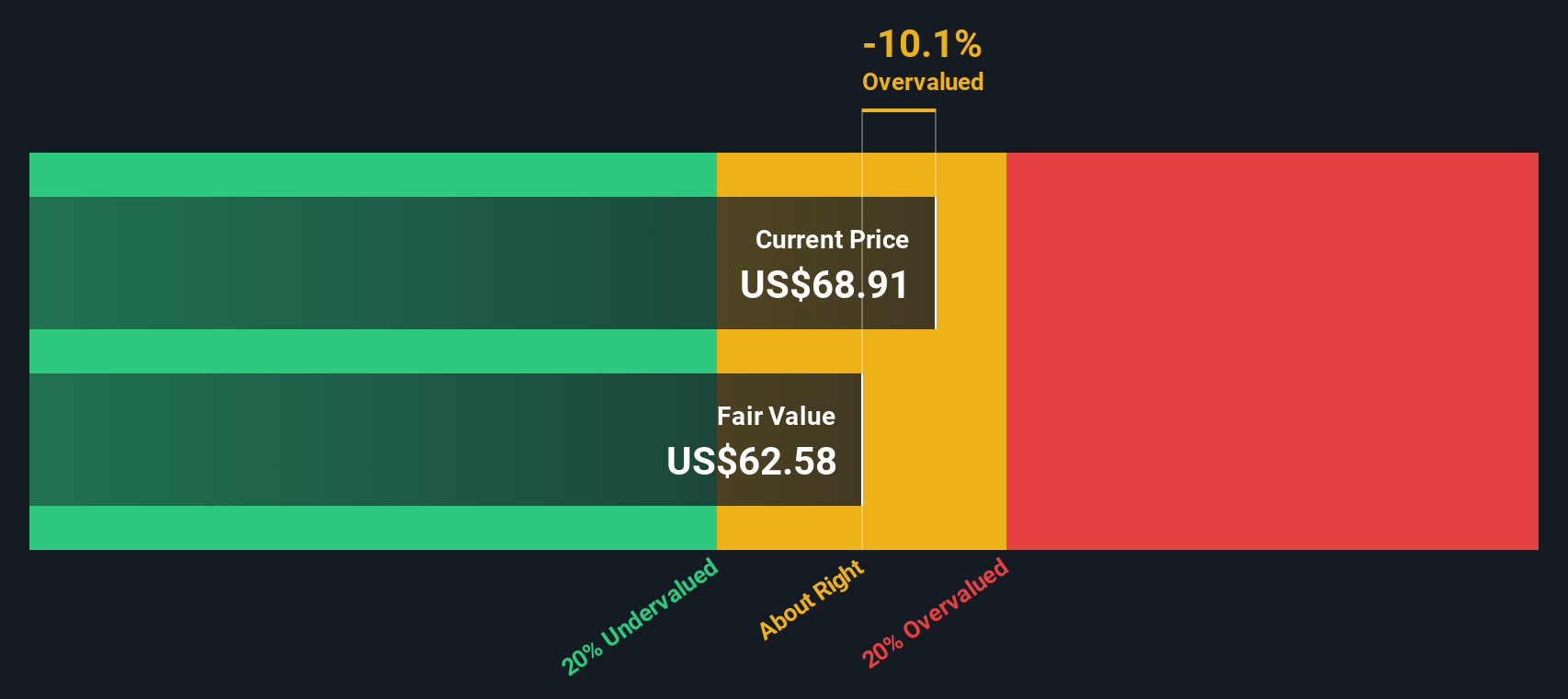

For NIKE, the most recent Free Cash Flow is $2.85 Billion. Analyst estimates predict steady growth, with projections rising as high as $5.89 Billion by 2030. Only the next five years have direct analyst estimates. After that, projections are extrapolated. This approach captures both near-term expectations and a possible long-term trajectory, though accuracy tends to decrease further out.

Based on cash flow modeling, the DCF model suggests NIKE’s fair value is $62.65 per share. Compared to today’s market price, this signals that NIKE shares are about 7.5% overvalued. This represents a slight but notable premium to the model’s estimate.

While not dramatically detached from intrinsic value, the market is pricing NIKE a little above what standard cash flow modeling would suggest.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out NIKE's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: NIKE Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used tool for valuing established, profitable companies like NIKE. It measures how much investors are willing to pay for each dollar of the company’s earnings. A higher PE can signal optimism about future growth prospects, while a lower PE might signal investor caution or slower expected growth.

Growth expectations and risk are key factors when interpreting a PE ratio. A business with strong earnings growth and low risk typically commands a higher PE. Companies facing uncertainty or lagging growth will often trade closer to the industry average or lower.

NIKE currently trades at a PE of 34.4x, just above the peer average of 33.8x and well above the broader luxury industry average of 19.4x. This suggests investors see NIKE as a standout in its sector, assuming it can keep delivering strong results. But how does this stack up to what is fair for NIKE specifically?

Simply Wall St's proprietary “Fair Ratio” for NIKE is 27.3x. Unlike a simple peer or industry comparison, this Fair Ratio incorporates factors such as profit margins, earnings growth, risks unique to NIKE, and its market capitalization. By accounting for these variables, the Fair Ratio offers a more tailored benchmark than broad averages can provide.

Since NIKE's actual PE of 34.4x is a fair bit higher than its Fair Ratio of 27.3x, the stock appears somewhat overvalued on this metric, though the gap is not extreme.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NIKE Narrative

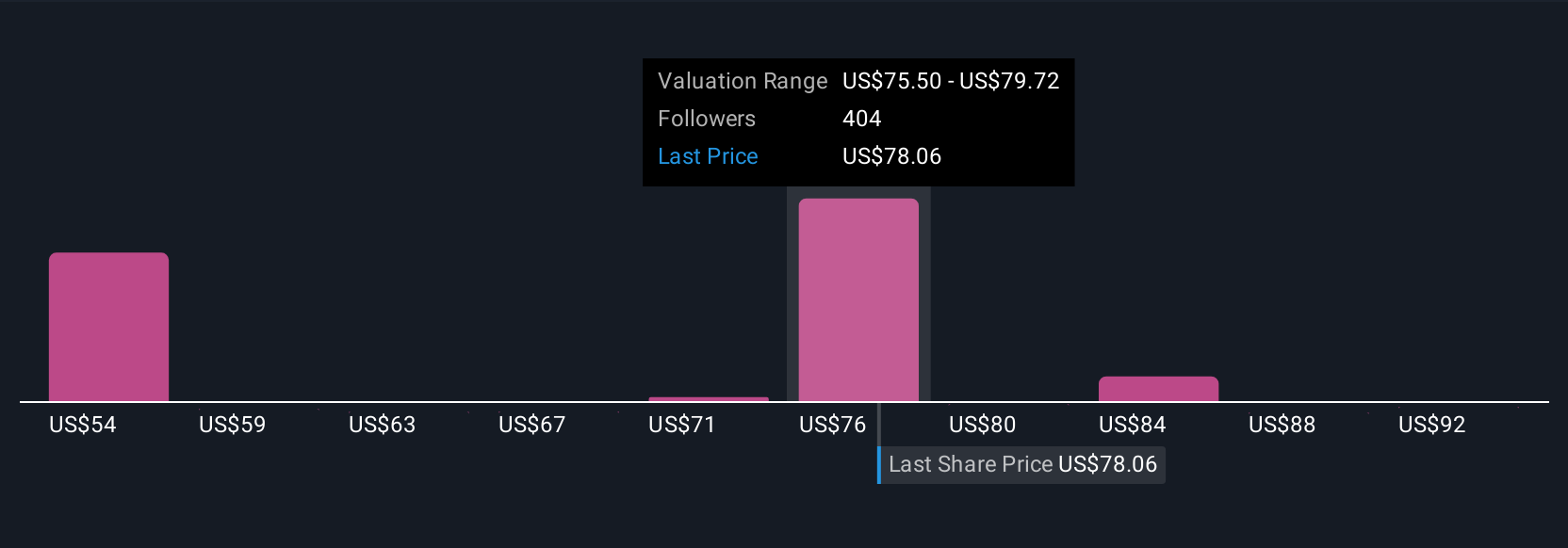

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, intuitive approach that lets investors connect the company’s story with future financial expectations and a personal estimate of fair value, all in one place. Narratives allow you to explain the numbers by writing your perspective on what drives NIKE’s future. Your confidence (or caution) about revenue trends, margins, or major company shifts directly shapes your assumptions around fair value and growth.

Narratives do not require deep financial expertise. They are available to millions of Simply Wall St users on the Community page, making it easy for investors at any level to craft and share their own outlook, compare with others, and update views as new news or earnings reports emerge. This dynamic, story-driven approach means your fair value estimate, and ultimately your buy or sell decision, can adapt instantly when the real-world picture changes.

For example, among recent NIKE Narratives, some investors see a fair value as high as $120 based on turnaround optimism and strong brand leverage, while others are more cautious, putting fair value near $38, reflecting concerns about competition and weaker sales. Narratives empower you to make decisive, well-informed choices by linking your view of the company to clear, actionable numbers.

Do you think there's more to the story for NIKE? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NKE

NIKE

Designs, develops, markets, and sells athletic and casual footwear, apparel, equipment, accessories, and services for men, women, and kids in North America, Europe, the Middle East, Africa, Greater China, the Asia Pacific, and Latin America.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives