- United States

- /

- Banks

- /

- NasdaqGS:VLY

3 US Dividend Stocks To Consider With Up To 5.4% Yield

Reviewed by Simply Wall St

As the U.S. stock market continues its rally, with the Dow Jones Industrial Average reaching record highs and the S&P 500 extending its winning streak, investors are increasingly looking towards dividend stocks as a way to capitalize on this momentum while securing a steady income stream. In such an environment, selecting stocks that offer attractive yields and demonstrate stability can be a prudent strategy for those seeking to enhance their portfolios amidst ongoing economic developments.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.44% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.30% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.51% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.50% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.51% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.25% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.73% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.45% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.30% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.35% | ★★★★★★ |

Click here to see the full list of 133 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

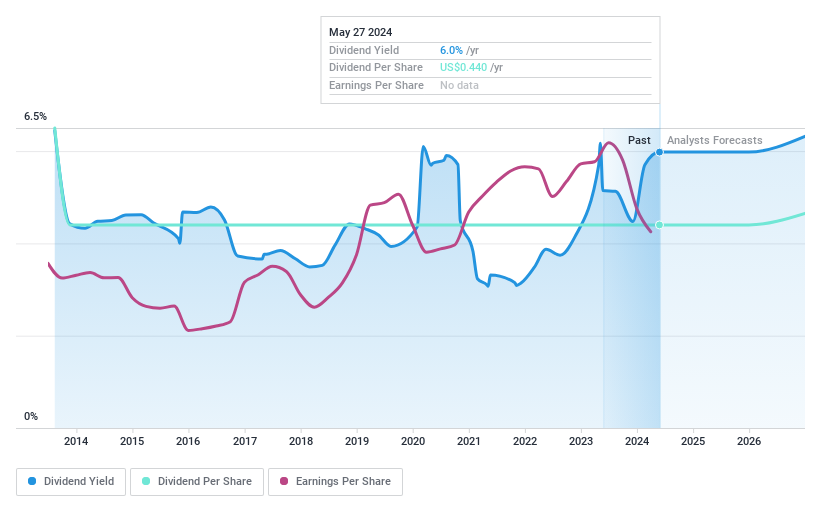

Valley National Bancorp (NasdaqGS:VLY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valley National Bancorp is a holding company for Valley National Bank, offering a range of commercial and private banking, retail, insurance, and wealth management services with a market cap of approximately $5.90 billion.

Operations: Valley National Bancorp generates its revenue through segments including Consumer Banking ($234.79 million), Commercial Banking ($1.30 billion), and Treasury and Corporate Other ($72.02 million).

Dividend Yield: 4.1%

Valley National Bancorp maintains a steady dividend, recently affirming a US$0.11 per share payout, consistent with previous quarters. Despite its stable payout ratio of 70.4%, the dividend yield of 4.08% is slightly below top-tier U.S. dividend payers and has not grown over the past decade, indicating unreliability in historical growth patterns. Recent financials show declining net income and profit margins, while a follow-on equity offering suggests potential dilution concerns for shareholders.

- Get an in-depth perspective on Valley National Bancorp's performance by reading our dividend report here.

- The analysis detailed in our Valley National Bancorp valuation report hints at an inflated share price compared to its estimated value.

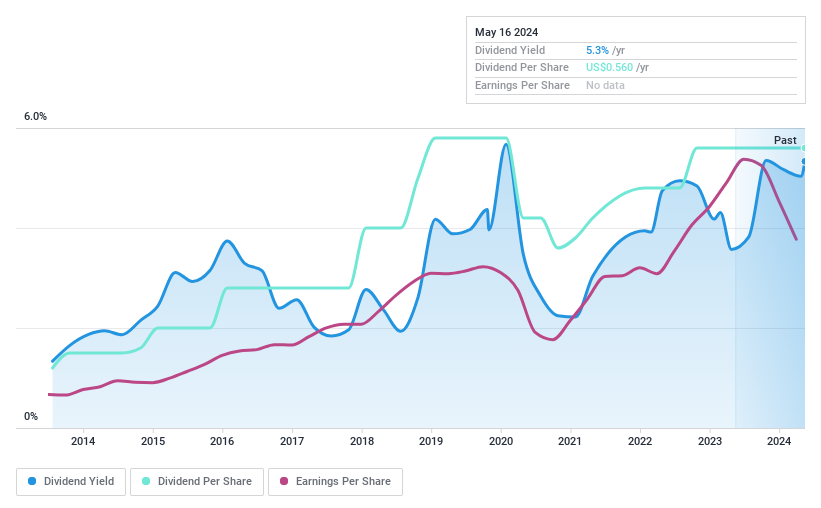

Marine Products (NYSE:MPX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Marine Products Corporation designs, manufactures, and sells recreational fiberglass powerboats for the sport boat and sport fishing boat markets worldwide, with a market cap of approximately $346.44 million.

Operations: Marine Products Corporation generates revenue primarily from its Powerboat Manufacturing Business, which accounted for $259.61 million.

Dividend Yield: 5.5%

Marine Products Corporation declared a quarterly dividend of US$0.14 per share, reflecting its position among the top 25% of U.S. dividend payers with a yield of 5.48%. However, this dividend is not well covered by earnings due to a high payout ratio of 102%, and historical volatility raises concerns about reliability. Recent financials show declining sales and net income, impacting profit margins and sustainability despite dividends being covered by cash flows at a reasonable rate.

- Click here and access our complete dividend analysis report to understand the dynamics of Marine Products.

- Insights from our recent valuation report point to the potential overvaluation of Marine Products shares in the market.

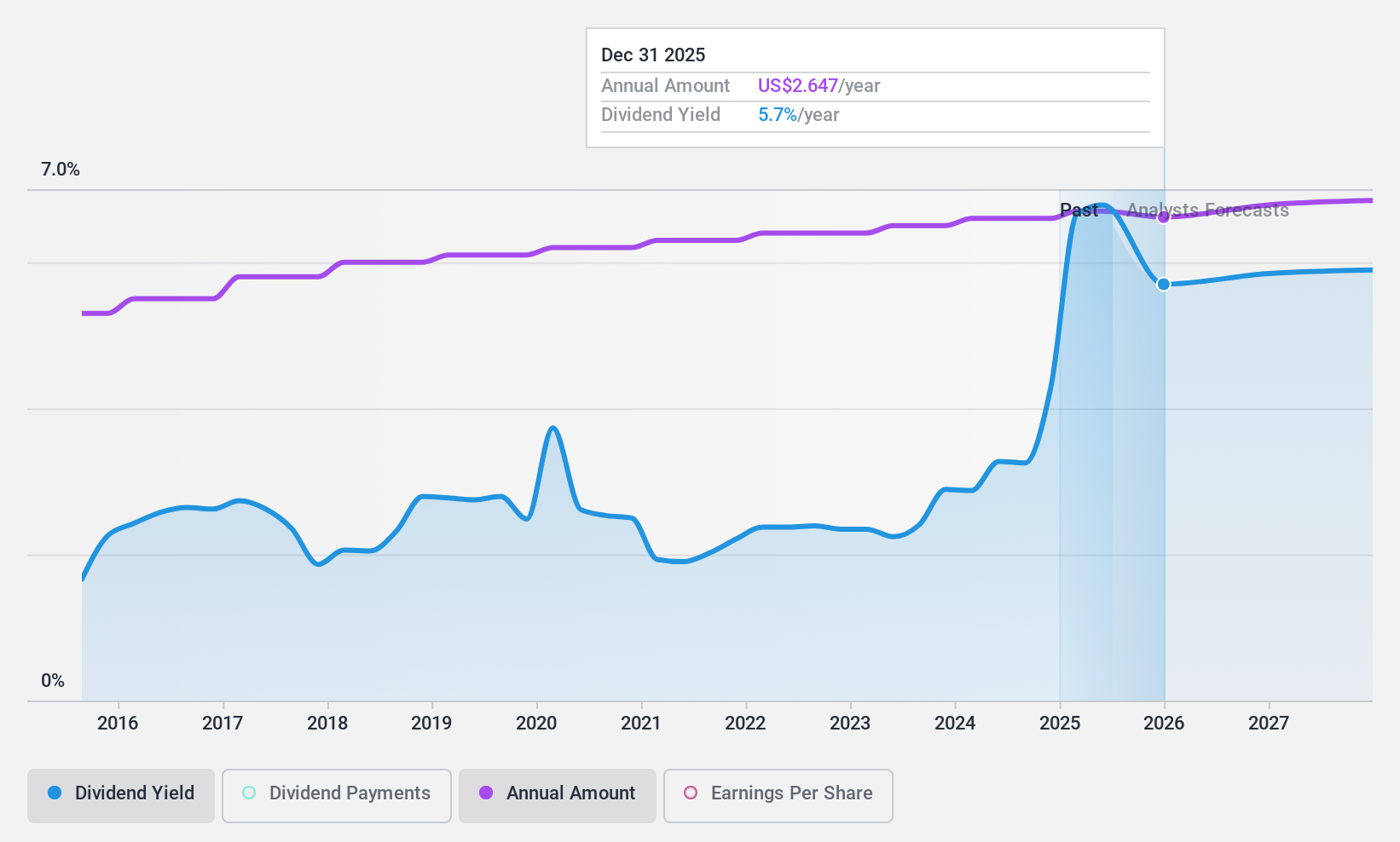

Polaris (NYSE:PII)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Polaris Inc. designs, engineers, manufactures, and markets powersports vehicles globally, with a market cap of approximately $3.79 billion.

Operations: Polaris Inc. generates revenue through its segments, including Marine at $486.70 million, On-Road at approximately $1.04 billion, and Off-Road at about $6.19 billion.

Dividend Yield: 3.7%

Polaris Inc. offers a stable dividend yield of 3.71%, supported by a sustainable payout ratio of 73.2% and cash flow coverage at 57.6%. Despite this, its profit margins have decreased from last year, and the dividend yield is lower than the top U.S. payers' average of 4.21%. Recent leadership changes and product innovations highlight strategic shifts amidst a challenging financial landscape with declining sales and net income impacting earnings performance.

- Take a closer look at Polaris' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Polaris is priced lower than what may be justified by its financials.

Key Takeaways

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 130 more companies for you to explore.Click here to unveil our expertly curated list of 133 Top US Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VLY

Valley National Bancorp

Operates as the holding company for Valley National Bank that provides various commercial, private banking, retail, insurance, and wealth management financial services products.

Flawless balance sheet with reasonable growth potential and pays a dividend.