- United States

- /

- Consumer Durables

- /

- NYSE:MHO

M/I Homes (MHO) Margin Decline Underscores Softer Profit Growth vs Investor Narratives

Reviewed by Simply Wall St

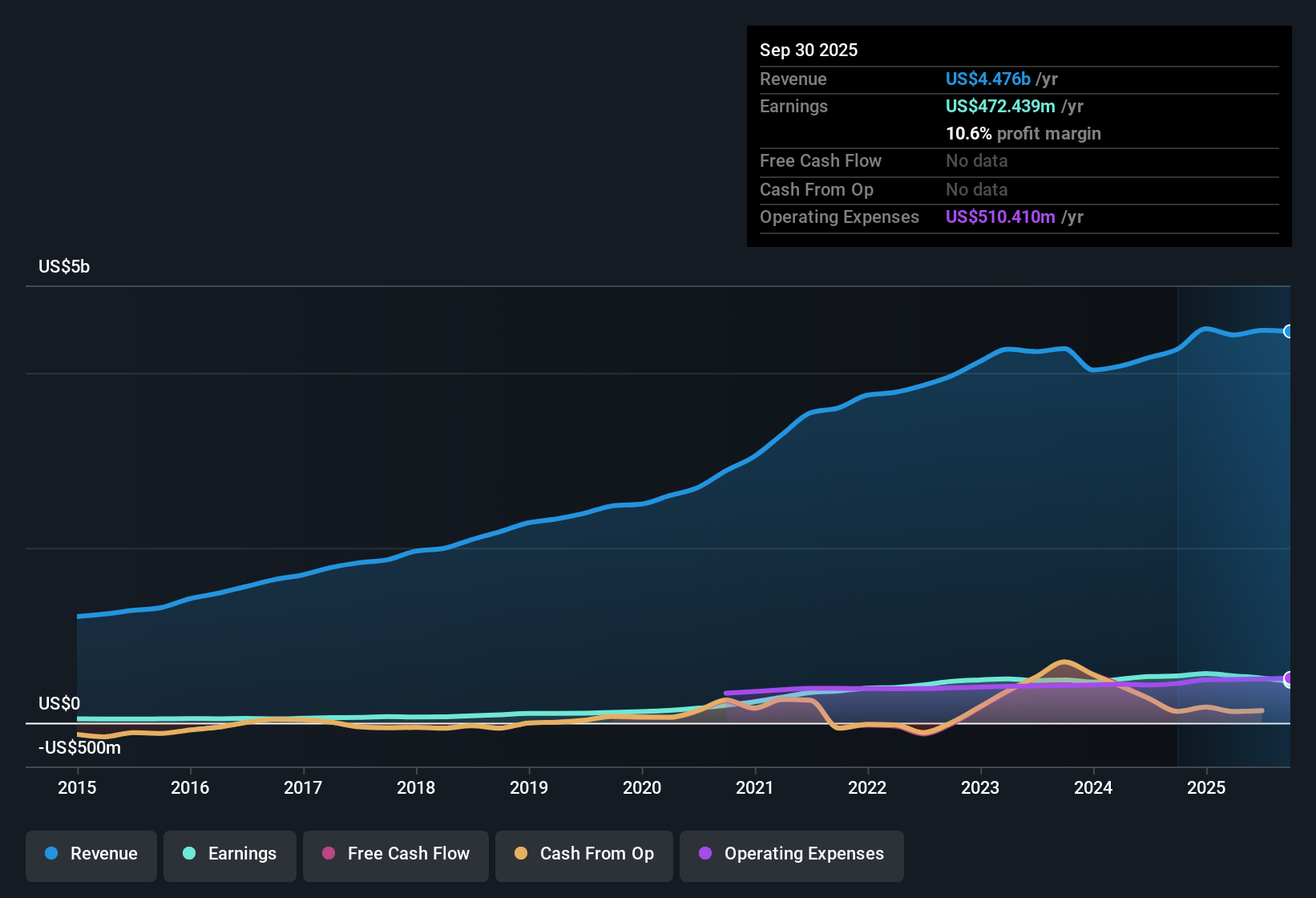

M/I Homes (MHO) reported a net profit margin of 11.4%, a decrease from 12.7% the previous year, with recent data showing negative earnings growth over the past year. While the company has managed to grow its earnings by an average of 14.4% per year over the past five years, its anticipated annual profit growth is now forecast at 4%, noticeably slower than the broader US market's 15.5% per year. Despite the margin compression and softer profit outlook, M/I Homes stands out for its good value given a price-to-earnings ratio of 6.8x, which is well below both industry and peer averages. No flagged risks in the current data lend support to a constructive read for investors, even as outperformance expectations moderate.

See our full analysis for M/I Homes.Next, we’ll see how these headline numbers compare to the widely followed narratives for M/I Homes. Some market views may get reinforced here, while others could be put to the test.

See what the community is saying about M/I Homes

Gross Margin Squeeze Pressures Profit Quality

- Gross margins declined by 320 basis points versus the prior year, contributing to a drop in net profit margin from 12.7% to 11.4%. This reflects the impact of heavier incentives and increased costs.

- Analysts' consensus view acknowledges that margin compression is partly driven by M/I Homes’ use of mortgage rate buydowns and higher inventory exposure. However, the company’s strategic expansion and robust land position could support a rebound as housing demand recovers.

- A 5 to 6 year supply of owned and controlled land is expected to help minimize future downside, even if margins remain pressured in the near term.

- Operational discipline in cost management and improvements in build cycle times are seen as setting a foundation for future margin stabilization.

- Curious whether M/I Homes can regain lost profitability as margins face headwinds? See how analysts weigh the trade-offs in their full narrative. 📊 Read the full M/I Homes Consensus Narrative.

Inventory Exposure and Rising Costs Heighten Risks

- Inventory/spec homes now make up 73% of sales, while SG&A expenses are rising faster than revenue, with a 7% year-over-year increase despite only 5% revenue growth. This could threaten operating leverage if home sales do not accelerate.

- Bears argue that swelling inventory and heavy land investments put future profitability at risk, especially if demand softens further.

- New contracts dropped 8% year-over-year, suggesting ongoing pressure on sales momentum and backlog conversion.

- If home prices or absorption rates fall, the company could face increased discounting and possible land value impairments.

Share Price Holds Premium to DCF Value Despite Low PE

- At $131.69, M/I Homes trades well above its DCF fair value of $96.51 but remains at a steep discount to sector averages on a PE basis (6.8x versus Consumer Durables average of 10.5x). This highlights mixed valuation signals for investors.

- Analysts' consensus narrative interprets this as fair pricing given the company’s solid balance sheet and expected long-term revenue growth, but flags the limited upside to the $162.00 analyst target, which is just 5.6% above current trading. This suggests most of the medium-term optimism may already be priced in.

- This tension between discounted valuation ratios and a share price premium to modeled fair value reflects cautious optimism amid sector headwinds and cyclical uncertainties.

- Future upside may depend on the pace of margin recovery and the strength of demand in high-growth regions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for M/I Homes on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another angle on these results? Shape your viewpoint into a unique narrative in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding M/I Homes.

See What Else Is Out There

M/I Homes is feeling the squeeze from margin pressure, rising inventory, and slower profit and sales momentum. Analysts are now tempering growth expectations for the company.

If you want to focus on companies that keep delivering reliable revenue and earnings growth through market ups and downs, start with stable growth stocks screener (2092 results) and see which names lead the pack.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MHO

M/I Homes

Engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives