- United States

- /

- Consumer Durables

- /

- NYSE:MHO

M/I Homes, Inc. (NYSE:MHO) Shares Fly 32% But Investors Aren't Buying For Growth

The M/I Homes, Inc. (NYSE:MHO) share price has done very well over the last month, posting an excellent gain of 32%. The last 30 days bring the annual gain to a very sharp 63%.

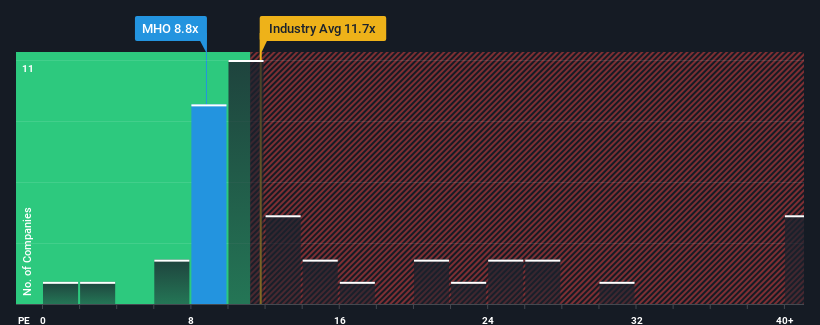

Even after such a large jump in price, M/I Homes may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.8x, since almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 33x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

The recently shrinking earnings for M/I Homes have been in line with the market. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. You'd much rather the company wasn't bleeding earnings if you still believe in the business. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

View our latest analysis for M/I Homes

Is There Any Growth For M/I Homes?

There's an inherent assumption that a company should far underperform the market for P/E ratios like M/I Homes' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.1% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 77% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 3.3% during the coming year according to the dual analysts following the company. That's shaping up to be materially lower than the 13% growth forecast for the broader market.

In light of this, it's understandable that M/I Homes' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

M/I Homes' recent share price jump still sees its P/E sitting firmly flat on the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of M/I Homes' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for M/I Homes with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than M/I Homes. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MHO

M/I Homes

Engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives