- United States

- /

- Consumer Durables

- /

- NYSE:MHK

After Leaping 25% Mohawk Industries, Inc. (NYSE:MHK) Shares Are Not Flying Under The Radar

Mohawk Industries, Inc. (NYSE:MHK) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 10% is also fairly reasonable.

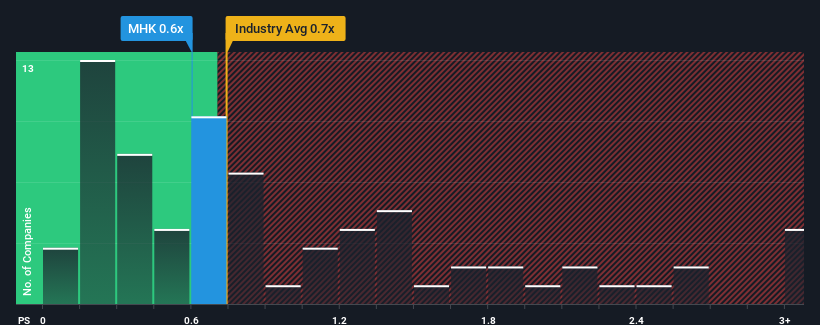

Although its price has surged higher, there still wouldn't be many who think Mohawk Industries' price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in the United States' Consumer Durables industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Mohawk Industries

What Does Mohawk Industries' P/S Mean For Shareholders?

Mohawk Industries could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Mohawk Industries' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Mohawk Industries would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 5.7% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 20% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 2.0% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 4.0% per year, which is not materially different.

With this in mind, it makes sense that Mohawk Industries' P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Mohawk Industries' P/S

Its shares have lifted substantially and now Mohawk Industries' P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Mohawk Industries' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Consumer Durables industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Plus, you should also learn about this 1 warning sign we've spotted with Mohawk Industries.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Mohawk Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MHK

Mohawk Industries

Designs, manufactures, sources, distributes, and markets flooring products for residential and commercial remodeling, and new construction channels in the United States, Europe, Latin America, and internationally.

Flawless balance sheet and undervalued.