- United States

- /

- Consumer Durables

- /

- NYSE:LZB

Assessing La-Z-Boy (LZB) Valuation After Recent Share Price Decline and Expansion Plans

Reviewed by Kshitija Bhandaru

See our latest analysis for La-Z-Boy.

La-Z-Boy’s latest 1-year total shareholder return sits at -16%, with the share price currently at $33. After last year’s strong multi-year gains, momentum has clearly faded. Economic jitters and shifting consumer habits have weighed on the stock’s short-term direction more than any single event.

If you’re curious what else is catching investors’ attention lately, now is a smart time to broaden your horizons and discover fast growing stocks with high insider ownership

With the valuation now sitting well below analyst targets and a history of both periods of rapid growth and setbacks, the key question for investors is whether La-Z-Boy is trading at a bargain, or if the market is already factoring in future performance.

Most Popular Narrative: 19.5% Undervalued

La-Z-Boy’s most-followed valuation narrative sees room for a meaningful price recovery, with the fair value set much higher than its recent $33 close. This story is gaining traction because it leans on both operational improvements and ambitious expansion plans that could set up the next upcycle.

Expansion of company-owned retail stores, including a significant new 15-store acquisition and plans to open 15 new stores this year, positions La-Z-Boy to capture increased demand from new homeownership and consumer investment in home comfort, supporting future revenue growth and market share gains.

Curious how these ambitious store rollouts and a major shift in strategy could spark a re-rating? The narrative’s numbers hint at some bullish underlying assumptions for revenue growth, profit margins, and even share buybacks. Want to know what makes this valuation stand out compared to other home furnishing stocks? You’ll need to dive into the full narrative to get the full scoop.

Result: Fair Value of $41.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in store traffic or continued industry-wide promotional pressure could disrupt La-Z-Boy’s expansion-driven recovery narrative.

Find out about the key risks to this La-Z-Boy narrative.

Another View: The Multiples Approach

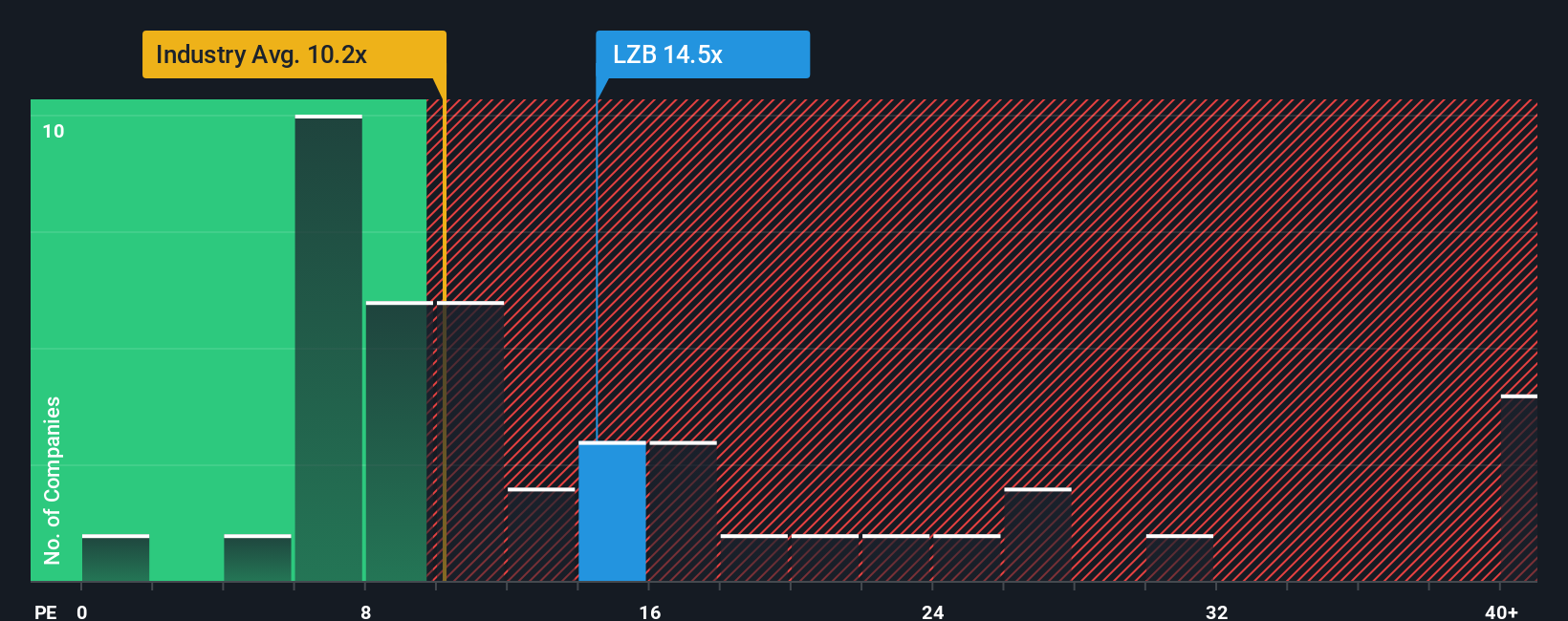

While the main narrative points to La-Z-Boy being undervalued using future earnings estimates, looking at its price-to-earnings ratio tells a different story. The company's current ratio of 14.8x is noticeably higher than the US Consumer Durables industry average of 11.1x and the peer average of 12.4x. Even though it is close to the fair ratio of 15.3x, investors should weigh whether paying a premium today leaves enough margin for safety if industry trends do not improve. Does this suggest the stock is riskier than it first appears?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own La-Z-Boy Narrative

If the consensus doesn’t match your outlook or you want a fresh angle built on your own analysis, you can easily shape your version of the story in just a few minutes. Do it your way

A great starting point for your La-Z-Boy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to just one stock when there’s a world of opportunities waiting. If you want to strengthen your portfolio, now is the time to check these out:

- Tap into the income potential of companies offering reliable yields by browsing these 19 dividend stocks with yields > 3%. These companies have standout track records for shareholder returns.

- Ride the momentum of fast-growing technologies reshaping industries by reviewing these 25 AI penny stocks. These stocks are involved in artificial intelligence breakthroughs and may shape tomorrow’s leaders.

- Capitalize on value opportunities with these 889 undervalued stocks based on cash flows. These meet strict cash flow and fundamentals criteria, offering attractive entry points for selective investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LZB

La-Z-Boy

Manufactures, markets, imports, exports, distributes, and retails upholstery furniture products in the United States, Canada, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives