- United States

- /

- Consumer Durables

- /

- NYSE:LEN

Should You Rethink Lennar After a 14% Surge Amid Housing Market Volatility?

Reviewed by Bailey Pemberton

- Wondering if Lennar stock is an overlooked bargain or just another name in the headlines? Let’s dive in together and find out if there’s real value behind the current price.

- Lennar shares have surged 14.0% in the past 7 days, despite being down 17.0% over the last year and rising over 114% in the past five years. This highlights both volatility and long-term growth strength.

- Recent headlines have focused on shifting mortgage rates and a tightening housing market, sparking fresh debates about demand for new homes. These factors have driven renewed interest in Lennar, with some analysts suggesting that recent market moves are tied to evolving confidence and risk perceptions across the homebuilder sector.

- The current valuation score for Lennar is 1/6, indicating it checks just one of six undervaluation boxes. In the next sections, we’ll break down what that really means and ultimately reveal a smarter way to analyze value that most investors miss.

Lennar scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lennar Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and then discounts them back to today’s value, aiming to determine what the stock should truly be worth right now. In Lennar’s case, this means looking at the cash the business actually produces, rather than just reported profits, and weighing the likelihood of those cash flows continuing far into the future.

Lennar’s last twelve months Free Cash Flow stands at -$702.5 Million, indicating a period of negative cash generation. However, analysts expect a turnaround, with cash flows forecasted to reach around $2.15 Billion by 2026. Projecting further out, Simply Wall St estimates that, over the next decade, Lennar’s annual Free Cash Flow will remain above $1.3 Billion per year. Some years show a tapering trend before modest growth resumes near the end of the period. Notably, analysts only directly estimate the first five years, and later projections are inferred using financial modeling techniques.

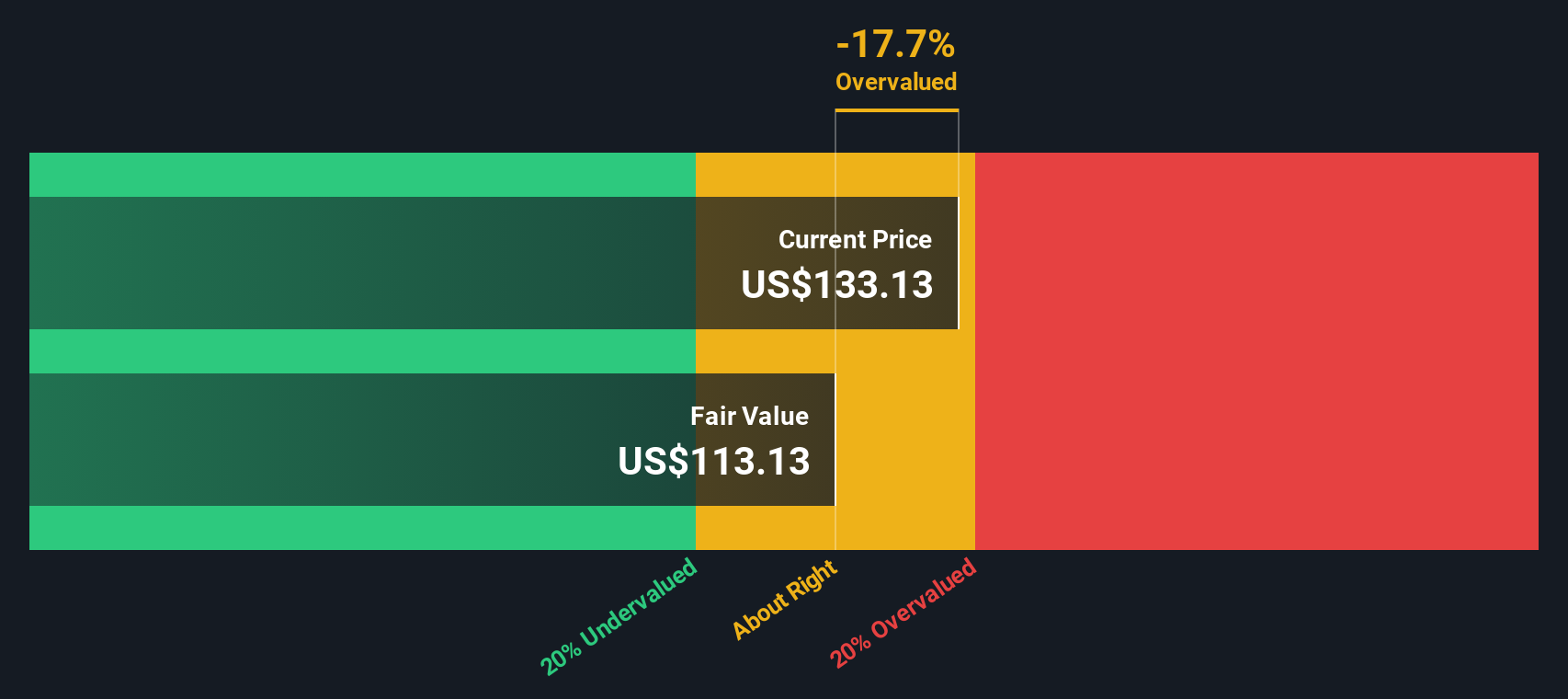

Summing and discounting these future cash flows, Lennar’s estimated intrinsic value is $80.87 per share. This compares to the current share price and implies the stock is actually trading about 62.3% above what its future cash flows would justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lennar may be overvalued by 62.3%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Lennar Price vs Earnings

For established, profitable companies like Lennar, the Price-to-Earnings (PE) ratio is often considered a reliable measure of valuation. The PE ratio helps investors see how much they are paying for each dollar of earnings, which makes it especially meaningful when profits are consistent and growth potential matters.

What is a “normal” or “fair” PE ratio? It depends on a mix of factors. Companies expected to grow faster or take on less risk often command higher PE multiples, while those with slower growth or higher risk tend to trade at a lower PE.

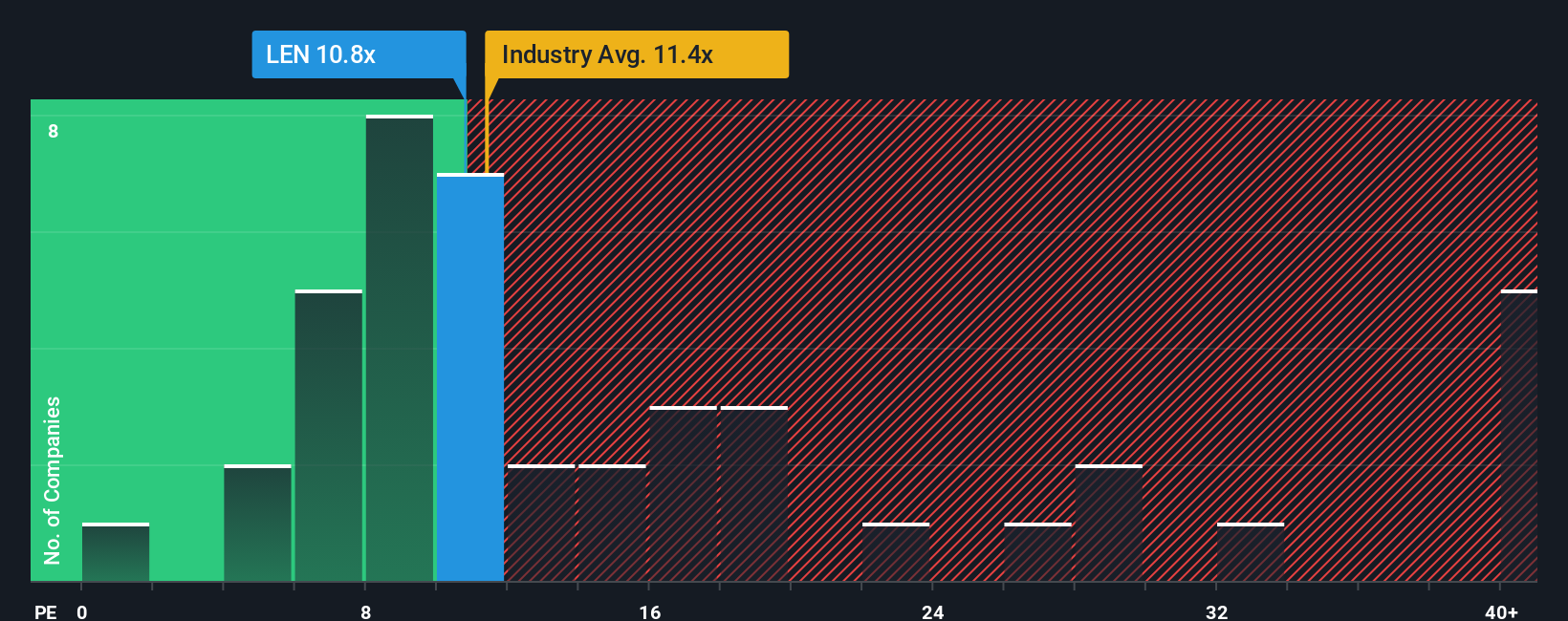

Currently, Lennar trades at a 12.6x PE ratio. Compared to the Consumer Durables industry average of 11.9x and a peer group average of 11.8x, Lennar’s valuation appears slightly higher than its immediate benchmarks. However, there is more to the story than simple averages.

Simply Wall St’s proprietary “Fair Ratio” for Lennar stands at 15.5x. This figure goes beyond peer and industry comparisons by blending factors like earnings growth, profit margin, market cap, and overall risk profile. It aims to offer a more personalized, data-driven benchmark for fair value that is attuned to Lennar's unique strengths and the broader environment it operates in.

With Lennar’s current PE at 12.6x and its Fair Ratio at 15.5x, the stock looks modestly undervalued on this basis, suggesting there may be value that traditional comparisons could overlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lennar Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story, your perspective on a company’s future, captured through your assumptions for key numbers like fair value, future revenue, earnings, and profit margins.

Narratives connect what you believe about Lennar’s business to a financial forecast and then calculate a personal fair value based on your inputs. This allows you to see precisely how your outlook translates into real numbers. This approach makes investment decisions more dynamic and personalized, and it is easily accessible to everyone through Simply Wall St's Community page, which millions of investors use worldwide.

By comparing your Narrative-derived Fair Value with Lennar’s current market price, you can more confidently decide whether to buy, hold, or sell. Since Narratives update automatically whenever fresh news or earnings are released, your framework always stays relevant.

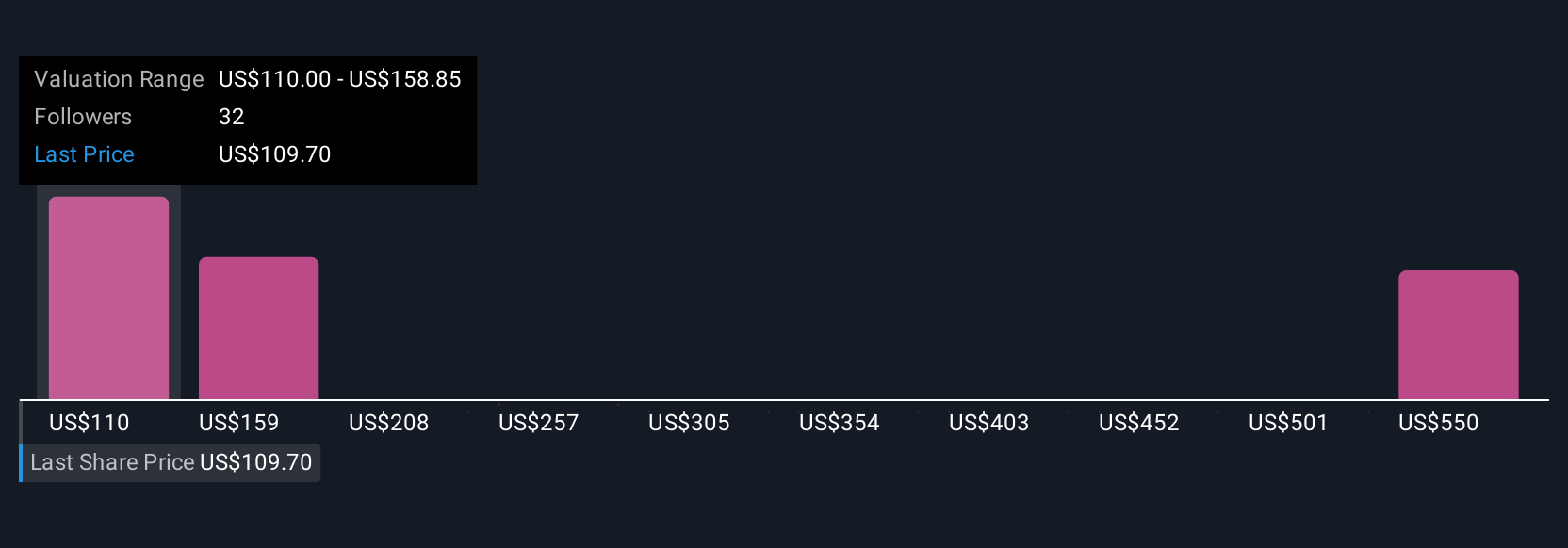

For example, recent Narratives from actual investors show Lennar fair values ranging from $95 (with margins expected to compress and sales to flatten) to $215 (with major margin expansion and three years of strong earnings growth), all powered by real users’ assumptions and regularly refreshed with new information.

For Lennar, however, we'll make it really easy for you with previews of two leading Lennar Narratives: 🐂 Lennar Bull CaseFair Value: $162.49

Undervalued by: 19.2%

Revenue Growth Rate: 5.67%

- Sees short-term headwinds due to high mortgage rates and oversupply, but predicts long-term gains as pent-up demand returns and the structural housing shortage drives growth.

- Thesis includes 1-year price target of $149.57 and 3-year price target of $215.56, with estimates based on revenue growth of 5.7% annually and margins improving over time.

- Political and regulatory context expected to favor homebuilders, with policy changes and population growth, especially in affordable regions like Texas, offering compelling catalysts for Lennar’s future.

Fair Value: $127.50

Overvalued by: 3.0%

Revenue Growth Rate: 4.21%

- Analysts expect shrinking profit margins from 9.1% to 6.1% over the next 3 years due to persistent high mortgage rates, constrained home supply, and increased sales incentives pressuring profitability.

- Forecasts future earnings per share growth will be limited, with a consensus price target of $124, below the recent share price, indicating that Lennar could face a period of stagnation or slight decline.

- Recently, Lennar has maintained steady revenue but faces cautious delivery and margin recovery expectations, with the current valuation near or slightly above fair value based on analysts’ assumptions.

Do you think there's more to the story for Lennar? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEN

Lennar

Operates as a homebuilder primarily under the Lennar brand in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success