- United States

- /

- Consumer Durables

- /

- NYSE:LEN

Lennar (LEN): Evaluating Valuation as Incentives and Policy Support Boost Homebuilder Sentiment

Reviewed by Kshitija Bhandaru

Lennar (LEN) has joined several other national builders in introducing new buyer incentives and promotions to address the challenges of higher home prices and interest rates. Recent policy attention toward supporting big homebuilders is also in the spotlight.

See our latest analysis for Lennar.

Lennar’s year has been marked by brisk news, from launching new communities like River Bridge Ranch in Texas to drawing fresh investor attention and even a notable exchange offer with Millrose Properties. Despite these moves and some recent policy tailwinds for big homebuilders, the stock has posted a 2.4% share price gain in the last day and a 5.9% climb over the week. Its total shareholder return over the past year is down 26.7%. Over the longer term, however, Lennar remains a strong performer with a 93.6% total return in three years and nearly 87% over five years, highlighting solid momentum for patient investors.

If Lennar’s recent developments have you thinking bigger, now is an ideal time to explore See the full list for free..

With homebuilders rolling out incentives and policy makers showing support, Lennar’s fundamentals look intriguing alongside a long-term track record of growth. However, is Lennar undervalued in this environment, or are investors already factoring in its future?

Most Popular Narrative: 1.3% Undervalued

Lennar finished trading at $125.82, almost exactly matching the most popular narrative’s fair value target of $127.50. This close alignment raises questions about whether market optimism or caution is justified for the homebuilder heading into 2025.

The company's focus on driving consistent volume and production efficiency by matching production pace with sales pace aims to maximize profitability and operational efficiency. This strategy is expected to lower construction costs and cycle times, which could impact future earnings positively.

Want to know what’s fueling this tight valuation? The narrative hinges on ambitious earnings targets, bold profit margin shifts, and a future price multiple that stands out. Craving the exact projections and why this consensus sees upside? Jump in to get the numbers behind the story.

Result: Fair Value of $127.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently higher mortgage rates and weak consumer confidence could continue to weigh on Lennar’s revenues and margins, which may challenge this bullish outlook.

Find out about the key risks to this Lennar narrative.

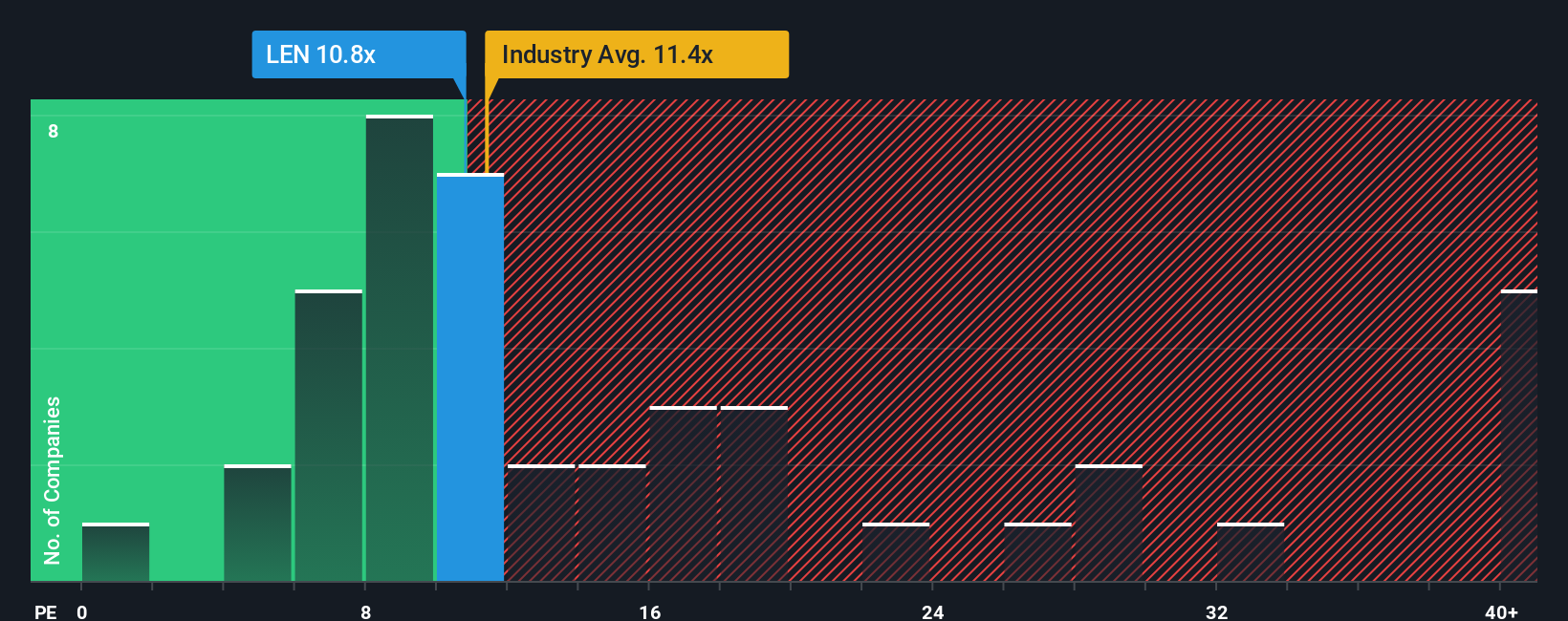

Another View: Sizing Up by Market Ratios

Looking at Lennar through a common market metric, its price-to-earnings ratio of 12.1 is higher than both the peer average (11.1) and the broader industry (10.2). Despite this, it is still lower than the fair ratio of 16.7, suggesting there is potential for further upside or risk if market sentiment shifts. Is Lennar’s premium pricing a sign of strength or added valuation risk for buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lennar Narrative

If you’re eager to dig into the numbers yourself and form your own perspective, you can shape a narrative in just a few minutes: Do it your way.

A great starting point for your Lennar research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t stop with Lennar. Use the Simply Wall Street Screener to quickly target stocks that fit your goals. These handpicked ideas could boost your returns and help you spot hidden winners before others catch on.

- Boost your portfolio's income by picking from these 18 dividend stocks with yields > 3% offering yields above 3%. This approach can be ideal for steady cash flow and compounding gains over time.

- Tap into explosive innovation by tracking these 24 AI penny stocks at the forefront of artificial intelligence breakthroughs and technology disruption.

- Uncover genuine bargains in today's market with these 878 undervalued stocks based on cash flows, highlighting companies whose solid fundamentals haven't yet caught up to their price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEN

Lennar

Operates as a homebuilder primarily under the Lennar brand in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives