- United States

- /

- Consumer Durables

- /

- NYSE:LEN

Can Lennar’s (LEN) Leadership Shift Reshape Its Strategic Direction and Operational Edge?

Reviewed by Sasha Jovanovic

- Lennar Corporation announced that President and Co-Chief Executive Officer Jon Jaffe will retire effective December 31, 2025, concluding a 42-year tenure during which he helped lead the company's expansion and operational integration.

- Jaffe's departure marks a pivotal leadership transition at Lennar, with Executive Chairman Stuart Miller set to serve as sole CEO and no immediate plans to replace the Co-CEO role, signaling potential implications for company strategy and continuity.

- With Jaffe's legacy of operational excellence and leadership in focus, we will examine how this leadership change affects Lennar’s investment outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Lennar Investment Narrative Recap

To be a shareholder in Lennar, you need conviction in the company’s ability to maintain operational efficiency and deliver solid cash flow amid challenging housing market conditions, including elevated mortgage rates and consumer uncertainty. The recent announcement of Jon Jaffe’s planned retirement does not present a material impact on the biggest near-term catalyst, which remains Lennar’s asset-light, land-light operating strategy, or on key risk factors such as margin pressure tied to a weak sales environment.

The company’s steady rollout of new communities, including River Bridge Ranch in Texas and expansions in New Jersey and New York, underscores a consistent focus on growing market share and supporting volume. This approach remains relevant to the current catalyst of leveraging production efficiency to preserve profitability and generate predictable revenue, regardless of executive transitions.

However, despite ongoing operational execution, investors should be aware that pressure on net margins from continued incentives could still pose...

Read the full narrative on Lennar (it's free!)

Lennar's narrative projects $40.2 billion in revenue and $2.5 billion in earnings by 2028. This requires 4.3% yearly revenue growth and a $0.7 billion decrease in earnings from $3.2 billion today.

Uncover how Lennar's forecasts yield a $127.50 fair value, a 11% upside to its current price.

Exploring Other Perspectives

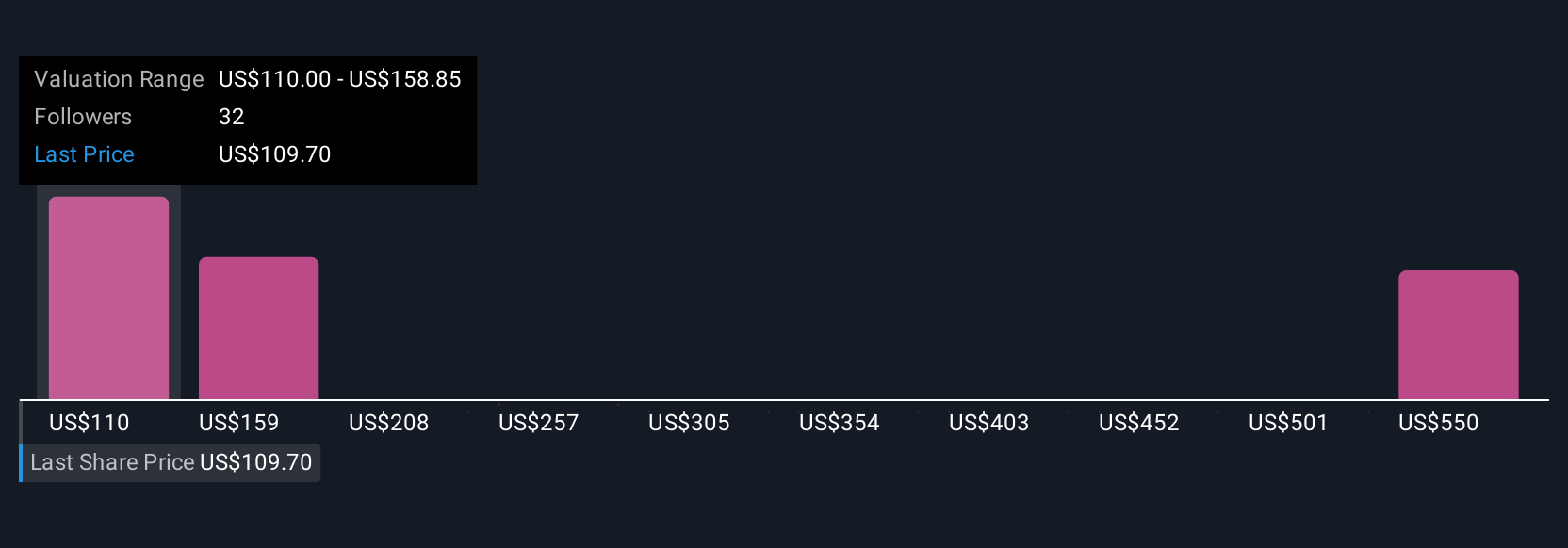

Seven different Simply Wall St Community fair value estimates for Lennar span from US$80.77 to US$162.49 per share, reflecting a wide range of investor analyses. While opinions differ, recent earnings signals and tighter housing affordability continue to shape expectations for Lennar’s future performance, consider reading more viewpoints before forming your own outlook.

Explore 7 other fair value estimates on Lennar - why the stock might be worth as much as 41% more than the current price!

Build Your Own Lennar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lennar research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Lennar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lennar's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEN

Lennar

Operates as a homebuilder primarily under the Lennar brand in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives