- United States

- /

- Consumer Durables

- /

- NYSE:LEG

Will Leggett & Platt's (LEG) Aerospace Exit Refocus Its Core Business for Greater Resilience?

Reviewed by Sasha Jovanovic

- Leggett & Platt recently reported quarterly revenues of US$1.04 billion, reflecting a 6% decline year-on-year but surpassing analyst expectations by 1.1%.

- The company also completed the sale of its Aerospace business, highlighting a sharper focus on its core operations and a shift in its business strategy.

- We’ll now explore how the Aerospace business sale informs Leggett & Platt’s investment narrative and core business outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Leggett & Platt Investment Narrative Recap

To be a shareholder of Leggett & Platt, you would need to believe the company’s core Bedding Products and residential segments have the potential to recover from subdued industry demand and that ongoing restructuring can restore earnings power. The recent sale of the Aerospace business narrows Leggett & Platt’s strategic focus, but the effect on the most immediate catalyst, industry tariff enforcement and demand stabilization, appears limited, while the main risk remains continued weakness in bedding demand, which could persist even as management refines their portfolio.

Among recent announcements, the company’s reaffirmed quarterly dividend stands out as most relevant. This steady payout, maintained despite weak near-term sales, may be seen as a signal of management’s focus on shareholder returns and cost discipline, core issues for investors monitoring whether margin improvement efforts and restructuring gains can offset challenging conditions in core product categories.

However, investors should be alert to the persistent softness across the bedding market, which remains a significant risk if...

Read the full narrative on Leggett & Platt (it's free!)

Leggett & Platt's outlook anticipates $4.3 billion in revenue and $200.1 million in earnings by 2028. This projection is based on an annual revenue decline of 0.7% and an increase in earnings of $57.9 million from the current $142.2 million.

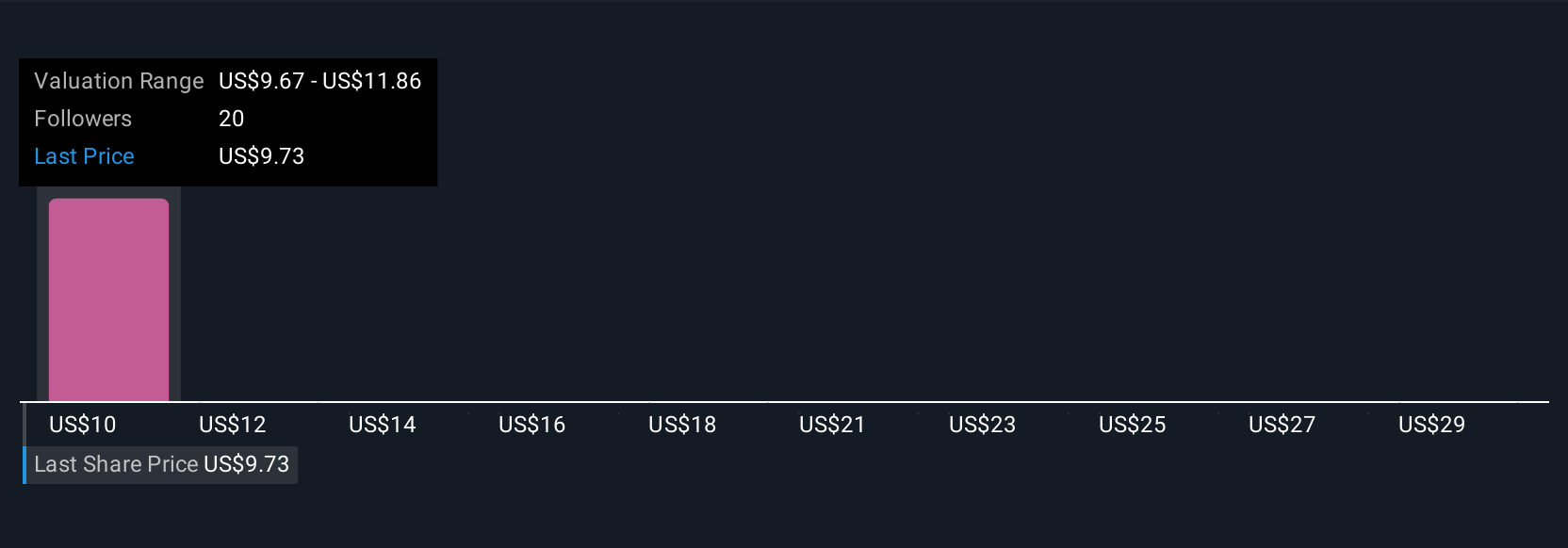

Uncover how Leggett & Platt's forecasts yield a $11.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided seven fair value estimates for Leggett & Platt ranging from US$9.99 to US$31.63. While opinions vary widely, continued slow sales growth and industry competition are key factors shaping expectations for the company’s future performance.

Explore 7 other fair value estimates on Leggett & Platt - why the stock might be worth just $9.99!

Build Your Own Leggett & Platt Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leggett & Platt research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Leggett & Platt research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leggett & Platt's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEG

Leggett & Platt

Designs, manufactures, and sells engineered components and products in the United States, Europe, China, Canada, Mexico, and internationally.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.