- United States

- /

- Luxury

- /

- NYSE:KTB

Kontoor Brands (KTB): Assessing Valuation Following a Year of Steady Gains and Growth Momentum

Reviewed by Simply Wall St

Kontoor Brands (KTB) has delivered steady gains for investors this year, as its shares climbed 1% over the past day and added 13% across the past year. The company's revenue and net income both grew around 12% in the most recent annual report, highlighting continued momentum.

See our latest analysis for Kontoor Brands.

Kontoors’s latest jump comes on strong momentum that has been building all year. Recent buying has driven a 7% share price return over the past month and an impressive 13% total shareholder return over the last year. With gains like these, investors are clearly noticing the growth story taking shape.

If you’re looking for your next opportunity, now is a great moment to explore fast growing stocks with high insider ownership.

With such strong gains and solid annual growth, the big question now is whether Kontoor Brands shares are trading at an attractive value, or if the market has already factored in all the company’s upside potential.

Most Popular Narrative: Fairly Valued

Kontoors Brands’ most widely followed narrative puts its fair value almost exactly in line with the latest closing price, suggesting the market has left little on the table for value hunters. This sets the stage for a deeper look at the bold drivers behind the current valuation.

Ongoing investments in digital platforms and direct-to-consumer (DTC) channels have resulted in strong double-digit digital growth and growing penetration, with further scaling of bespoke and digital marketing expected to improve mix, increase brand equity among younger consumers, and expand both top-line and margins going forward.

Curious how digital momentum and channel shifts could rewrite the growth script? The narrative behind this valuation is powered by high-stakes bets on new platforms, changing consumers, and one transformative acquisition. Find out which critical projections and future financial levers define the story. These assumptions may surprise you.

Result: Fair Value of $85.43 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures and the challenge of revitalizing legacy brands could quickly undermine this growth narrative if market dynamics shift unexpectedly.

Find out about the key risks to this Kontoor Brands narrative.

Another View: Discounted Cash Flow Perspective

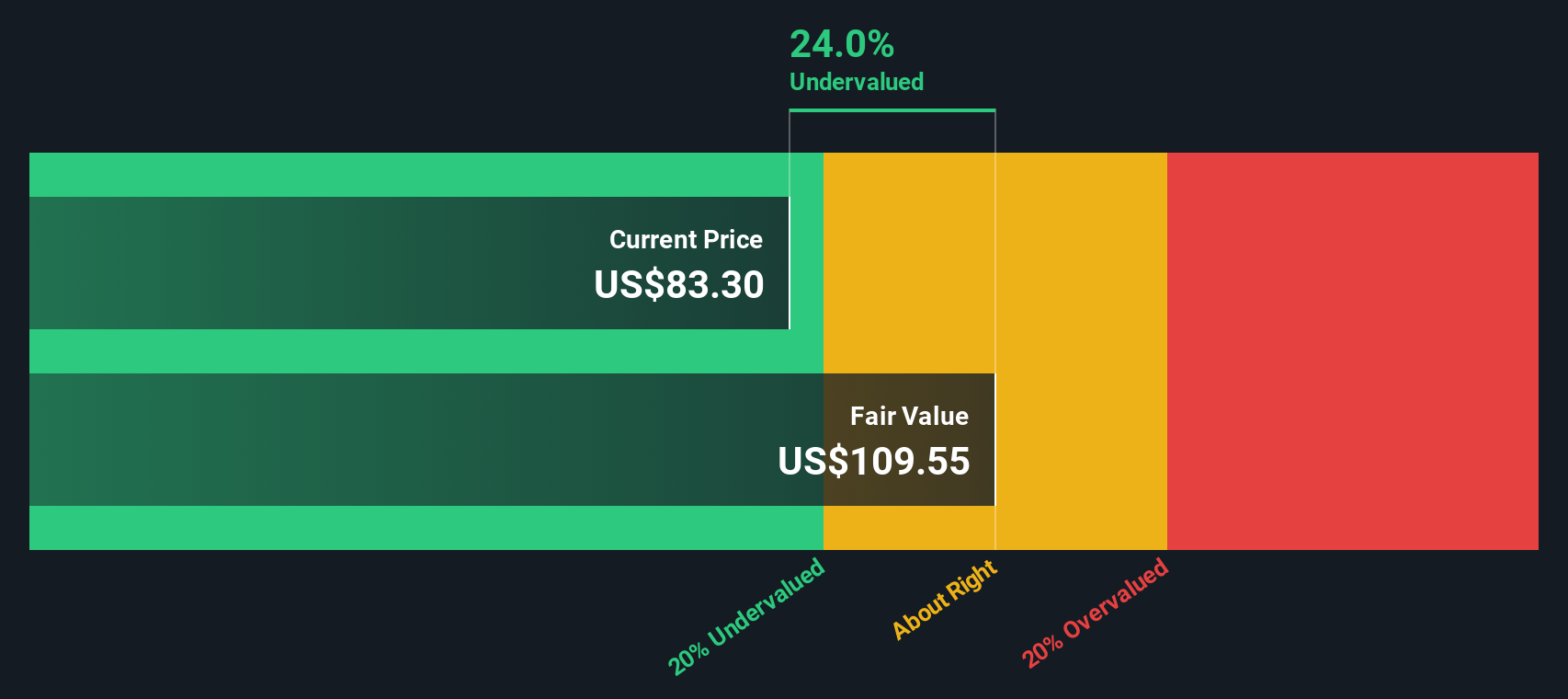

While the current valuation suggests Kontoor Brands is priced appropriately based on market multiples, our DCF model offers a differing perspective. The SWS DCF model estimates the fair value at $109.4 per share, which is well above today’s trading price. This implies the stock could be undervalued by a notable margin. Could the market be underestimating Kontoor’s long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kontoor Brands Narrative

Don’t just take these viewpoints as final. You can dig into the details yourself and craft your own narrative in just minutes: Do it your way.

A great starting point for your Kontoor Brands research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at one opportunity. Widen your perspective with more high-potential stocks curated for your strategy. The next breakout idea could be waiting just a click away, so don’t let it slip through your fingers.

- Tap into the growth of artificial intelligence by checking out these 24 AI penny stocks, which are reshaping industries with innovative solutions and significant upside potential.

- Spot undervalued gems primed for a turnaround as you review these 879 undervalued stocks based on cash flows, identified for strong fundamentals and compelling value signals.

- Secure dependable income streams with these 17 dividend stocks with yields > 3%, focusing on companies offering yields above 3% and robust payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kontoor Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KTB

Kontoor Brands

A lifestyle apparel company, designs, produces, procures, markets, distributes, and licenses denim, apparel, footwear, and accessories, primarily under the Wrangler and Lee brands.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives