- United States

- /

- Luxury

- /

- NYSE:KTB

Earnings Working Against Kontoor Brands, Inc.'s (NYSE:KTB) Share Price Following 25% Dive

Kontoor Brands, Inc. (NYSE:KTB) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 19%.

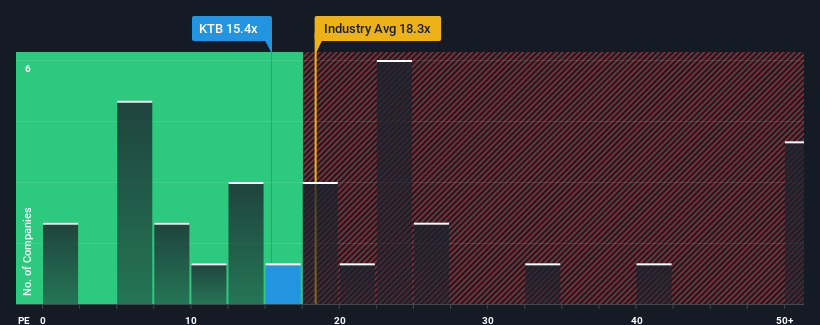

Although its price has dipped substantially, Kontoor Brands may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 15.4x, since almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 33x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Kontoor Brands certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Kontoor Brands

How Is Kontoor Brands' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Kontoor Brands' is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a worthy increase of 7.4%. The latest three year period has also seen an excellent 31% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 0.5% per annum as estimated by the five analysts watching the company. With the market predicted to deliver 11% growth each year, that's a disappointing outcome.

In light of this, it's understandable that Kontoor Brands' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Kontoor Brands' P/E

Kontoor Brands' recently weak share price has pulled its P/E below most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Kontoor Brands' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Kontoor Brands is showing 2 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kontoor Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KTB

Kontoor Brands

A lifestyle apparel company, designs, produces, procures, markets, distributes, and licenses denim, apparel, footwear, and accessories, primarily under the Wrangler and Lee brands.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives