- United States

- /

- Consumer Durables

- /

- NYSE:KBH

KB Home’s New Community Launches Might Change The Case For Investing In KB Home (KBH)

Reviewed by Simply Wall St

- In recent weeks, KB Home has launched several new communities across the U.S., including the grand openings of Camas Ridge in Bothell, Washington; Lenox at Park West in Perris, California; Stoney Chase in Del Valle, Texas; and Sandal Key in Weeki Wachee, Florida.

- While these expansions showcase KB Home's focus on energy efficiency, design personalization, and community amenities, analyst sentiment remains cautious due to recent downward revisions in earnings estimates.

- We’ll examine how KB Home’s wave of new home community launches might impact its investment narrative and earnings outlook.

KB Home Investment Narrative Recap

Being a KB Home shareholder means believing in the company’s ability to turn expanded community launches, efficient build times, and personalized home offerings into sustained growth, even in periods of softer demand and earnings downgrades. The recent wave of grand openings nationwide showcases execution on growth strategy, but this activity has not yet materially offset concerns about reduced revenue and profit guidance, or the risk of continued moderation in homebuyer demand as a near-term catalyst.

Of particular interest is the newly launched Camas Ridge community near Seattle, where premium pricing and energy-efficient designs target higher-income buyers. While this aligns with KB Home’s focus on innovation and customer satisfaction, the success of such upscale offerings may only partially counterbalance competitive pressures and slowing deliveries impacting overall earnings.

But before embracing the optimism of expanded offerings, investors should be aware that shifting regional dynamics, such as the necessity for price reductions in markets like Florida, are still...

Read the full narrative on KB Home (it's free!)

KB Home's narrative projects $6.8 billion revenue and $496.4 million earnings by 2028. This requires a 0.2% annual revenue decline and a $125.1 million decrease in earnings from $621.5 million today.

Uncover how KB Home's forecasts yield a $66.42 fair value, a 22% upside to its current price.

Exploring Other Perspectives

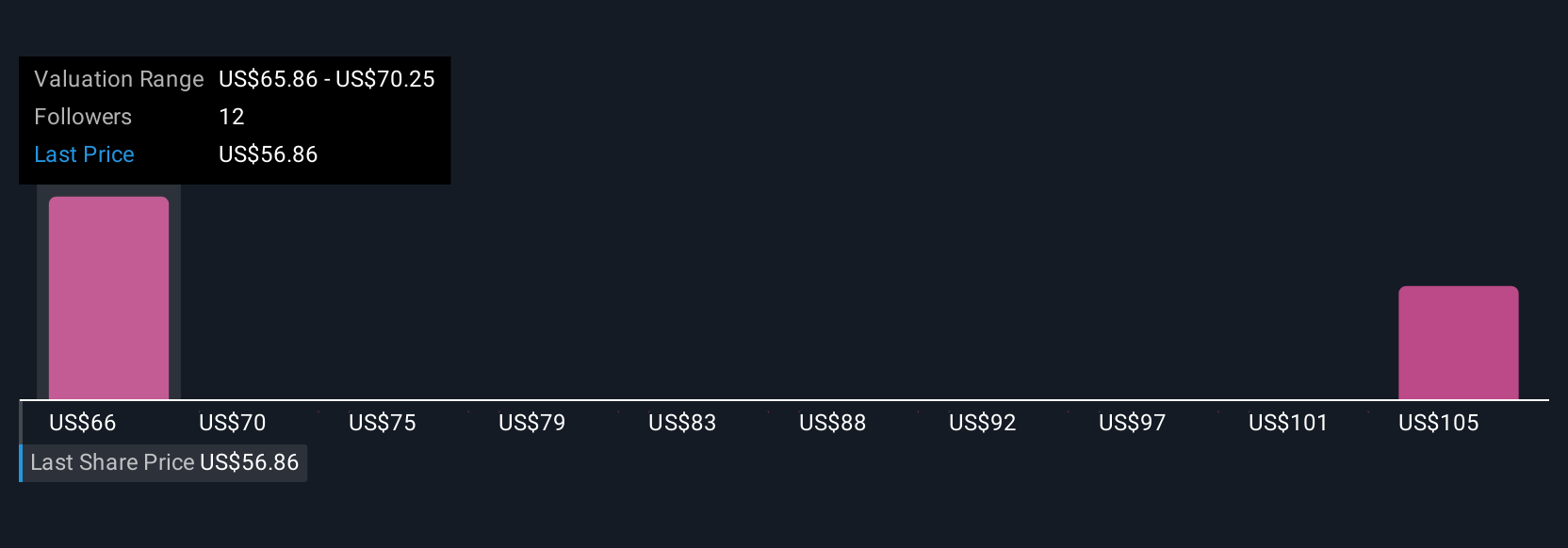

Three fair value estimates from the Simply Wall St Community range from US$65.86 to US$108.87 per share. In the face of falling earnings forecasts and inconsistent revenue trends, market participants clearly see room for debate about KB Home’s future performance.

Build Your Own KB Home Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KB Home research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free KB Home research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KB Home's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KB Home might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBH

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives