- United States

- /

- Consumer Durables

- /

- NYSE:KBH

KB Home (KBH): Assessing Valuation After New Community Openings in Key Growth Markets

Reviewed by Simply Wall St

KB Home (KBH) just rolled out a string of new communities across Florida, California and Texas, underscoring steady demand for its energy efficient, highly customizable homes and giving investors fresh evidence of underlying business momentum.

See our latest analysis for KB Home.

All of that rollout has come while KB Home’s share price has been choppy, with a 1 month share price return of 5.40% but a 1 year total shareholder return of negative 16.71%. The 3 year total shareholder return is still up 112.55%, which suggests longer term momentum remains intact, while near term sentiment is cautious.

If these new communities have you thinking more broadly about housing driven themes, it could be worth exploring fast growing stocks with high insider ownership as another way to spot compelling growth stories.

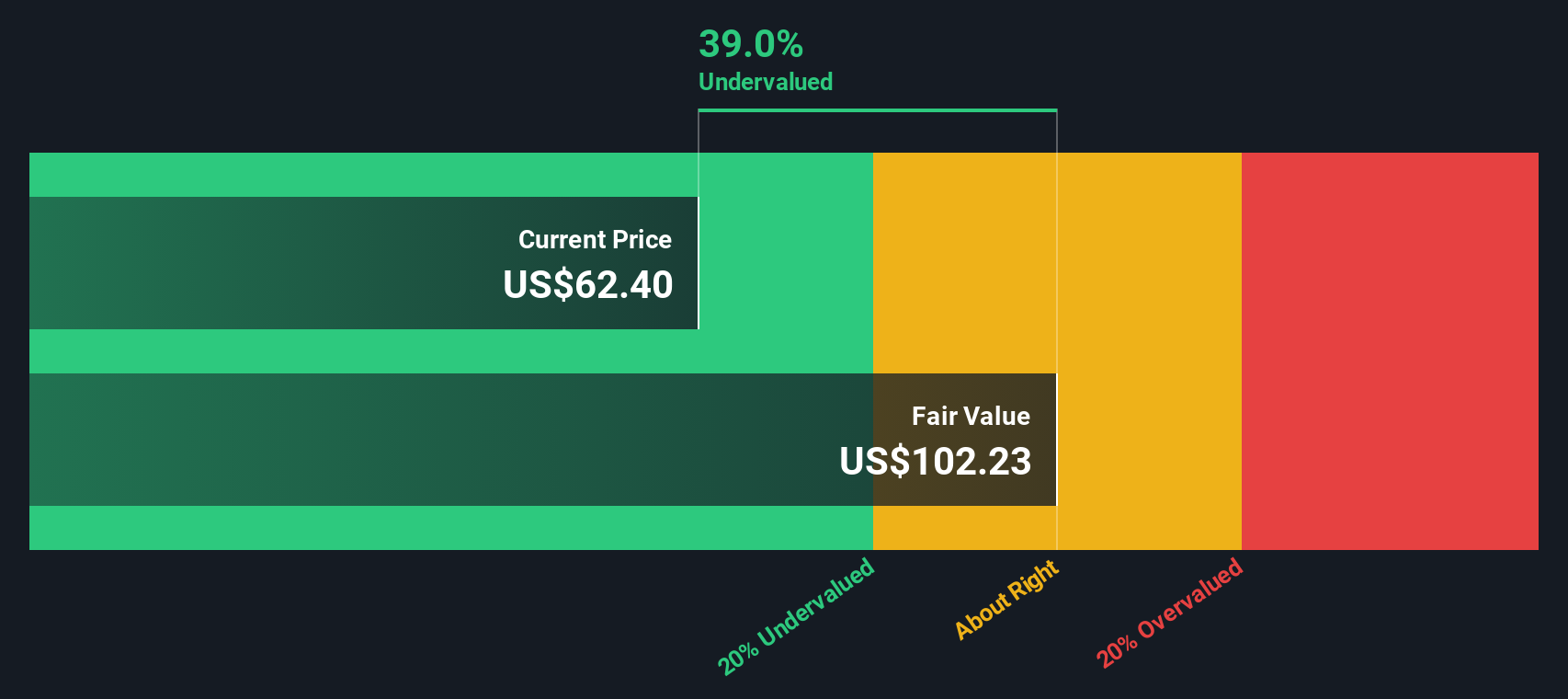

With revenue and earnings both dipping over the past year, but the stock still trading just shy of analyst targets, the key question now is simple: Is KB Home quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 1% Undervalued

With KB Home last closing at $64.19 against a narrative fair value of about $64.67, the valuation case rests heavily on how future earnings are framed.

Analysts expect earnings to reach $496.4 million (and earnings per share of $9.19) by about May 2028, down from $621.5 million today. In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.7x on those 2028 earnings, up from 6.1x today.

Want to know why a shrinking earnings base still supports a richer future multiple than the wider industry? The answer hides in margin resilience and capital returns. Curious which assumptions really carry this story and how sensitive that fair value is to even small shifts in demand or pricing power? Read on to unpack the full narrative math.

Result: Fair Value of $64.67 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer demand, regional pricing pressure and delivery disruptions could all undermine margin resilience and challenge the case for a higher future multiple.

Find out about the key risks to this KB Home narrative.

Another Take On Value

While the narrative fair value pegs KB Home at about where it trades today, our DCF model tells a tougher story. On that view, the stock looks overvalued, with an estimated fair value closer to $46.63. Is the market overpaying for resilience, or underestimating risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out KB Home for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own KB Home Narrative

If you want to dig into the numbers yourself or challenge this view, you can spin up a fresh narrative in under three minutes, Do it your way.

A great starting point for your KB Home research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your advantage by using the Simply Wall St Screener to uncover fresh, data backed opportunities across themes the market still underestimates.

- Target reliable cash generators and let compounding work harder by focusing on these 15 dividend stocks with yields > 3% that can support income and total return potential.

- Ride structural growth in automation and intelligent software by zeroing in on these 26 AI penny stocks shaping the next wave of productivity gains.

- Position yourself ahead of quiet market mispricings by filtering for these 908 undervalued stocks based on cash flows where fundamentals outpace current expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KB Home might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBH

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026