- United States

- /

- Consumer Durables

- /

- NYSE:KBH

KB Home (KBH): Assessing the Valuation After Strong Profitability Offsets Lower Q3 Sales

Reviewed by Kshitija Bhandaru

KB Home (KBH) recently reported its third quarter results, showing lower sales but stronger profitability than many expected. Management put the spotlight on construction efficiency, cost control, and steady demand, highlighting resilience in the current environment.

See our latest analysis for KB Home.

Despite a dip in sales, KB Home’s share price has held up as investors responded to management’s focus on profitability and several upbeat new community launches in Washington and California. The stock’s one-year total shareholder return stands at -0.18%, but its strong three-year total return of 1.48% highlights the staying power of its disciplined approach and operational improvements.

If recent homebuilder activity has you thinking bigger, now is the time to broaden your search and discover fast growing stocks with high insider ownership

The question for investors is whether KB Home’s recent operational improvements and resilient profitability signal untapped value, or if the market has already priced in the company’s growth potential following its steady performance this year.

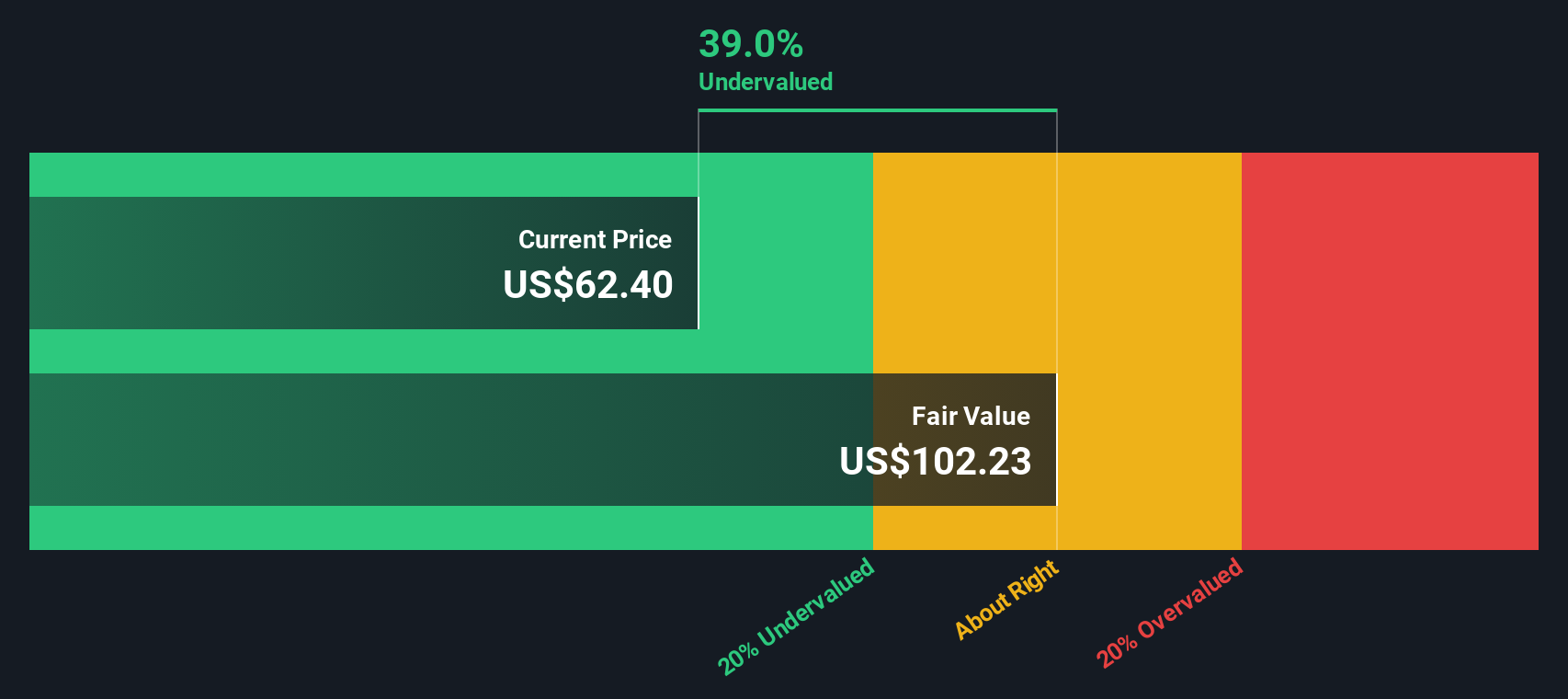

Most Popular Narrative: 0.4% Undervalued

With the latest fair value from the prevailing market narrative sitting at $66, just above KB Home’s last close at $65.76, the debate around whether upside remains is razor-thin. The story hinges on bold strategic moves, but a closer look reveals the underlying catalysts driving this view.

The company has made strategic land acquisitions, such as the purchase of two large parcels in Las Vegas, which are expected to support future community growth and enhance sales opportunities. This is likely to improve revenue streams as these new communities become operational.

Want to see what keeps analysts optimistic despite sluggish growth? The secret sauce of this valuation is hidden in a few aggressive margin, volume, and capital return forecasts, along with a premium multiple that could surprise even the bulls. Ready to find out what’s fueling the price?

Result: Fair Value of $66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in consumer confidence and regional market headwinds could undermine KB Home's margin improvements. These factors pose risks to the company’s optimistic outlook.

Find out about the key risks to this KB Home narrative.

Another View: What Does Our DCF Model Say?

While many investors rely on market multiples to judge valuation, the Simply Wall St DCF model tells a different story. According to this approach, KB Home’s fair value estimate lands at $58.24, which is actually below the current share price. Instead of signaling a bargain, it suggests the market may be paying up for future growth. This raises the question of whether the upside is already reflected, or if something else is unfolding beneath the surface.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out KB Home for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own KB Home Narrative

If you have a different take or want to investigate the numbers firsthand, you can easily craft your own interpretation in just a few minutes. Do it your way

A great starting point for your KB Home research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities go far beyond one company. Unlock your potential by searching the market for stocks that could outperform, or offer hidden value you never expected.

- Capture unique growth by seeking out these 26 quantum computing stocks working on breakthroughs in quantum computing and next-generation innovation.

- Access steady returns by finding these 19 dividend stocks with yields > 3% that offer consistent income with strong yields above 3%.

- Ride the wave of artificial intelligence advances through these 24 AI penny stocks already making an impact in tomorrow’s digital economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KB Home might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBH

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives