- United States

- /

- Consumer Durables

- /

- NYSE:IBP

Installed Building Products (IBP) Valuation: How Macroeconomic Jitters Are Shaping Investor Perspectives

Reviewed by Simply Wall St

If you’ve been following Installed Building Products (IBP), you probably noticed the recent dip that caught more than a few investors off guard. The drop didn’t start with an earnings miss or a product recall. Instead, it was tied to fresh U.S. government jobs data showing the workforce shrank by 911,000 more than previously thought. That adjustment rattled the entire market and especially hit stocks like IBP that are sensitive to economic swings. This move draws attention for anyone weighing whether this is a temporary shakeup or something more lasting.

Even with the latest macroeconomic headwinds, IBP has put up an impressive track record over the past several years. While shares lost ground over the past month, IBP’s stock still climbed over 21% in the past year and has more than doubled over five years. This comes amid headline-making acquisitions, such as the latest addition of Carolina Precision Fibers, which expands IBP’s reach into new, eco-friendly materials. Still, the near-term momentum appears mixed as investors weigh company growth moves against concerns about a softening U.S. economy.

With the stock pulling back on macro news, the question is whether investors see hidden value here or if the market is already factoring in everything IBP can deliver in the months ahead.

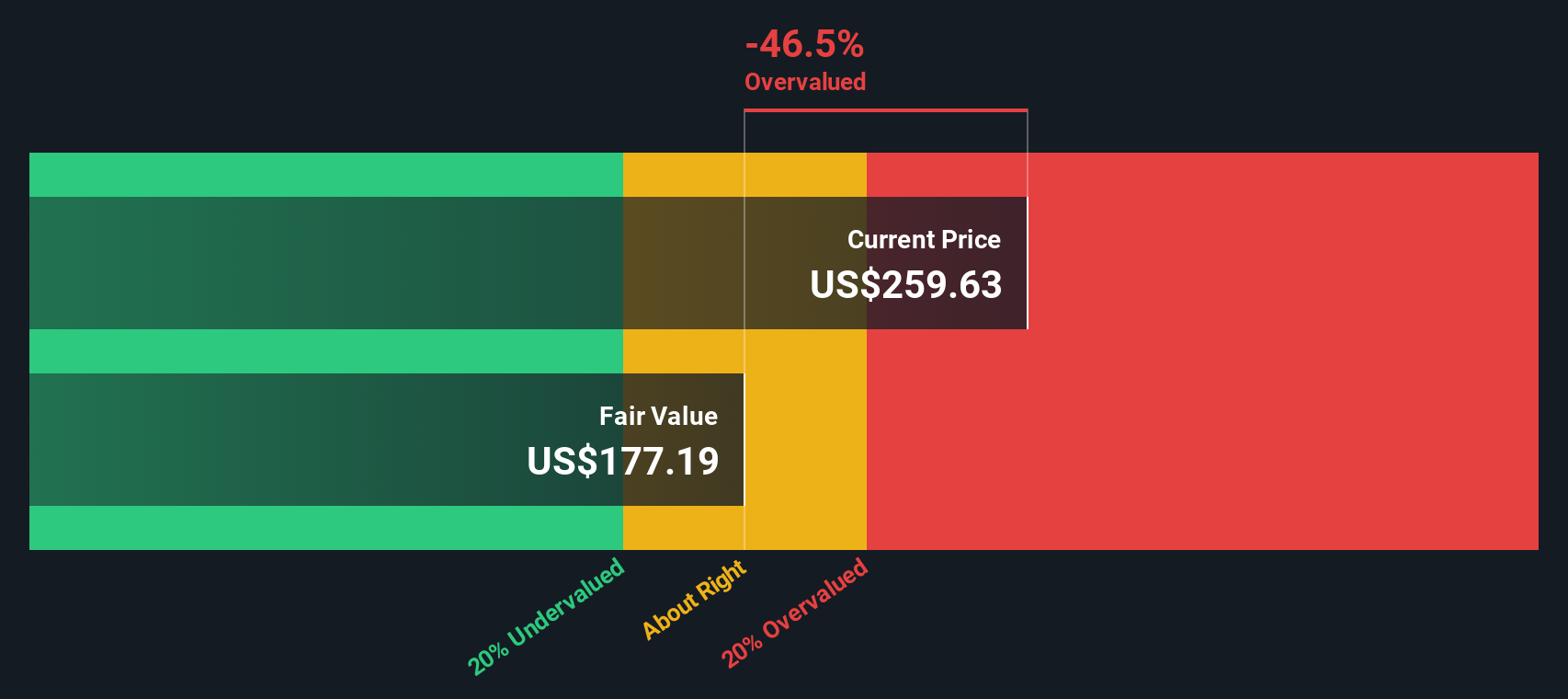

Most Popular Narrative: 12.7% Overvalued

The most widely followed narrative views Installed Building Products as trading above its estimated fair value. This overvaluation is attributed to higher valuation multiples, even as growth outlooks moderate.

Elevated expectations for sustained commercial and multifamily backlog strength could be driving overvaluation. While current heavy commercial activity is robust and backlogs have grown, management cautioned that multifamily headwinds will persist through 2025, with meaningful benefit not expected until 2026. This could result in possible deceleration in revenue growth in the next year.

Curious why analysts think this price is too high? There is a tension between sky-high future multiples and softening growth assumptions, something not seen every day in this sector. Want to see the boldest projections and the surprising ingredients that built this valuation call? Find out what makes this narrative raise eyebrows among valuation watchers.

Result: Fair Value of $237.73 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a surge in multifamily demand or sustained strength in commercial backlogs could challenge these cautious forecasts and could reignite optimism around IBP’s future growth.

Find out about the key risks to this Installed Building Products narrative.Another View: Discounted Cash Flow Paints a Similar Picture

Looking through the lens of our DCF model, Installed Building Products is also seen as overvalued. While this method focuses on projected future cash flows rather than market comparisons, the outcome reinforces what multiples suggest. Could both approaches be overlooking something in IBP’s story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Installed Building Products for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Installed Building Products Narrative

If you see things differently or want to dig deeper into the numbers, you can easily shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Installed Building Products research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Smart investors always keep their opportunities open. Don’t limit yourself to just one stock when you could be uncovering game-changing companies that fit your goals perfectly.

- Uncover high-growth upstarts making waves in the market with penny stocks with strong financials.

- Capitalize on the artificial intelligence boom with companies leading the charge in automation, innovation, and data intelligence using AI penny stocks.

- Maximize your income potential by spotting stocks offering attractive yields and steady returns through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBP

Installed Building Products

Engages in the installation of insulation for residential and commercial builders in the United States.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives