Stock Analysis

- United States

- /

- Consumer Durables

- /

- NYSE:HOV

Exploring Undiscovered Gems In The US Market July 2024

Reviewed by Simply Wall St

As the U.S. market experiences a rebound, with notable gains in the Nasdaq 100 and S&P 500 driven by the tech sector, investors are keenly awaiting further economic indicators such as the upcoming GDP and PCE index data. In this context, identifying stocks that show potential for growth yet remain underappreciated can offer unique opportunities, especially when broader market sentiment is cautiously optimistic.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 14.93% | 0.44% | 7.74% | ★★★★★★ |

| Omega Flex | NA | 2.13% | 4.77% | ★★★★★★ |

| Teekay | NA | -8.88% | 49.65% | ★★★★★★ |

| First Northern Community Bancorp | NA | 6.68% | 9.08% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Gravity | NA | 15.31% | 24.42% | ★★★★★★ |

| FirstSun Capital Bancorp | 27.36% | 10.54% | 30.73% | ★★★★★★ |

| CSP | 2.17% | -5.57% | 73.73% | ★★★★★☆ |

| Security National Financial | 33.63% | 3.33% | 4.15% | ★★★★★☆ |

| FRMO | 0.19% | 6.49% | 15.82% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Pathward Financial (NasdaqGS:CASH)

Simply Wall St Value Rating: ★★★★★★

Overview: Pathward Financial, Inc. serves as the bank holding company for Pathward, National Association, offering a range of banking products and services across the United States with a market capitalization of approximately $1.62 billion.

Operations: The company generates revenue through its operations, consistently achieving a gross profit margin of 100% across multiple reporting periods. With no cost of goods sold reported, the firm's expenses are primarily driven by general and administrative costs along with sales and marketing expenses, contributing to varying net income margins over time.

Pathward Financial, a lesser-known gem with robust financial health, has total assets of $7.5B and equity of $765.2M. With total deposits at $6.4B and loans at $4.5B, its prudent management is evident in a 0.8% bad loans ratio and a sufficient allowance for bad loans (235%). The company's earnings grew by 13% last year, outpacing the industry's -15.1%, signaling potential undervalued status as it trades 49.3% below estimated fair value.

- Take a closer look at Pathward Financial's potential here in our health report.

Explore historical data to track Pathward Financial's performance over time in our Past section.

Republic Bancorp (NasdaqGS:RBCA.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Republic Bancorp, Inc. is a bank holding company for Republic Bank & Trust Company, offering diverse banking products and services across the United States, with a market capitalization of $1.24 billion.

Operations: Republic Bancorp generates its revenue through diverse financial services, including traditional banking which is its largest segment, warehouse lending, and various processing solutions such as tax refunds, credit solutions, and payment processing. The company's operations reflect a consistent gross profit margin of 100%, with significant contributions from general and administrative expenses to operating costs.

Republic Bancorp, an often overlooked entity in the banking sector, presents a compelling case for investors seeking hidden value. With total assets of $6.6 billion and a robust allowance for bad loans at 393%, the company demonstrates strong financial health. It reported a notable earnings growth of 10.8% over the past year, outpacing its industry's average decline of 15.1%. Additionally, recent dividends affirm stability and shareholder commitment, further underscoring its potential as an undiscovered gem in today's market.

- Click here and access our complete health analysis report to understand the dynamics of Republic Bancorp.

Assess Republic Bancorp's past performance with our detailed historical performance reports.

Hovnanian Enterprises (NYSE:HOV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hovnanian Enterprises, Inc., a U.S.-based company, engages in the design, construction, marketing, and sale of residential homes across various regions with a market capitalization of $1.14 billion.

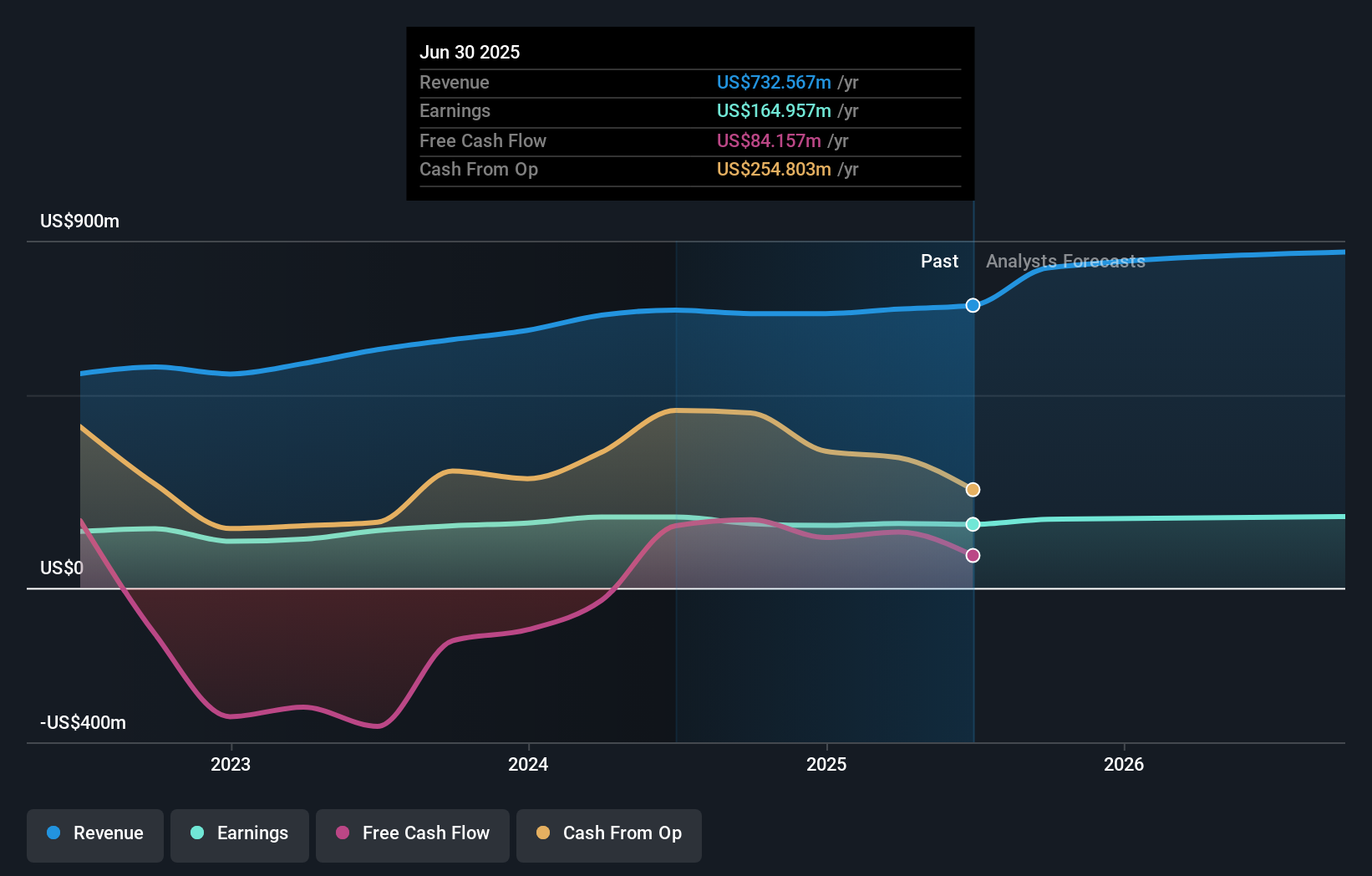

Operations: Hovnanian Enterprises primarily generates revenue through its homebuilding operations across various U.S. regions, with significant segments including the West, Northeast, and Southeast. The company also derives income from financial services related to its main business.

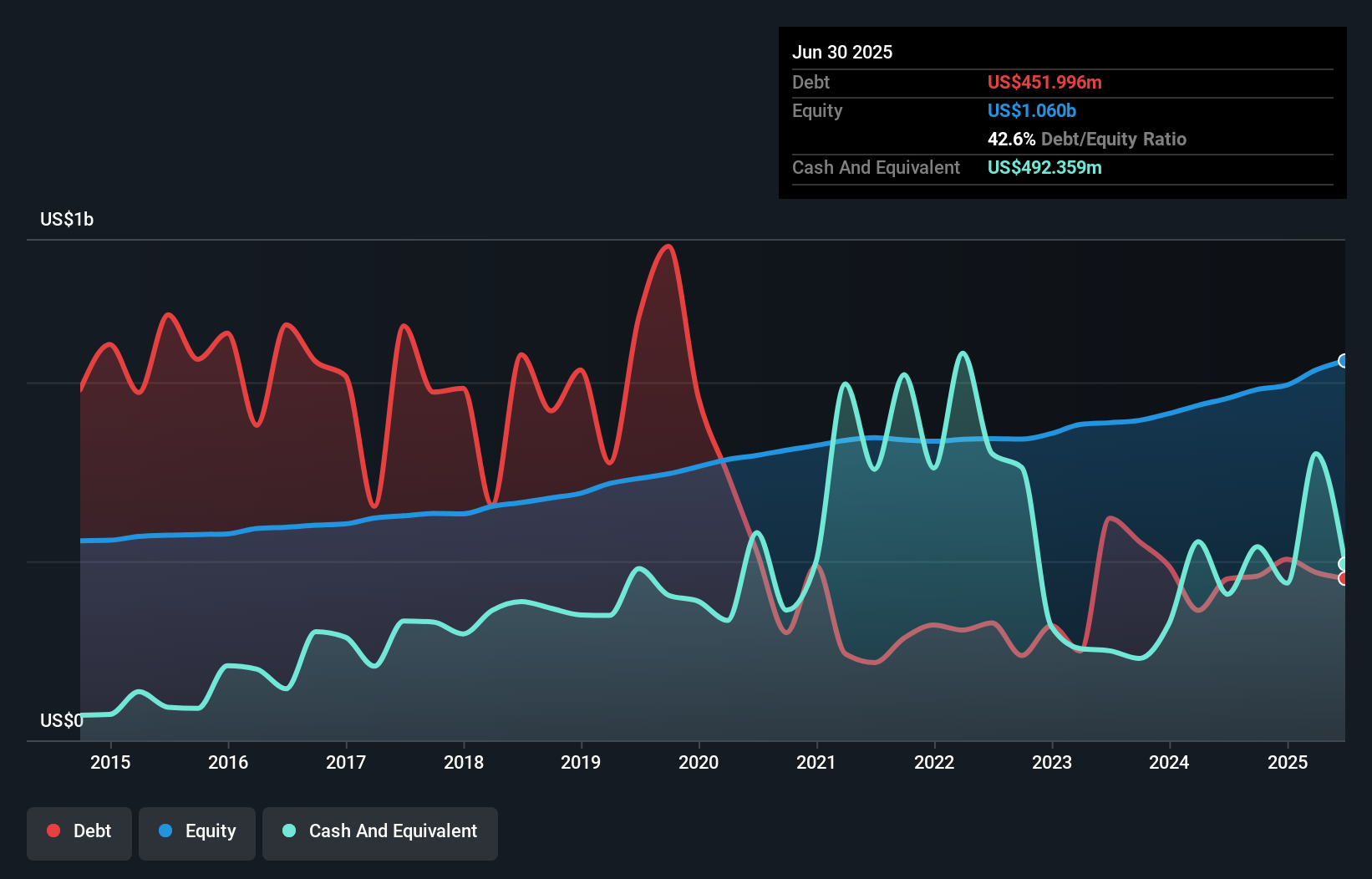

Hovnanian Enterprises, a lesser-known player in the consumer durables sector, has shown robust performance with a 20.3% earnings growth over the past year, outpacing the industry's 11% decline. Despite a high net debt to equity ratio of 142%, its interest payments are well-covered by EBIT at 6.5 times. Recently added to several Russell indexes and completing significant share repurchases totaling $36.82 million, Hovnanian is trading at an appealing 86.8% below estimated fair value, suggesting potential for growth-oriented investors.

- Navigate through the intricacies of Hovnanian Enterprises with our comprehensive health report here.

Understand Hovnanian Enterprises' track record by examining our Past report.

Taking Advantage

- Click through to start exploring the rest of the 219 US Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hovnanian Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOV

Hovnanian Enterprises

Through its subsidiaries, designs, constructs, markets, and sells residential homes in the United States.

Excellent balance sheet and good value.