- United States

- /

- Building

- /

- NYSE:HAYW

Statutory Profit Doesn't Reflect How Good Hayward Holdings' (NYSE:HAYW) Earnings Are

Hayward Holdings, Inc. (NYSE:HAYW) just reported healthy earnings but the stock price didn't move much. Investors are probably missing some underlying factors which are encouraging for the future of the company.

Check out our latest analysis for Hayward Holdings

Zooming In On Hayward Holdings' Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

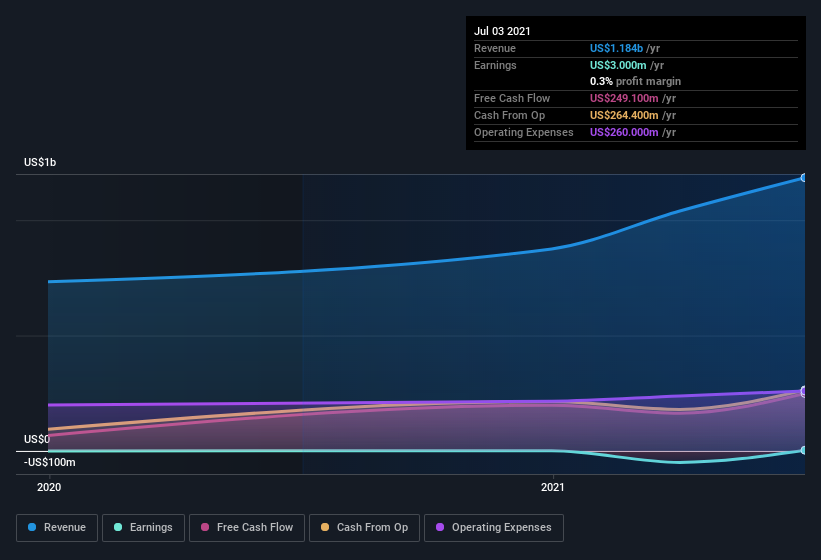

Hayward Holdings has an accrual ratio of -0.15 for the year to July 2021. Therefore, its statutory earnings were very significantly less than its free cashflow. In fact, it had free cash flow of US$249m in the last year, which was a lot more than its statutory profit of US$3.00m. Hayward Holdings' free cash flow improved over the last year, which is generally good to see. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

Finally, we should also talk about the US$27m in unusual items that weighed on profit over the year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Hayward Holdings doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Hayward Holdings' Profit Performance

Considering both Hayward Holdings' accrual ratio and its unusual items, we think its statutory earnings are unlikely to exaggerate the company's underlying earnings power. Based on these factors, we think Hayward Holdings' earnings potential is at least as good as it seems, and maybe even better! Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. At Simply Wall St, we found 1 warning sign for Hayward Holdings and we think they deserve your attention.

After our examination into the nature of Hayward Holdings' profit, we've come away optimistic for the company. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Hayward Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hayward Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:HAYW

Hayward Holdings

Designs, manufactures, and markets a portfolio of pool equipment and associated automation systems in North America, Europe, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives