- United States

- /

- Consumer Durables

- /

- NYSE:GRMN

Garmin (GRMN) Posts Strong Earnings Growth and Confirms Future Dividend Schedule

Reviewed by Simply Wall St

Garmin (GRMN) recently announced a dividend of $0.90 per share, with sales and net income figures highlighting notable year-over-year growth for Q2 2025. Sales increased to $1,815 million and net income rose to $401 million. Over the last quarter, Garmin's share price climbed 28%, driven by this robust financial performance and positive earnings results. The company's new product launches in aviation and marine technology, alongside strong corporate guidance anticipating $7.1 billion in revenue, may have added further momentum to its shares, reflecting broader market optimism and alignment with sectors experiencing strong performance due to increased corporate earnings.

Buy, Hold or Sell Garmin? View our complete analysis and fair value estimate and you decide.

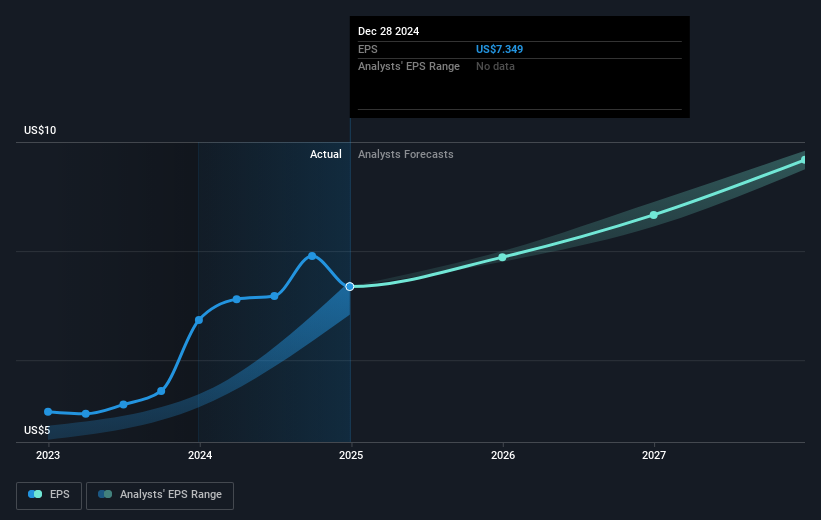

Garmin's recent announcement of a $0.90 per share dividend and strong Q2 2025 results, with sales reaching US$1.82 billion and net income at US$401 million, has positively influenced its stock in the short term. Looking at the longer-term period, Garmin has delivered a total shareholder return of 167.72% over the past five years, highlighting its capacity to generate significant value for investors. Comparatively, over the past year, Garmin's earnings growth of 7.8% outperformed the Consumer Durables industry, which experienced a decline of 6.8%.

The company's focus on premium services and advanced product offerings, such as the Garmin Connect+ and Vívoactive 6, suggests a potential positive impact on revenue and earnings forecasts. Analysts project Garmin's revenue growth at 8.6% annually over the next three years, driven by intensified demand and higher-margin services. However, with Garmin's current share price at US$239.30 above the consensus analyst price target of US$205.33, the price movement perhaps indicates market optimism or a premium placed on the company's future growth prospects. Investors should note that while recent performance has been robust, the stock now trades at a PE ratio significantly higher than its industry peers, reflecting market sentiment and expectations.

Click here to discover the nuances of Garmin with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRMN

Garmin

Designs, develops, manufactures, markets, and distributes a range of wireless devices worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives