- United States

- /

- Consumer Durables

- /

- NYSE:GRBK

Here's Why We Think Green Brick Partners (NYSE:GRBK) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Green Brick Partners (NYSE:GRBK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Green Brick Partners with the means to add long-term value to shareholders.

See our latest analysis for Green Brick Partners

Green Brick Partners' Improving Profits

Over the last three years, Green Brick Partners has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Green Brick Partners' EPS shot from US$2.81 to US$5.94, over the last year. Year on year growth of 111% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

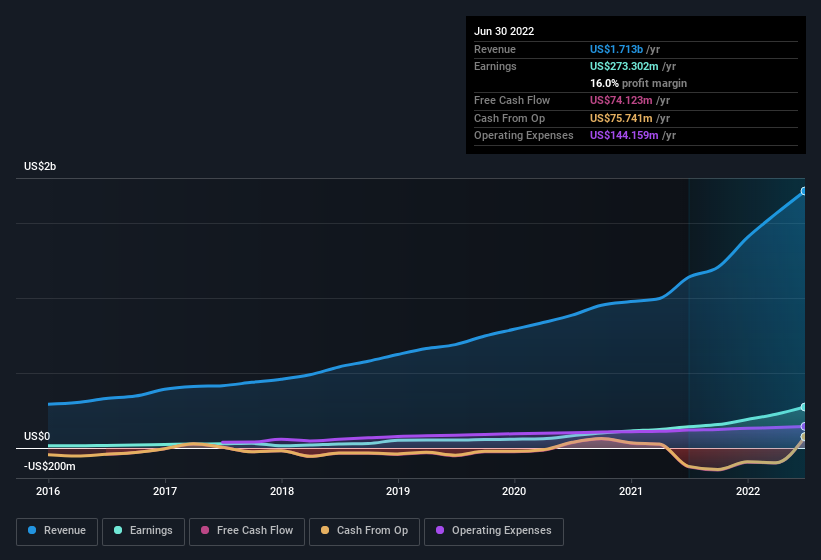

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Green Brick Partners shareholders can take confidence from the fact that EBIT margins are up from 15% to 19%, and revenue is growing. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Green Brick Partners' forecast profits?

Are Green Brick Partners Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Our analysis into Green Brick Partners has shown that insiders have sold US$304k worth of shares over the last 12 months. This falls short of the share acquisition by Independent Director Harry Brandler, who has acquired US$499k worth of shares, at an average price of US$19.97. And that's a reason to be optimistic.

The good news, alongside the insider buying, for Green Brick Partners bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a significant chunk of shares, currently valued at US$66m, they have plenty of motivation to push the business to succeed. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

Is Green Brick Partners Worth Keeping An Eye On?

Green Brick Partners' earnings per share have been soaring, with growth rates sky high. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Green Brick Partners deserves timely attention. However, before you get too excited we've discovered 1 warning sign for Green Brick Partners that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Green Brick Partners isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GRBK

Green Brick Partners

A diversified homebuilding and land development company in the United States.

Solid track record with adequate balance sheet.