- United States

- /

- Luxury

- /

- NYSE:FIGS

Is FIGS’ (FIGS) Shift Away from Promotions a Sign of Pricing Power or Risk to Growth?

Reviewed by Sasha Jovanovic

- In early October 2025, an analyst at Raymond James expressed optimism about FIGS' continued business momentum into the second half of the year following meetings with company management.

- A unique takeaway is that the analyst highlighted stronger-than-anticipated results driven by less discounting, even as FIGS communicated some expectations for softer promotional activity in upcoming months.

- We'll examine how management’s emphasis on operational momentum could influence FIGS’ long-term growth narrative and analyst expectations.

Find companies with promising cash flow potential yet trading below their fair value.

FIGS Investment Narrative Recap

To be a FIGS shareholder, you have to believe in the sustained growth of healthcare employment and ongoing adoption of direct-to-consumer models, all while the company manages margin pressures from tariffs and reduced promotional activity. The Raymond James analyst’s positive remarks reinforce the near-term optimism, but the underlying risk of slower revenue growth from less discounting remains in focus; overall, the news does not materially alter the key short-term catalyst or primary risk outlined in recent guidance.

One recent announcement closely tied to this narrative is FIGS’s updated earnings guidance calling for low-single-digit revenue growth in 2025. This aligns with management’s approach to pull back on promotions, which could support margins but may also challenge customer acquisition, intensifying attention on underlying demand as the chief driver for results in the coming quarters.

However, with external cost headwinds from tariffs persisting, investors should also be aware of the risk that if demand doesn’t keep pace with less promotional push, …

Read the full narrative on FIGS (it's free!)

FIGS' outlook projects $656.8 million in revenue and $37.0 million in earnings by 2028. This requires 4.9% yearly revenue growth and a $29.8 million increase in earnings from the current $7.2 million.

Uncover how FIGS' forecasts yield a $6.42 fair value, a 10% downside to its current price.

Exploring Other Perspectives

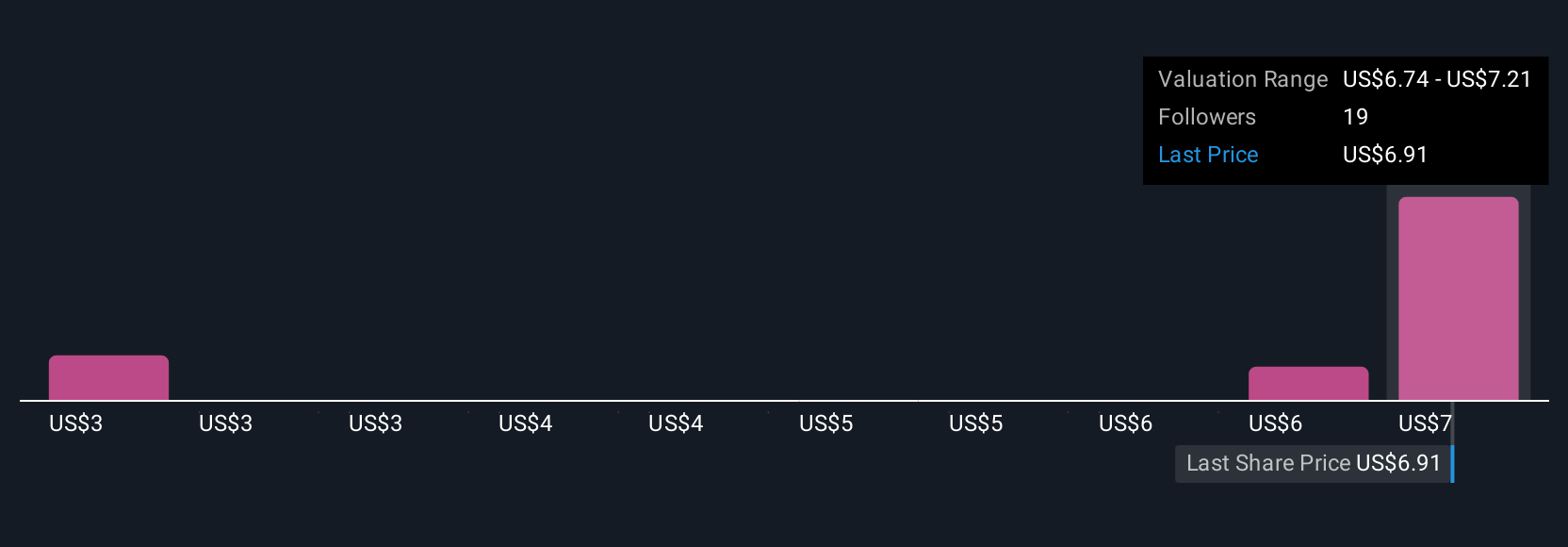

Simply Wall St Community members have published four fair value estimates for FIGS ranging from US$2.48 to US$7.21 per share. While many are weighing the impact of margin pressures from tariffs, these differing outlooks reflect a range of expectations about how catalysts and risks could shape future performance.

Explore 4 other fair value estimates on FIGS - why the stock might be worth as much as $7.21!

Build Your Own FIGS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FIGS research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free FIGS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FIGS' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIGS

FIGS

Together with its subsidiary, FIGS Canada, Inc., operates as a direct-to-consumer healthcare apparel and lifestyle company in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives