- United States

- /

- Consumer Durables

- /

- NYSE:ETD

We Ran A Stock Scan For Earnings Growth And Ethan Allen Interiors (NYSE:ETD) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Ethan Allen Interiors (NYSE:ETD). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Ethan Allen Interiors with the means to add long-term value to shareholders.

Check out our latest analysis for Ethan Allen Interiors

How Fast Is Ethan Allen Interiors Growing Its Earnings Per Share?

In the last three years Ethan Allen Interiors' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Ethan Allen Interiors' EPS catapulted from US$2.38 to US$4.08, over the last year. It's a rarity to see 72% year-on-year growth like that.

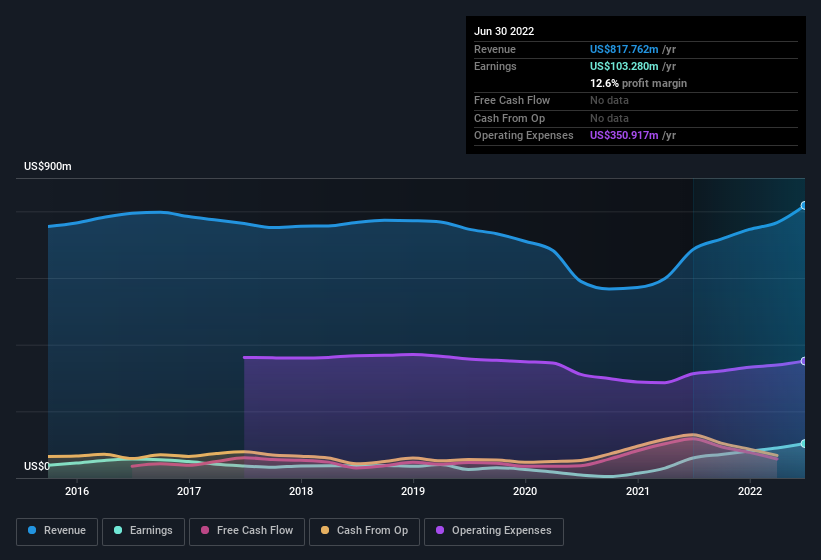

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Ethan Allen Interiors is growing revenues, and EBIT margins improved by 4.6 percentage points to 16%, over the last year. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Ethan Allen Interiors' forecast profits?

Are Ethan Allen Interiors Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Ethan Allen Interiors followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Given insiders own a significant chunk of shares, currently valued at US$53m, they have plenty of motivation to push the business to succeed. Amounting to 8.3% of the outstanding shares, indicating that insiders are also significantly impacted by the decisions they make on the behalf of the business.

Is Ethan Allen Interiors Worth Keeping An Eye On?

Ethan Allen Interiors' earnings per share growth have been climbing higher at an appreciable rate. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So based on this quick analysis, we do think it's worth considering Ethan Allen Interiors for a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 1 warning sign for Ethan Allen Interiors you should be aware of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Ethan Allen Interiors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ETD

Ethan Allen Interiors

Operates as an interior design company, and manufacturer and retailer of home furnishings in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives