- United States

- /

- Media

- /

- NYSE:IPG

Top US Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As of November 2024, the U.S. stock market is experiencing a robust upswing, with the Dow Jones Industrial Average closing at record highs and major indices posting weekly gains. In this thriving market environment, dividend stocks can offer investors a combination of income and potential growth, making them an attractive consideration for those looking to benefit from both steady payouts and capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.46% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.55% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.51% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.71% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.30% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.34% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.30% | ★★★★★★ |

Click here to see the full list of 136 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ethan Allen Interiors (NYSE:ETD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ethan Allen Interiors Inc. is an interior design company that manufactures and retails home furnishings both in the United States and internationally, with a market cap of approximately $761.12 million.

Operations: Ethan Allen Interiors Inc. generates revenue through its Retail segment, which accounts for $539.70 million, and its Wholesale segment, contributing $357.71 million.

Dividend Yield: 6.5%

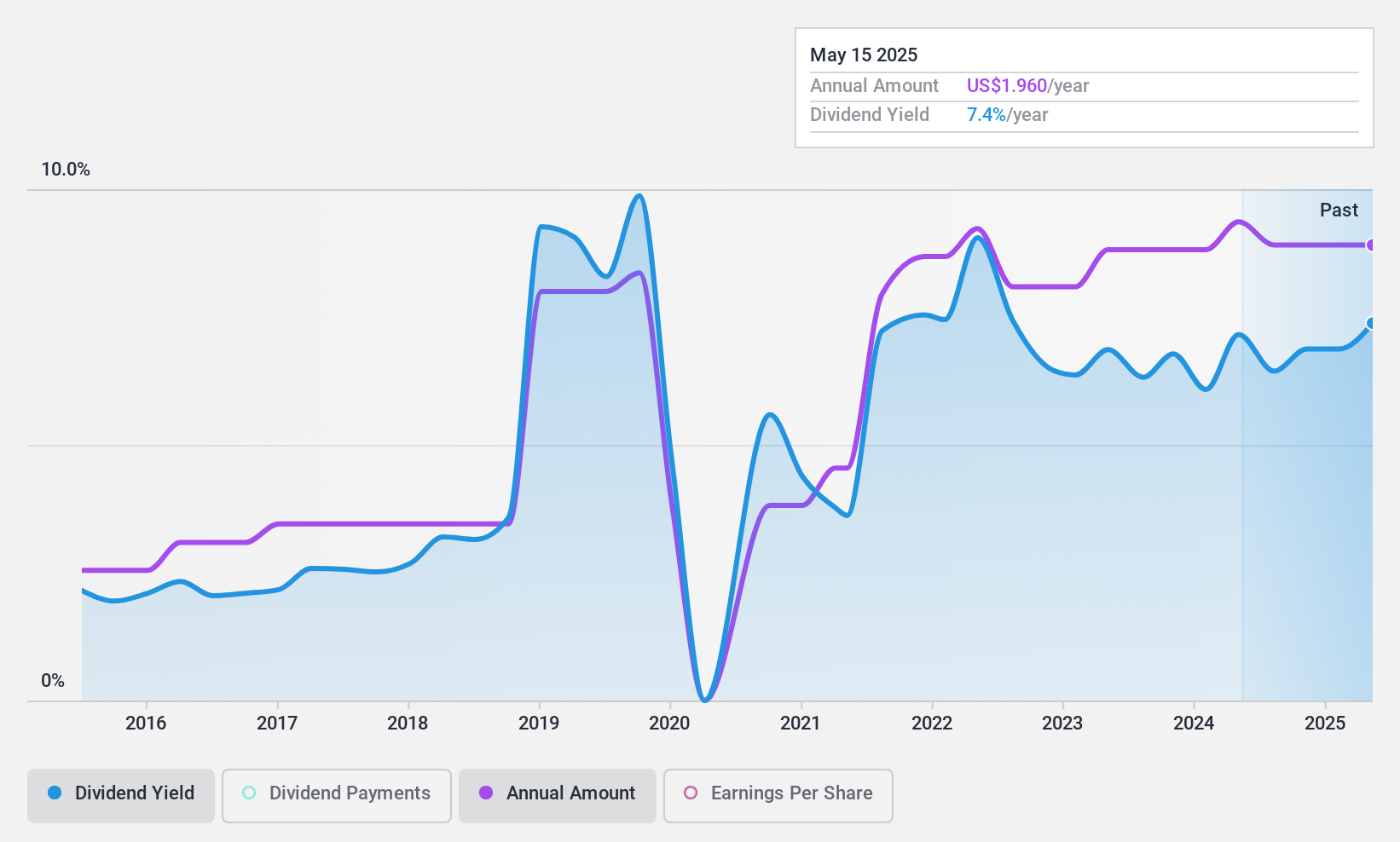

Ethan Allen Interiors' dividend is covered by earnings (payout ratio: 60.2%) and cash flows (cash payout ratio: 72.2%), although its dividend track record has been unstable over the past decade. Despite this volatility, the dividend yield of 6.55% ranks in the top quartile among US payers. Recent earnings showed a slight decline, with sales at US$154.34 million and net income at US$14.72 million for Q1 2024 compared to last year, yet dividends were affirmed at $0.39 per share.

- Unlock comprehensive insights into our analysis of Ethan Allen Interiors stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Ethan Allen Interiors is priced lower than what may be justified by its financials.

Interpublic Group of Companies (NYSE:IPG)

Simply Wall St Dividend Rating: ★★★★★★

Overview: The Interpublic Group of Companies, Inc. offers advertising and marketing services globally and has a market cap of approximately $11.02 billion.

Operations: Interpublic Group of Companies generates revenue through three primary segments: Media, Data & Engagement Solutions ($4.29 billion), Integrated Advertising & Creativity Led ($3.62 billion), and Specialized Communications & Experiential Solutions ($1.43 billion).

Dividend Yield: 4.5%

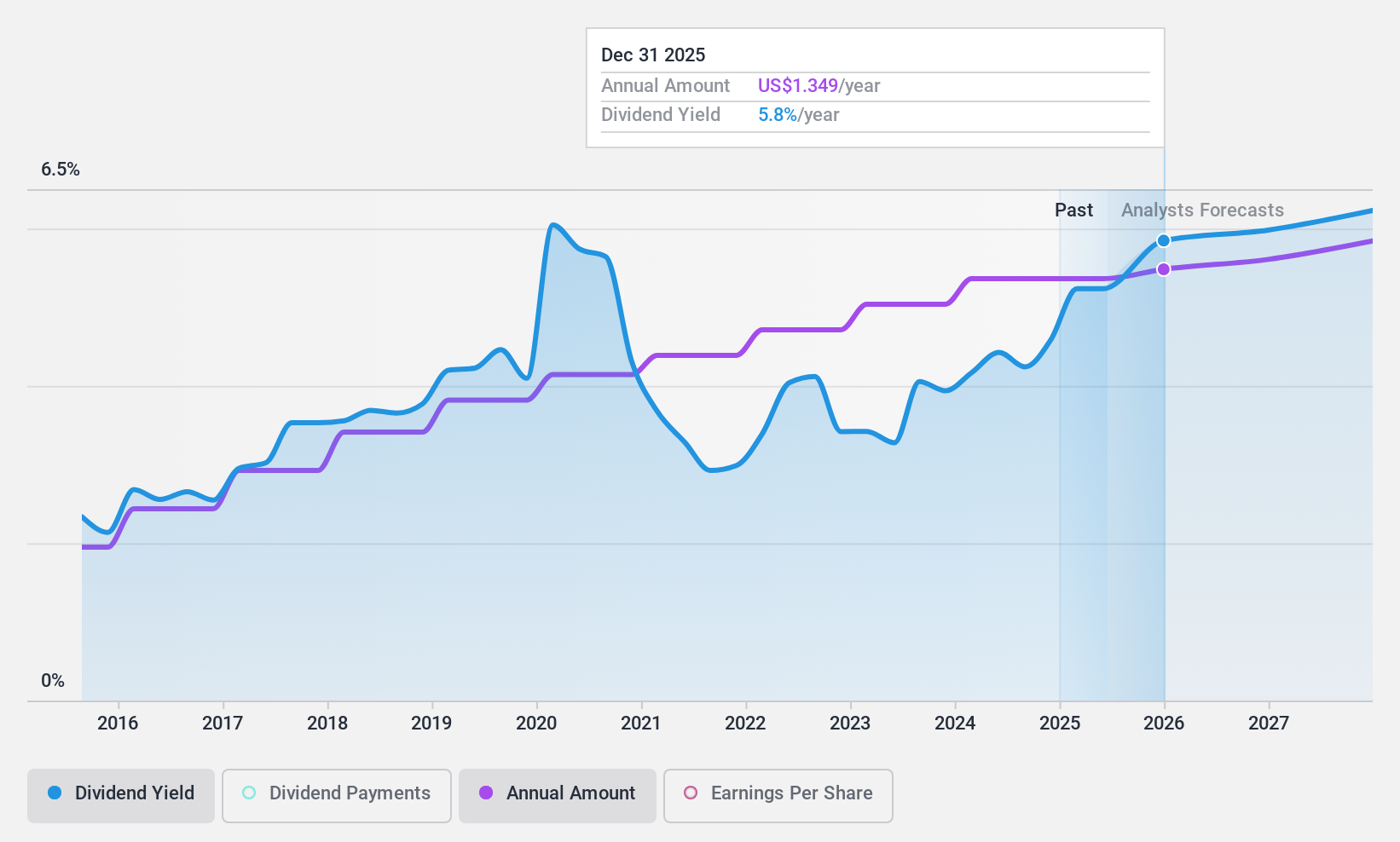

Interpublic Group offers a stable dividend yield of 4.46%, supported by a payout ratio of 60.7% and cash flow coverage at 53.3%. Despite recent earnings challenges, including goodwill impairments and reduced net income for Q3 2024, dividends remain reliable and have grown over the past decade. The company trades significantly below its estimated fair value, presenting potential value opportunities for investors seeking dividend stability amidst market volatility.

- Navigate through the intricacies of Interpublic Group of Companies with our comprehensive dividend report here.

- Our valuation report unveils the possibility Interpublic Group of Companies' shares may be trading at a discount.

Insperity (NYSE:NSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Insperity, Inc. provides human resources and business solutions aimed at enhancing the performance of small and medium-sized businesses in the United States, with a market cap of approximately $2.84 billion.

Operations: Insperity, Inc.'s revenue is primarily derived from its Staffing & Outsourcing Services segment, which generated approximately $6.55 billion.

Dividend Yield: 3.2%

Insperity's recent dividend affirmation of US$0.60 per share highlights its commitment to stable payouts, although dividends are not covered by free cash flow. Despite trading 85.6% below its estimated fair value, the company's profitability has declined, with net income dropping significantly in Q3 2024 compared to the previous year. While dividends have grown steadily over the past decade, a payout ratio of 74.1% raises concerns about sustainability given recent earnings challenges and substantial insider selling.

- Delve into the full analysis dividend report here for a deeper understanding of Insperity.

- Our valuation report here indicates Insperity may be undervalued.

Where To Now?

- Click through to start exploring the rest of the 133 Top US Dividend Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IPG

Interpublic Group of Companies

Provides advertising and marketing services worldwide.

Flawless balance sheet 6 star dividend payer.