- United States

- /

- Leisure

- /

- NYSE:DTC

Solo Brands, Inc. (NYSE:DTC) Soars 26% But It's A Story Of Risk Vs Reward

Despite an already strong run, Solo Brands, Inc. (NYSE:DTC) shares have been powering on, with a gain of 26% in the last thirty days. But the last month did very little to improve the 55% share price decline over the last year.

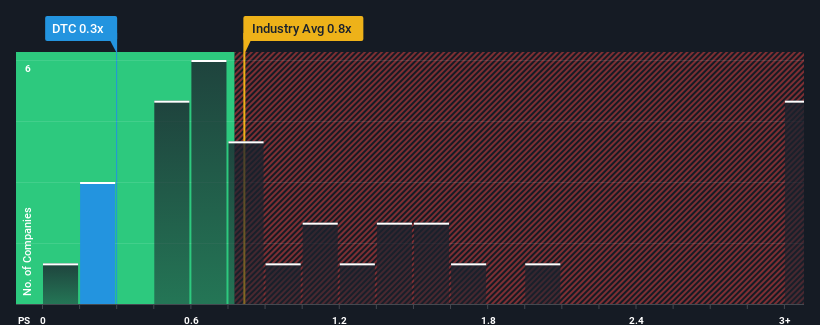

Even after such a large jump in price, considering around half the companies operating in the United States' Leisure industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider Solo Brands as an solid investment opportunity with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Solo Brands

What Does Solo Brands' P/S Mean For Shareholders?

Solo Brands' negative revenue growth of late has neither been better nor worse than most other companies. One possibility is that the P/S ratio is low because investors think the company's revenue may begin to slide even faster. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. At the very least, you'd be hoping that revenue doesn't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Solo Brands will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Solo Brands?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Solo Brands' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.1%. Still, the latest three year period has seen an excellent 168% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 5.7% per annum as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 2.3% per annum, which is noticeably less attractive.

With this in consideration, we find it intriguing that Solo Brands' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Solo Brands' P/S Mean For Investors?

Despite Solo Brands' share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Solo Brands' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Solo Brands with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTC

Solo Brands

Operates a direct-to-consumer platform that offers outdoor and lifestyle branded products in the United States.

Undervalued with mediocre balance sheet.