- United States

- /

- Luxury

- /

- NYSE:DECK

How Analysts' Upgrades and Brand Momentum May Reshape Deckers Outdoor (DECK) Outlook

Reviewed by Sasha Jovanovic

- In recent weeks, multiple analysts upgraded Deckers Outdoor's outlook, citing renewed confidence in the company's fundamentals, while management outlined new strategies to better manage product cycles and capitalize on strong brand momentum from HOKA and UGG.

- Despite having experienced several weaker quarters, Deckers consistently exceeded revenue and earnings estimates, with improved management approaches and continued brand strength contributing to optimistic analyst sentiment towards its long-term prospects.

- We'll examine how analysts' increased confidence, driven by Deckers' focus on product cycle improvements and brand performance, shapes its investment narrative further.

Find companies with promising cash flow potential yet trading below their fair value.

Deckers Outdoor Investment Narrative Recap

To be a Deckers Outdoor shareholder, you need confidence in the enduring global appeal of HOKA and UGG, and believe the company's product cycle management can keep driving demand. The recent analyst upgrades, while positive, do not fundamentally alter the most important short-term catalyst, which remains successful product launches tied to peak shopping periods, nor the principal risk, which is sustained margin pressure from a heightened promotional retail environment. The news underscores continued sensitivity to these factors, but the big picture for investors is unchanged.

Among the corporate announcements, the updated fiscal year guidance stands out. Deckers projects net sales near US$5.35 billion and diluted EPS of US$6.30 to US$6.39, reinforcing management's optimism around operational momentum after a challenging stretch. This aligns directly with analyst focus on top-line and bottom-line execution as key drivers of near-term share price recovery.

In contrast, investors should be alert to signs of a more promotional environment eroding margins, as sharp increases in discounting could quickly...

Read the full narrative on Deckers Outdoor (it's free!)

Deckers Outdoor's narrative projects $6.5 billion revenue and $1.1 billion earnings by 2028. This requires 8.5% yearly revenue growth and a $110.3 million earnings increase from $989.7 million today.

Uncover how Deckers Outdoor's forecasts yield a $111.97 fair value, a 37% upside to its current price.

Exploring Other Perspectives

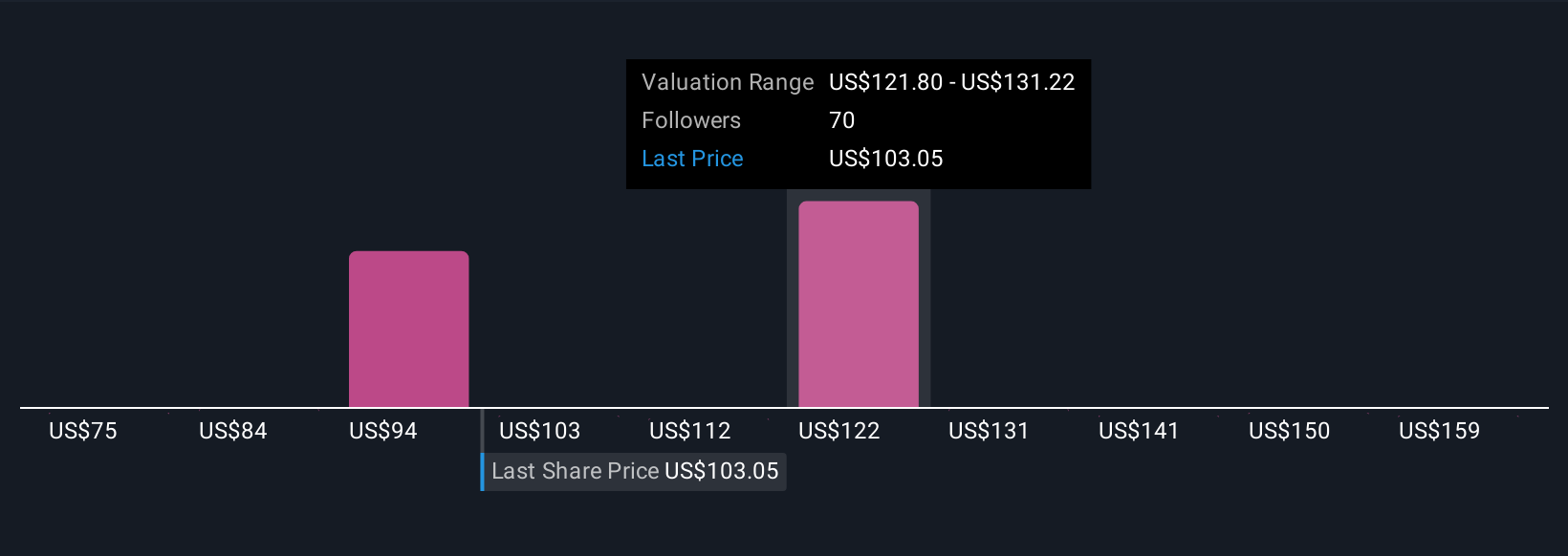

Twenty-two fair value estimates from the Simply Wall St Community cluster between US$74.68 and US$158 per share, reflecting both optimism and caution among private investors. While product innovation and global brand growth drive much of the positive sentiment, ongoing risks to gross margins from increased discounting may weigh on future returns, so explore diverse viewpoints before forming your own outlook.

Explore 22 other fair value estimates on Deckers Outdoor - why the stock might be worth 8% less than the current price!

Build Your Own Deckers Outdoor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deckers Outdoor research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Deckers Outdoor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deckers Outdoor's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DECK

Deckers Outdoor

Designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives