- United States

- /

- Luxury

- /

- NYSE:CRI

Here's Why We're Wary Of Buying Carter's' (NYSE:CRI) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Carter's, Inc. (NYSE:CRI) is about to trade ex-dividend in the next three days. Typically, the ex-dividend date is one business day before the record date, which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is important as the process of settlement involves a full business day. So if you miss that date, you would not show up on the company's books on the record date. Accordingly, Carter's investors that purchase the stock on or after the 2nd of June will not receive the dividend, which will be paid on the 20th of June.

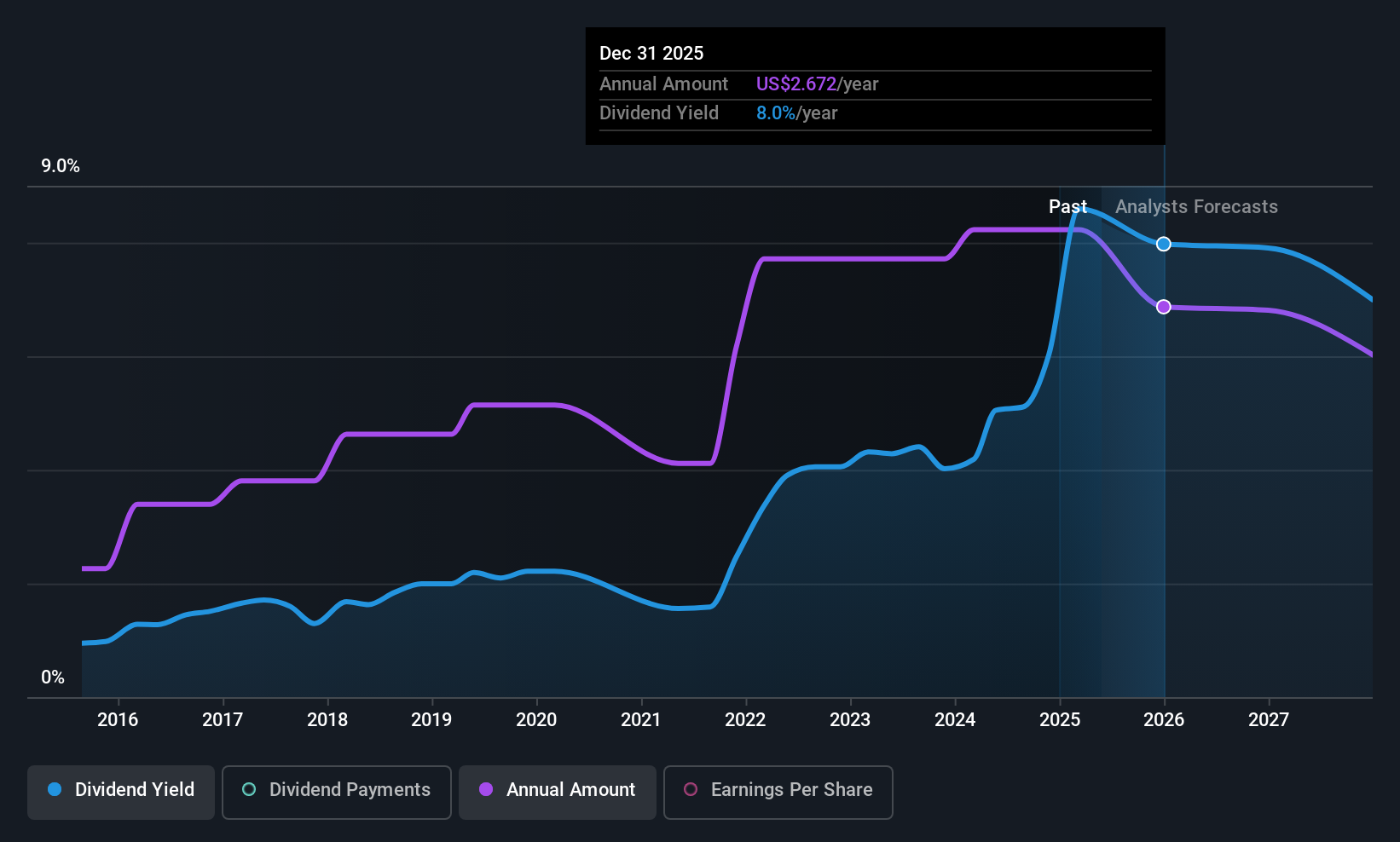

The company's next dividend payment will be US$0.25 per share. Last year, in total, the company distributed US$3.20 to shareholders. Calculating the last year's worth of payments shows that Carter's has a trailing yield of 9.6% on the current share price of US$33.50. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Carter's can afford its dividend, and if the dividend could grow.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Carter's is paying out an acceptable 71% of its profit, a common payout level among most companies. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out more than half (52%) of its free cash flow in the past year, which is within an average range for most companies.

It's positive to see that Carter's's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Check out our latest analysis for Carter's

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. Readers will understand then, why we're concerned to see Carter's's earnings per share have dropped 5.7% a year over the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Carter's has delivered 15% dividend growth per year on average over the past 10 years. That's interesting, but the combination of a growing dividend despite declining earnings can typically only be achieved by paying out more of the company's profits. This can be valuable for shareholders, but it can't go on forever.

The Bottom Line

From a dividend perspective, should investors buy or avoid Carter's? While earnings per share are shrinking, it's encouraging to see that at least Carter's's dividend appears sustainable, with earnings and cashflow payout ratios that are within reasonable bounds. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Carter's.

So if you're still interested in Carter's despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. For instance, we've identified 2 warning signs for Carter's (1 is potentially serious) you should be aware of.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CRI

Carter's

Designs, sources, and markets branded childrenswear and related products under the Carter's, OshKosh, Skip Hop, Child of Mine, Just One You, Simple Joys, Little Planet, and other brands in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion