- United States

- /

- Luxury

- /

- NYSE:CRI

Carter’s (CRI) Net Margin Drops to 4.7%, Underscoring Profitability Concerns

Reviewed by Simply Wall St

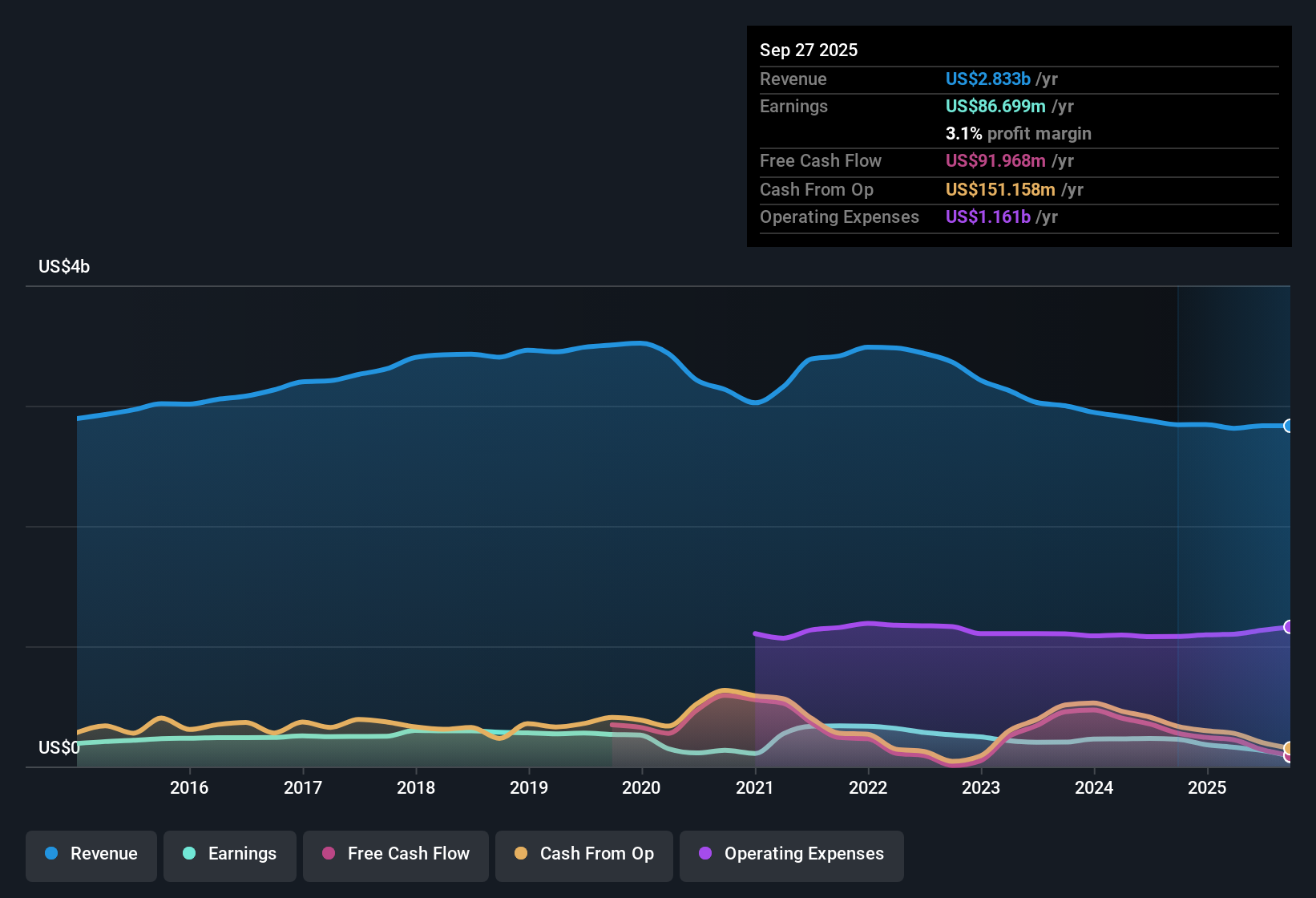

Carter's (CRI) reported a net profit margin of 4.7%, down from 8.1% a year ago, and annual earnings have declined by 6.8% over the past five years. Revenue is set to decrease by 1.1% per year over the next three years, while recent earnings growth remains negative. With the stock trading at a Price-To-Earnings ratio of 9.1x, notably lower than the industry average, investors are weighing the value case against ongoing pressure on margins and profits.

See our full analysis for Carter's.Next, we will set these headline numbers against the prevailing narratives to see which market assumptions hold up and where the story might be changing.

See what the community is saying about Carter's

Profit Margins Projected to Shrink Further

- Analysts forecast Carter's net profit margin will fall from 4.7% today to just 1.4% within three years, highlighting the pressure on bottom-line profitability going forward.

- According to the analysts' consensus view, heavy reliance on the baby and children's apparel segment, ongoing cost inflation from tariffs and sustainability initiatives, and intensifying price competition from e-commerce are expected to further erode both gross and net margins.

- The consensus narrative points to persistent declines in birth rates and the company's limited international penetration as core structural challenges that could cap future earnings growth.

- At the same time, cost headwinds may not ease soon as Carter’s invests in supply chain re-engineering and faces higher material costs, further restricting earnings expansion even if some pricing power is maintained.

- Consensus narrative shows the latest squeeze in profit margins could confirm broader worries about the impact of demographic and competitive shifts on Carter's valuation. 📊 Read the full Carter's Consensus Narrative.

Valuation Discount Masks Weak Earnings Outlook

- Carter’s trades at a Price-To-Earnings ratio of 9.1x, significantly below the US luxury industry average of 19.7x and peer average of 55.7x. Yet, the current share price of $32.98 remains above the DCF fair value estimate of $18.92.

- Consensus narrative highlights that while the low valuation appears attractive relative to peers, shrinking expected earnings and margins temper any value thesis.

- Bears argue the low Price-To-Earnings ratio is more a reflection of the market's skepticism in the face of sustained revenue and earnings declines rather than an overlooked bargain.

- Analysts also note that to justify further upside, Carter’s would need to reach a lofty PE ratio of 32.1x in 2028, far above both today’s valuation and the industry average.

Revenue Pressures Compound Competitive Headwinds

- Consensus estimates project Carter’s annual revenue will decline by 1.1% each year over the next three years, reinforcing the narrative of a shrinking addressable market.

- Analysts' consensus view underlines that Carter’s faces multiple headwinds beyond demographics, including fast-growing e-commerce players and rising customer acquisition costs.

- While the company has seen momentum in its core baby segment, with four straight quarters of double-digit sales growth, this strength has not offset longer-term erosion in its broader revenue base.

- Strategic moves such as international expansion and product innovation are starting to gain traction, but remain too modest to counter domestic declines and shifting competitive dynamics in the near term.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Carter's on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on these figures? Put your interpretation into action and shape your own view in just a few minutes with Do it your way.

A great starting point for your Carter's research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Carter’s faces ongoing margin pressure, weak earnings prospects, and a shrinking revenue base. These factors point to uncertainty about sustained growth and profitability.

If you prefer reliable performers, use stable growth stocks screener (2110 results) to uncover companies consistently delivering steady revenue and earnings expansion, even when others are under pressure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRI

Carter's

Designs, sources, and markets branded childrenswear and related products under the Carter's, OshKosh, Skip Hop, Child of Mine, Just One You, Simple Joys, Little Planet, and other brands in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion