- United States

- /

- Consumer Durables

- /

- NYSE:CCS

Century Communities (CCS) Margin Decline Reinforces Bearish Narratives on Profit Growth Outlook

Reviewed by Simply Wall St

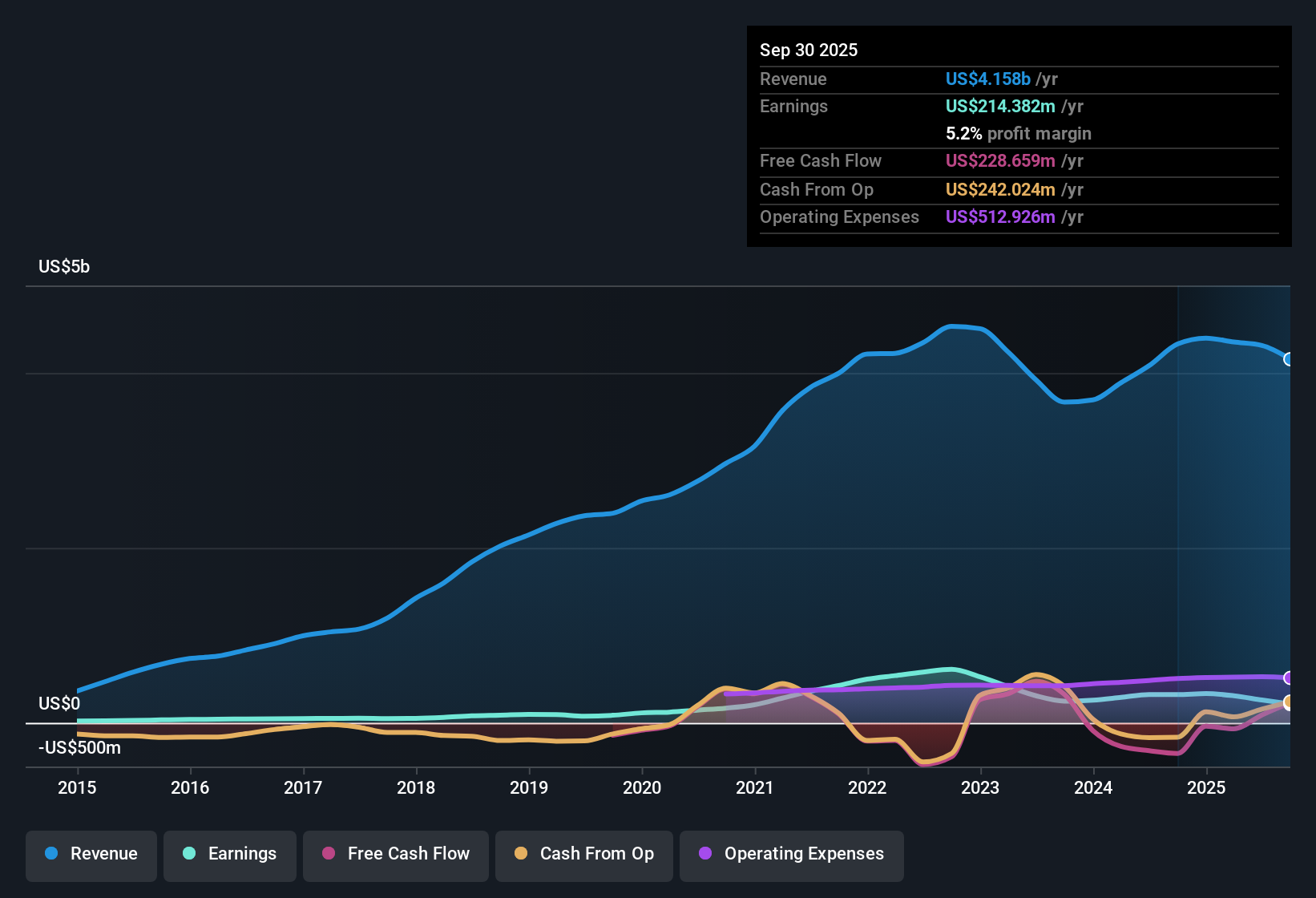

Century Communities (CCS) posted a net profit margin of 5.2%, retreating from last year’s 7.4% and capping off a $65.08 share price that sits well above analyst targets. Over the past five years, EPS has slipped by an average of 5% annually, and future guidance points to further 22.1% EPS declines per year through the next three years, even as revenue is expected to grow just 1.9% annually, trailing the US market’s 10% pace. With margins under pressure and negative profit growth, the main upside for investors is the company’s comparatively lower P/E ratio versus the industry, but that alone is not offsetting the broad risk picture right now.

See our full analysis for Century Communities.Next up, we’ll weigh these headline results against the community’s widely held narratives to see which stories hold and which might be challenged.

See what the community is saying about Century Communities

Margins Squeezed by Affordability Headwinds

- Profit margins are set to fall from 6.0% now to 2.8% over the next three years, according to analyst assumptions. This compression highlights how higher mortgage rates and lower prices are impacting profitability even more than last year's decline.

- Analysts' consensus view emphasizes that Century Communities is being forced to use incentives and accept lower average selling prices to boost sales. Because a large part of its business depends on entry-level buyers, this amplifies how shrinking affordability could lead to slower sales volume and weaker top-line growth.

- The company recently reduced its full-year home delivery guidance and is seeing unit sales trend below seasonal expectations, highlighting near-term demand headwinds.

- Supply cost inflation remains a persistent issue. Potential higher lumber prices and land inflation threaten to squeeze net margins further, especially if the company cannot fully offset these costs through operational efficiencies.

- What could surprise the street is that despite these pressures, Century Communities is still holding a substantial lot pipeline, with about 70,000 lots owned or controlled, along with a record community count (327 at Q2). Its ability to scale back up if demand improves should not be overlooked.

Analysts will be watching whether Century Communities' expanding footprint can counterbalance margin pressure and keep its long-term potential intact. 📈 Read the full Century Communities Consensus Narrative.

Share Buybacks Power Per-Share Value

- Century Communities repurchased over 8% of its shares outstanding since 2024 at an average price of $54.35, well below the book value per share of $86.39. This has helped offset some EPS drag from lower profits.

- Analysts' consensus view sees these buybacks and the company’s stable dividend policy as levers to boost per-share earnings and support longer-term shareholder returns, even as industry conditions remain challenging.

- Share count is projected to fall by 5.29% annually over the next three years, which directly enhances value for remaining investors.

- This disciplined capital allocation, plus a flexible “land-light” model, is highlighted by bulls as a buffer against ongoing housing cycle turbulence.

Valuation Discount Challenged by Analyst Targets

- The current share price of $65.08 trades at an 8.9x PE ratio, lower than the US Consumer Durables industry average of 10.4x but considerably above the DCF fair value of $19.05 and also 14.2% above the $59.50 analyst consensus target.

- Analysts' consensus view acknowledges this modest valuation discount compared to peers, but warns that to justify the current price, Century Communities would need to reach $4.1 billion in revenues, $114.5 million in annual earnings, and a hefty 16.9x PE by 2028. This would be a significant step up from the present day and means today's price reflects a high level of optimism that may not materialize if margins continue to deteriorate.

- The potential disconnect between price and near-term earnings trajectory remains the central tension for valuation-focused investors.

- Sector growth rates (10% for the market versus 1.9% annual revenue growth expected at CCS) broaden this gap in future prospects, fueling debate about when “value” justifies the risk.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Century Communities on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Interpreting the figures in a new way? Share your viewpoint and craft a narrative in just a few minutes: Do it your way.

A great starting point for your Century Communities research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Century Communities faces declining margins, tepid revenue growth, and a share price that may not be justified if profits keep falling short.

Seeking a better margin of safety? Use these 876 undervalued stocks based on cash flows to target companies whose share prices offer true value relative to future prospects and market peers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCS

Century Communities

Engages in the design, development, construction, marketing, and sale of single-family attached and detached homes.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion