- United States

- /

- Consumer Durables

- /

- NYSE:BZH

There's No Escaping Beazer Homes USA, Inc.'s (NYSE:BZH) Muted Earnings Despite A 32% Share Price Rise

The Beazer Homes USA, Inc. (NYSE:BZH) share price has done very well over the last month, posting an excellent gain of 32%. The last month tops off a massive increase of 166% in the last year.

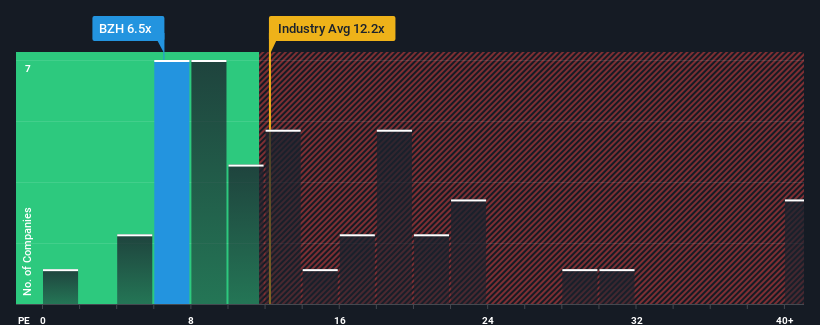

In spite of the firm bounce in price, Beazer Homes USA may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.5x, since almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 34x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Beazer Homes USA has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Beazer Homes USA

Is There Any Growth For Beazer Homes USA?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Beazer Homes USA's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's bottom line. Even so, admirably EPS has lifted 192% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings growth is heading into negative territory, declining 10% over the next year. That's not great when the rest of the market is expected to grow by 10%.

In light of this, it's understandable that Beazer Homes USA's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Shares in Beazer Homes USA are going to need a lot more upward momentum to get the company's P/E out of its slump. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Beazer Homes USA maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Beazer Homes USA that we have uncovered.

Of course, you might also be able to find a better stock than Beazer Homes USA. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Beazer Homes USA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BZH

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives