- United States

- /

- Consumer Durables

- /

- NYSE:BLD

Did TopBuild’s (BLD) $750 Million Bond Issue Reshape Its Financial Flexibility and Growth Outlook?

Reviewed by Sasha Jovanovic

- TopBuild Corp. recently completed a US$750 million fixed-income offering by issuing 5.625% senior unsecured notes due January 31, 2034, featuring attached guarantees, callability, and Regulation S/Rule 144A distribution.

- This sizable debt financing highlights TopBuild’s capacity to access capital markets for funding potential growth initiatives, balance sheet management, or future acquisitions.

- We’ll assess how TopBuild’s expanded financial flexibility from this major bond issuance could influence its evolving investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

TopBuild Investment Narrative Recap

TopBuild’s investment appeal centers on its ability to convert secular tailwinds in energy efficiency, aging US housing stock, and commercial market expansion into durable earnings power, even as cyclical pressures linger. The recent US$750 million senior note issuance boosts financial flexibility, but does not immediately address the biggest short-term risk, prolonged residential construction weakness, nor does it directly accelerate its most important growth catalyst, commercial and industrial diversification.

Among TopBuild’s recent announcements, the increase in its revolving credit facility and establishment of a new US$1 billion term loan earlier this year stand out. This further supports the company’s acquisition strategy, providing layered financial resources to pursue M&A at a time when balance sheet strength is crucial for navigating market volatility.

Yet, in contrast to this enhanced access to capital, investors should be keenly aware of the persistent risks from...

Read the full narrative on TopBuild (it's free!)

TopBuild's outlook anticipates $5.8 billion in revenue and $602.8 million in earnings by 2028. This reflects a projected annual revenue growth rate of 3.7% and an $8.3 million increase in earnings from the current $594.5 million.

Uncover how TopBuild's forecasts yield a $446.83 fair value, a 12% upside to its current price.

Exploring Other Perspectives

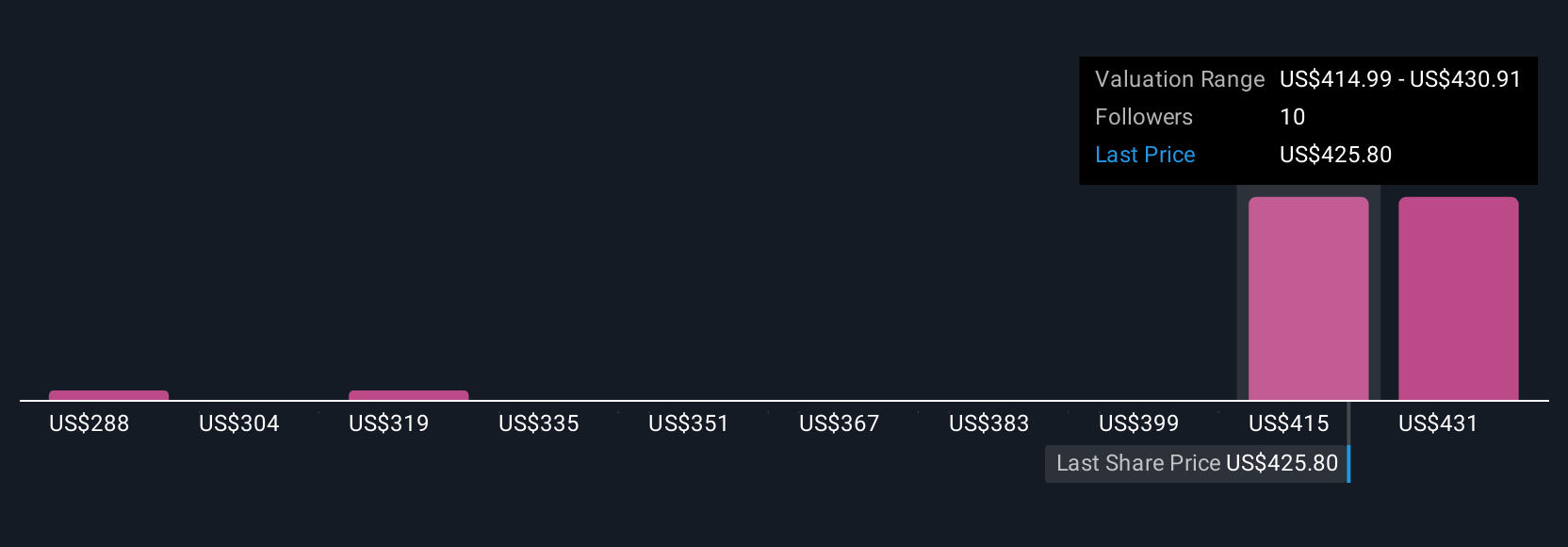

Simply Wall St Community members provided four fair value estimates for TopBuild ranging from US$287.60 to US$446.83. While opinions differ widely, many are weighing the significance of TopBuild’s debt-funded acquisition strategy and its implications for future returns.

Explore 4 other fair value estimates on TopBuild - why the stock might be worth as much as 12% more than the current price!

Build Your Own TopBuild Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TopBuild research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free TopBuild research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TopBuild's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TopBuild might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLD

TopBuild

Engages in the installation and distribution of insulation and other building material products to the construction industry.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives