- United States

- /

- Leisure

- /

- NYSE:BC

Brunswick (BC): Exploring Valuation After Analyst Upgrades and AutoCaptain Autonomous Boating Launch

Reviewed by Kshitija Bhandaru

Brunswick (BC) drew fresh attention this week after the announcement of the Simrad AutoCaptain Autonomous Boating System. The system features full auto-docking and exclusive Mercury Marine integration. Recent analyst enthusiasm adds another layer to the conversation.

See our latest analysis for Brunswick.

Following the AutoCaptain launch and renewed analyst optimism, Brunswick’s recent 7-day share price return of 6.06% stands out. While short-term gains are notable, its 1-year total shareholder return is still down 19.49%, indicating the stock is still working to rebuild momentum after a challenging period.

If this kind of marine innovation has you watching the sector, now is a good time to broaden your investing horizons and discover See the full list for free.

With cutting-edge innovation and renewed analyst optimism on the table, the key question is whether Brunswick’s shares still offer room for future gains or if the market has already priced in all the upside potential.

Most Popular Narrative: 3.8% Undervalued

With Brunswick's narrative fair value of $66.47 just above its last close at $63.91, analysts see only a slim margin between price and potential. This subtle gap has kept investor attention locked on what is driving the company's future prospects.

*Brunswick's ongoing expansion of high-margin, recurring revenue streams, such as digital boating services and the Freedom Boat Club, strengthens margin stability and earnings quality. This is reinforced by the successful launch of new franchise locations (for example, Dubai) and the continued global leadership of the club model.*

Curious what numbers are fueling this confident outlook? The fair value hinges on aggressive expectations for future profits, flashing a bold signal beyond today's headlines. Want to see exactly which game-changing forecasts power this price? The full narrative reveals what really sets Brunswick's story apart.

Result: Fair Value of $66.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent softness in the value boat market or rising supply chain costs could pose challenges to Brunswick's growth story and threaten its earnings momentum.

Find out about the key risks to this Brunswick narrative.

Another View: Upside According to Discounted Cash Flow

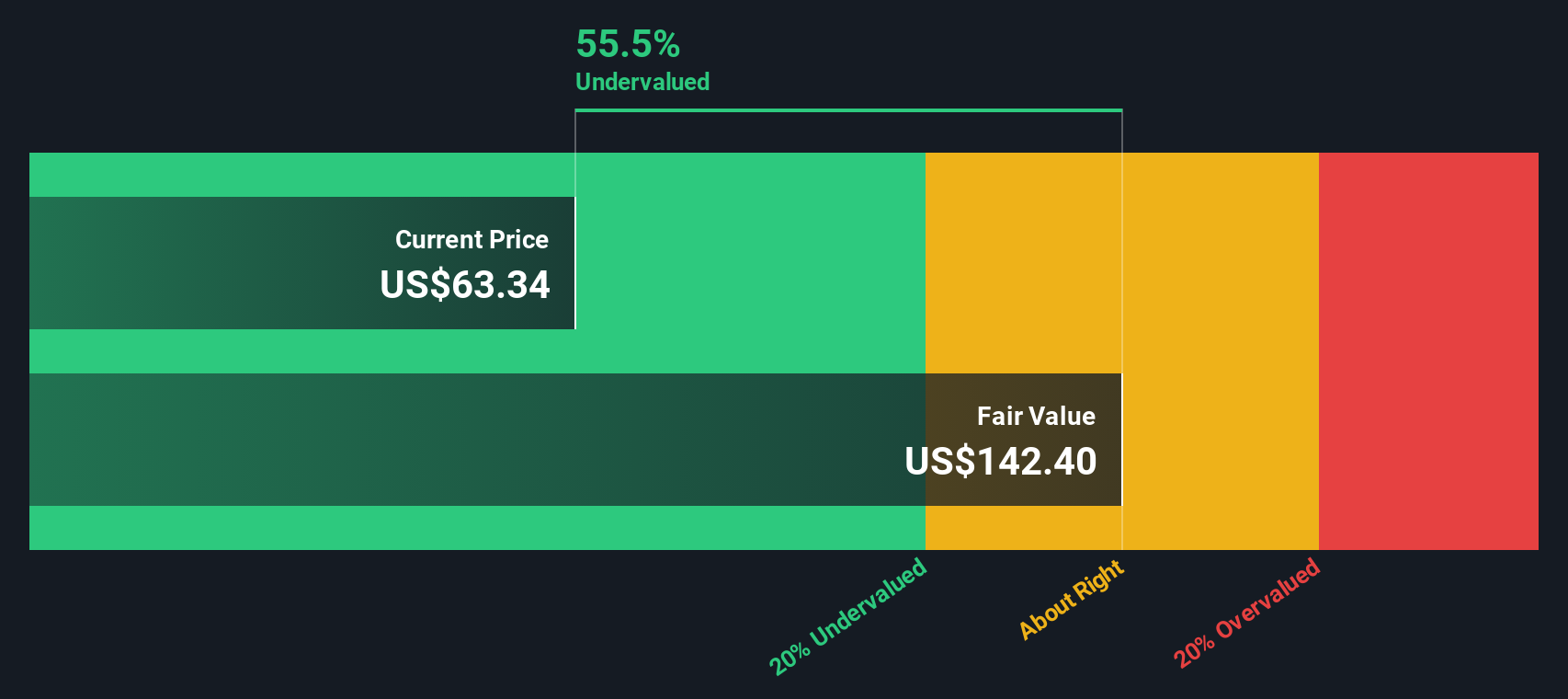

While analyst targets and narrative-based valuations suggest Brunswick is only modestly undervalued, our SWS DCF model takes a more optimistic stance. It estimates Brunswick’s fair value at $142.40, which is more than double the current market price. Is the market overlooking Brunswick’s long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Brunswick Narrative

If you have a different perspective or want to analyze the data firsthand, crafting your own narrative takes just a few minutes. Do it your way

A great starting point for your Brunswick research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t leave opportunity on the table. The Simply Wall Street Screener puts powerful filters in your hands so you can spot tomorrow’s winners with confidence and clarity.

- Boost your income potential by checking out these 18 dividend stocks with yields > 3% delivering yields above 3% and steady returns.

- Catch the next tech wave by exploring these 24 AI penny stocks shaping artificial intelligence transformations across global industries.

- Tap into early-stage opportunities with these 3596 penny stocks with strong financials poised for explosive financial growth and market impact.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brunswick might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BC

Brunswick

Designs, manufactures, and markets recreation products in the United States, Europe, the Asia-Pacific, Canada, and internationally.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives