- United States

- /

- Luxury

- /

- NYSE:AS

Assessing Amer Sports (NYSE:AS) Valuation After Its Strong Year-to-Date Share Price Rally

Reviewed by Simply Wall St

Amer Sports (NYSE:AS) has quietly put together a strong run, with the stock climbing about 34% year to date and roughly 51% over the past year as revenue and earnings growth pick up.

See our latest analysis for Amer Sports.

That move has been reinforced by a sharp 30 day share price return of about 31% and a 1 year total shareholder return just over 50%, suggesting momentum is building as investors lean into its growth story.

If Amer Sports’ run has you thinking about what else could surprise to the upside, this is a good moment to explore fast growing stocks with high insider ownership.

Yet with Amer Sports still trading around 20% below consensus price targets despite brisk growth, the key question now is whether the market is underestimating its earnings power or is already pricing in the next leg of expansion.

Most Popular Narrative Narrative: 16.6% Undervalued

With Amer Sports closing at $38.68 versus a narrative fair value nearer to the mid 40s, the valuation case hinges on aggressive growth and margin expansion.

Ongoing investment in direct-to-consumer channels (both physical stores and e-commerce) is fueling higher full-price sales, reduced markdowns, and enhanced customer engagement, supporting scalable top-line growth and driving adjusted operating margin expansion.

Curious how double digit growth, fatter margins, and a rich future earnings multiple can all coexist in one story? See how these assumptions stack up against that fair value call.

Result: Fair Value of $46.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if Asia Pacific growth stalls or heavy DTC expansion lifts costs faster than revenue and margin gains materialize.

Find out about the key risks to this Amer Sports narrative.

Another Way to Look at Valuation

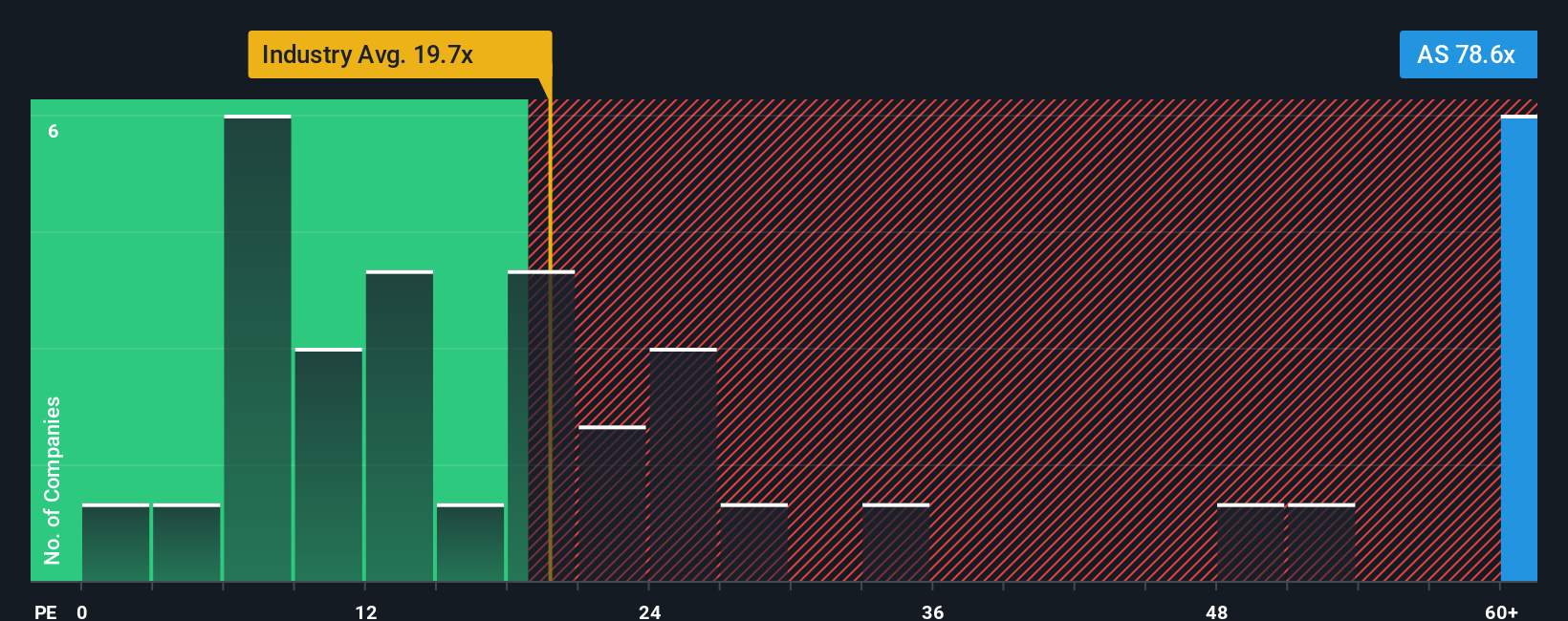

While the growth narrative suggests upside, Amer Sports trades on a rich 68.9x earnings multiple, far above the US Luxury industry at 20.6x and peers at 35.7x, and well above its 28.4x fair ratio. That gap points to real valuation risk if execution slips. Does the story still hold up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amer Sports Narrative

If you are not completely sold on this view, or simply prefer running your own numbers, you can build a custom scenario in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Amer Sports.

Ready for more investment ideas?

Before the market moves on without you, use the Simply Wall St Screener to pinpoint fresh opportunities that match your strategy and strengthen your next move.

- Capture potential mispricings by targeting these 903 undervalued stocks based on cash flows that may offer attractive upside based on their future cash flows and fundamentals.

- Ride structural shifts in technology by focusing on these 27 AI penny stocks positioned to benefit from accelerating adoption of intelligent software and automation.

- Reinforce your portfolio’s income engine with these 15 dividend stocks with yields > 3% that combine meaningful yields with the financial strength to keep paying shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AS

Amer Sports

Designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories in Europe, the Middle East, Africa, the Americas, Mainland China, Hong Kong, Macau, Taiwan, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026