- United States

- /

- Luxury

- /

- NYSE:AS

Amer Sports (NYSE:AS) Completes US$1.3 Billion Follow-On Equity Offering as Shareholders Seek Partial Exit

Reviewed by Simply Wall St

Amer Sports (NYSE:AS) experienced a 56% price increase over the past month, amidst significant financial developments. The company successfully completed a $1.302 billion follow-on equity offering while an Asian private equity firm, FountainVest Partners, aimed to sell about half its shares in Amer Sports, marking a major shift in shareholder dynamics. This activity coincided with a strong release of Q1 2025 earnings, showing increased sales and net income, and raised corporate guidance. While market conditions remained mixed, these events provided a significant counterweight, driving Amer Sports's upward momentum distinct from broader market trends.

Buy, Hold or Sell Amer Sports? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

The recent developments around Amer Sports, including the significant price increase and the restructuring of its shareholder base, have the potential to reinforce the company's strategic narrative. With the company's expansion in the Asia-Pacific region and investments in direct-to-consumer channels, the additional capital from the $1.30 billion equity offering could further bolster these growth initiatives. Over the past year, Amer Sports has achieved a total return of over 150%, which provides a robust context for its recent achievements and underscores investor confidence amid changing market dynamics. Compared to the overall U.S. market return of 11.3% over the past year, Amer Sports' performance has been exceptional, particularly as it outpaced the U.S. Luxury industry's return, which was negative. This puts the company in a favorable competitive position.

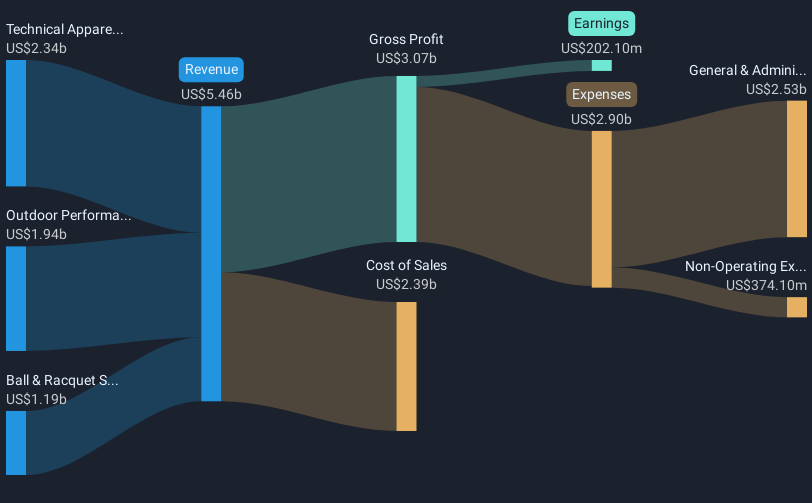

The company's strengthened financial position and positive Q1 2025 earnings could have a meaningful impact on revenue and earnings forecasts. Analysts expect revenue to grow by 13.8% annually over the next three years, with earnings anticipated to rise to US$728.60 million by 2028. Despite these upbeat projections, potential risks related to brand concentration and macroeconomic uncertainties still pose challenges. It's important to consider that the current share price of US$37.04 is closely aligned with the analyst price target of US$40.17, indicating a 7.8% upside potential. This suggests that the recent news and the company's growth prospects are somewhat priced in, making it essential for investors to continually assess growth assumptions against financial realities.

Assess Amer Sports' future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AS

Amer Sports

Designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories in Europe, the Middle East, Africa, the Americas, Mainland China, Hong Kong, Macau, Taiwan, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives