- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:VUZI

Shareholders Are Raving About How The Vuzix (NASDAQ:VUZI) Share Price Increased 392%

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. While not every stock performs well, when investors win, they can win big. For example, the Vuzix Corporation (NASDAQ:VUZI) share price rocketed moonwards 392% in just one year. It's also up 102% in about a month. Having said that, the longer term returns aren't so impressive, with stock gaining just 7.4% in three years.

View our latest analysis for Vuzix

Vuzix wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, Vuzix's revenue grew by 39%. We respect that sort of growth, no doubt. Arguably it's more than reflected in the truly wondrous share price gain of 392% in the last year. While we are always careful about jumping on a hot stock too late, there's certainly good reason to keep an eye on Vuzix.

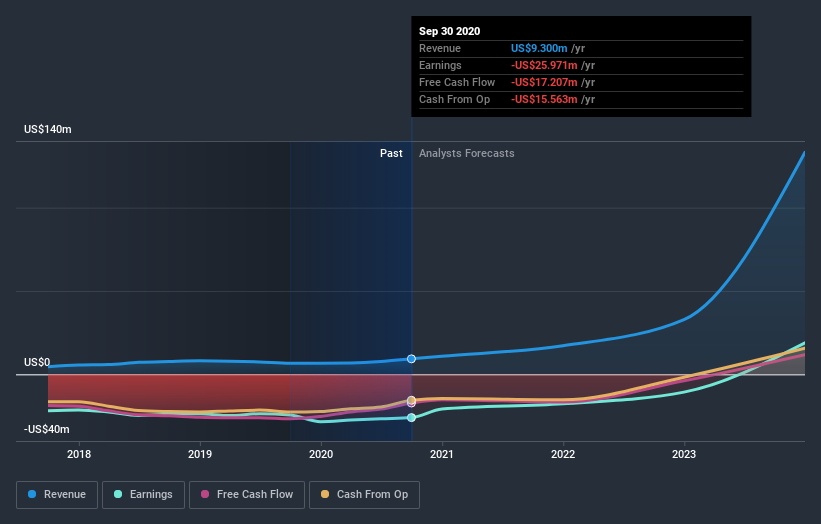

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Vuzix will earn in the future (free profit forecasts).

A Different Perspective

It's good to see that Vuzix has rewarded shareholders with a total shareholder return of 392% in the last twelve months. That's better than the annualised return of 11% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Vuzix better, we need to consider many other factors. Take risks, for example - Vuzix has 2 warning signs we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Vuzix, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:VUZI

Vuzix

Designs, manufactures, and markets artificial intelligence (AI)-powered smart glasses, waveguides, and augmented reality (AR) technologies in North America, Europe, the Asia Pacific, and internationally.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives