- United States

- /

- Leisure

- /

- NasdaqCM:VMAR

We're Hopeful That Vision Marine Technologies (NASDAQ:VMAR) Will Use Its Cash Wisely

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether Vision Marine Technologies (NASDAQ:VMAR) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Vision Marine Technologies

How Long Is Vision Marine Technologies' Cash Runway?

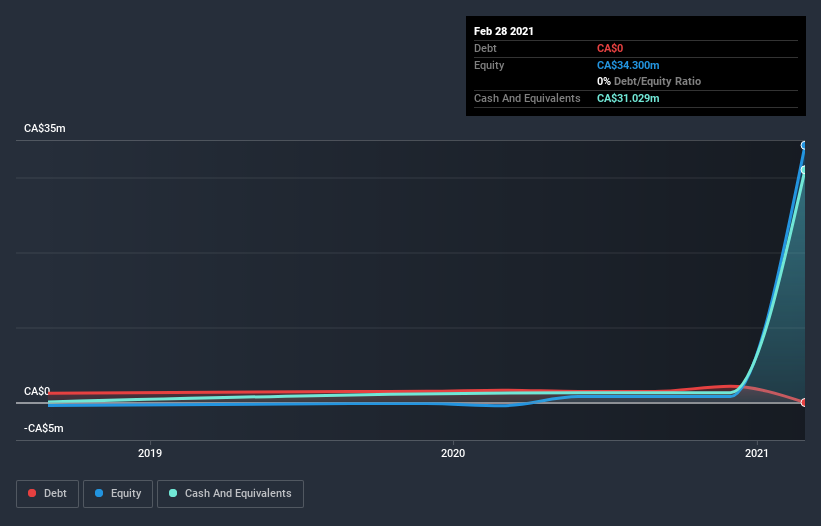

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Vision Marine Technologies last reported its balance sheet in February 2021, it had zero debt and cash worth CA$31m. Importantly, its cash burn was CA$5.3m over the trailing twelve months. So it had a cash runway of about 5.8 years from February 2021. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Vision Marine Technologies Growing?

It was quite stunning to see that Vision Marine Technologies increased its cash burn by 808% over the last year. On the bright side, at least operating revenue was up 20% over the same period, giving some cause for hope. Taken together, we think these growth metrics are a little worrying. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Vision Marine Technologies Raise More Cash Easily?

While Vision Marine Technologies seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Vision Marine Technologies has a market capitalisation of CA$44m and burnt through CA$5.3m last year, which is 12% of the company's market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

So, Should We Worry About Vision Marine Technologies' Cash Burn?

On this analysis of Vision Marine Technologies' cash burn, we think its cash runway was reassuring, while its increasing cash burn has us a bit worried. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Vision Marine Technologies' situation. An in-depth examination of risks revealed 3 warning signs for Vision Marine Technologies that readers should think about before committing capital to this stock.

Of course Vision Marine Technologies may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Vision Marine Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:VMAR

Vision Marine Technologies

Designs, develops, manufactures, rents, and sells electric boats in Canada, the United States, and internationally.

Flawless balance sheet medium-low.