- United States

- /

- Leisure

- /

- NasdaqGS:SWIM

Latham Group, Inc.'s (NASDAQ:SWIM) 25% Share Price Plunge Could Signal Some Risk

The Latham Group, Inc. (NASDAQ:SWIM) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term, the stock has been solid despite a difficult 30 days, gaining 16% in the last year.

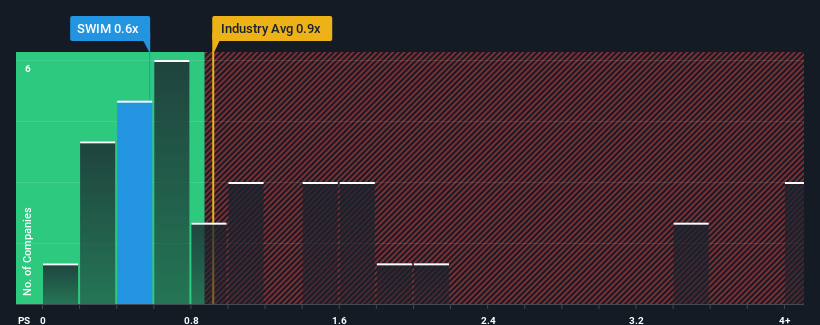

Even after such a large drop in price, there still wouldn't be many who think Latham Group's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in the United States' Leisure industry is similar at about 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Latham Group

What Does Latham Group's Recent Performance Look Like?

Recent times haven't been great for Latham Group as its revenue has been falling quicker than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Latham Group.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Latham Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. Even so, admirably revenue has lifted 40% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 0.03% each year as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 2.3% per annum, which is noticeably more attractive.

With this information, we find it interesting that Latham Group is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Latham Group's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of Latham Group's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Latham Group (of which 1 is a bit unpleasant!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SWIM

Latham Group

Designs, manufactures, and markets in-ground residential swimming pools in North America, Australia, and New Zealand.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives