- United States

- /

- Leisure

- /

- NasdaqGS:SWBI

Smith & Wesson (SWBI) Q2: Thin 2.1% TTM Margin Tests Bullish Earnings Recovery Narrative

Reviewed by Simply Wall St

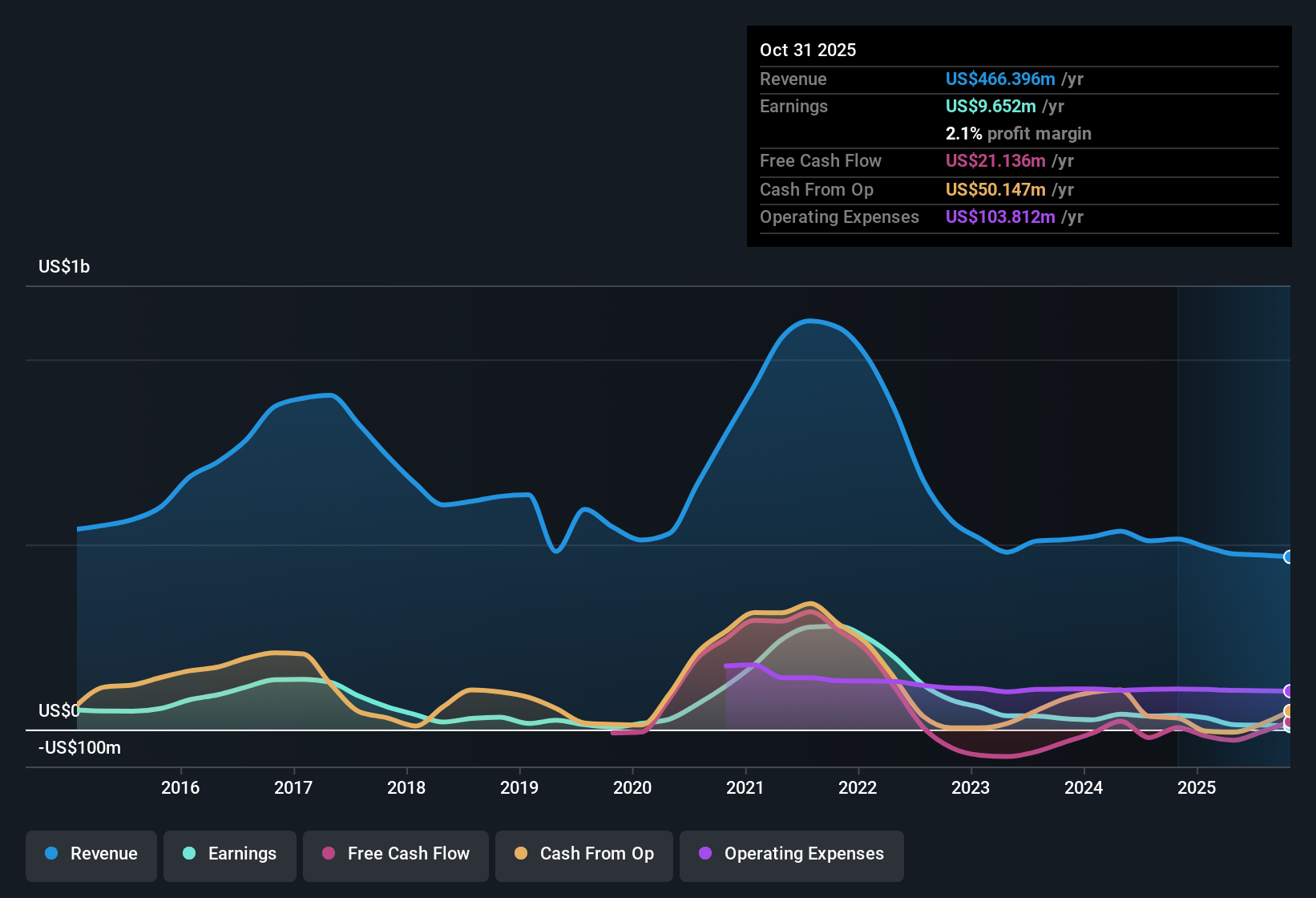

Smith & Wesson Brands (SWBI) has just posted a mixed Q2 2026 print, with revenue of about $124.7 million translating into basic EPS of roughly $0.04 on net income of $1.9 million. This sets a cautious tone around profitability. The company has seen quarterly revenue move from roughly $129.7 million in Q2 2025 to $124.7 million this quarter, while EPS has swung from $0.09 a year ago to a small profit after a loss of about $0.08 in Q1 2026, leaving investors watching whether margins can rebuild from these compressed levels.

See our full analysis for Smith & Wesson Brands.With the headline numbers on the table, the next step is to compare this latest quarter with the dominant narratives around Smith & Wesson Brands to see which stories about its growth, risks, and profitability really hold up.

See what the community is saying about Smith & Wesson Brands

Margins Thin at 2.1 percent TTM

- Over the last twelve months, Smith and Wesson Brands generated about 466.4 million dollars of revenue and 9.7 million dollars of net income, which works out to a net profit margin of roughly 2.1 percent, down from 7.4 percent a year earlier.

- Bears focus on this squeeze, arguing that weaker profitability could limit the upside from even modest revenue growth.

- The trailing earnings decline of 49.9 percent per year over five years lines up with the drop in margin from 7.4 percent to 2.1 percent, reinforcing concerns about how much profit the company keeps on each dollar of sales.

- Even with Q2 2026 revenue up from 85.1 million dollars in Q1 2026 to 124.7 million dollars, net income has only recovered to 1.9 million dollars, which keeps recent profitability well below the stronger quarters seen in 2025.

High 50.5x P E Hinges on Growth

- The stock currently trades at a price to earnings ratio of 50.5 times, more than double the Global Leisure industry average of 21.8 times, while trailing twelve month EPS of about 0.22 dollars is much lower than the 0.71 to 0.84 dollars range seen a year earlier on a trailing basis.

- Consensus narrative points to operational improvements and new products as reasons this premium valuation could still be justified.

- Analysts expect earnings to grow around 57.3 percent per year with profit margins rising from roughly 2.5 percent to 4.1 percent over three years, which would be a sharp improvement from the current 2.1 percent trailing margin.

- At a share price of 10.96 dollars and an analyst price target of 12.00 dollars, the implied upside is modest, so the elevated 50.5 times multiple leaves little buffer if those margin and earnings gains take longer than expected.

Dividend 4.74 percent but Stretched Cover

- The dividend yield sits at about 4.74 percent on the current 10.96 dollar share price, yet that payout is flagged as not well covered by either recent earnings or free cash flow, with trailing net income of only 9.7 million dollars on 466.4 million dollars of sales.

- Bullish investors argue that ongoing facility investments and product expansion can support both the dividend and future growth, but the numbers tell a more cautious story.

- Trailing twelve month EPS of about 0.22 dollars and a net profit margin of 2.1 percent give limited room to fund a near 5 percent yield while also backing capital spending such as the Tennessee facility and academy project.

- Even though a DCF fair value of 11.67 dollars is about 6.1 percent above the current price, weak dividend coverage means a larger share of that return may need to come from future earnings growth rather than dependable cash distributions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Smith & Wesson Brands on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? In just a few minutes, you can turn your own take on Smith and Wesson into a complete narrative: Do it your way.

A great starting point for your Smith & Wesson Brands research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Smith and Wesson is juggling thin margins, an expensive earnings multiple, and a stretched dividend that all rely heavily on forecasts of stronger profitability ahead.

If you would rather not bet on a rich valuation and fragile payout recovering on schedule, use our these 906 undervalued stocks based on cash flows to quickly focus on companies where price, earnings power, and dividend strength already line up more convincingly today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SWBI

Smith & Wesson Brands

Designs, manufactures, and sells firearms worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026