- United States

- /

- Luxury

- /

- NasdaqGS:RCKY

Rocky Brands (RCKY) Margin Gains Challenge Cautious Narratives Despite Slower Revenue Growth

Reviewed by Simply Wall St

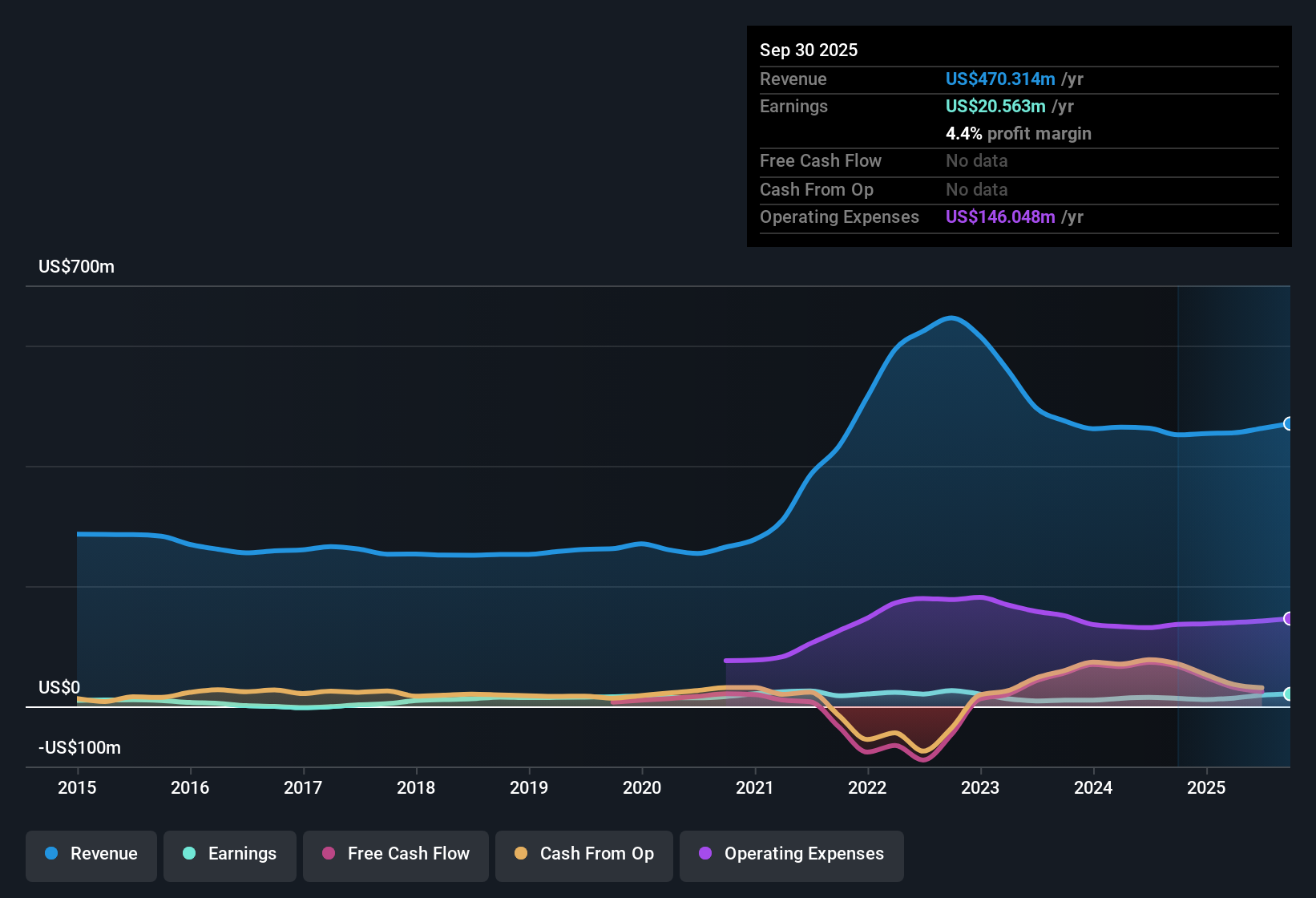

Rocky Brands (RCKY) reported net profit margins of 4.4%, up from last year’s 2.9%, with EPS growth of 54.6% over the past year. This strong bottom-line delivery outpaces the company’s five-year average decline of 9.9% per year, and value investors will note shares currently trade at a discounted 10.6x P/E compared to industry averages and the company’s estimated fair value. With recent margin improvements and a solid track record of dividends, the latest results provide reasons for optimism, even as revenue growth is expected to lag the broader US market.

See our full analysis for Rocky Brands.Let’s dive deeper by stacking up these numbers against the most widely held narratives. This approach reveals where the market story matches up and where new surprises might emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Strength Defies Five-Year Average

- Net profit margin is currently 4.4%, which is a meaningful lift over last year’s 2.9% and a notable deviation from the longer-term average decline of 9.9% per year in earnings.

- Recent margin improvement supports the view that operational adjustments are beginning to pay off. This is especially relevant as management initiatives have targeted cost control and efficiency.

- While average annual earnings have decreased over five years, last year’s 54.6% earnings growth provides a counterpoint that sharp turnarounds can happen despite an unfavorable trend.

- This momentum, if maintained, may encourage investors to reassess the company's ability to withstand sector challenges and transition toward more resilient profitability.

Revenue Growth Lags the Broader Market

- Rocky Brands is forecast to grow revenue at just 4.7% annually, which is less than half the broader US market’s projected rate of 10.2% per year.

- This muted revenue growth outlook tempers bullish arguments that the company’s operational improvements alone can deliver outperformance.

- Market observers highlight that, despite recent bottom-line gains, persistent underperformance on the top line means Rocky Brands could continue to trail sector growth leaders.

- Low revenue growth also raises questions about how much margin expansion can offset the pressure from less dynamic sales compared to peers.

Valuation Remains Attractive at a Discount

- Shares trade at 10.6x earnings, comfortably below the industry and peer averages of roughly 19.7x, and at a substantial discount to the DCF fair value of $52.92. This compares with a current share price of $29.14.

- The gap between market price and estimated fair value directly supports the argument that Rocky Brands offers value potential not yet reflected in the stock.

- Analysts monitoring the sector note that such a wide discount could entice value investors, particularly when combined with improved margins and ongoing dividend signals.

- At current multiples, the company is also better insulated against downside risk, as expectations are already conservative relative to industry peers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Rocky Brands's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite margin improvements and solid value metrics, Rocky Brands still faces slow revenue growth and lags well behind the broader US market expansion rates.

If steady growth matters more to you, consider using stable growth stocks screener (2122 results) to find companies demonstrating consistent revenue and earnings performance, even when others stagnate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RCKY

Rocky Brands

Designs, manufactures, and markets footwear and apparel in the United States, Canada, the United Kingdom, and internationally.

Established dividend payer and good value.

Market Insights

Community Narratives