- United States

- /

- Luxury

- /

- NasdaqGS:RCKY

Optimistic Investors Push Rocky Brands, Inc. (NASDAQ:RCKY) Shares Up 27% But Growth Is Lacking

Rocky Brands, Inc. (NASDAQ:RCKY) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 71%.

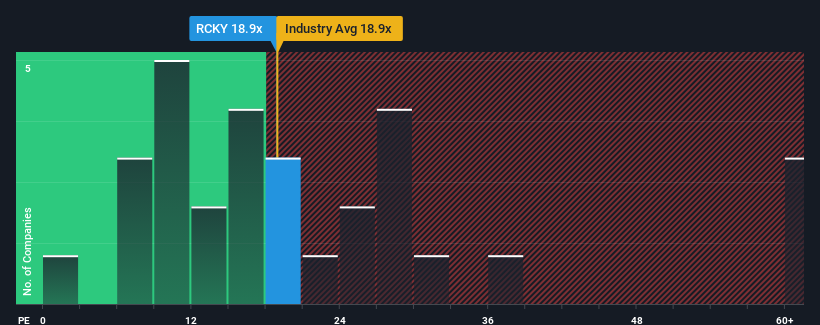

Although its price has surged higher, you could still be forgiven for feeling indifferent about Rocky Brands' P/E ratio of 18.9x, since the median price-to-earnings (or "P/E") ratio in the United States is also close to 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Rocky Brands has been doing a decent job lately as it's been growing earnings at a reasonable pace. It might be that many expect the respectable earnings performance to only match most other companies over the coming period, which has kept the P/E from rising. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Check out our latest analysis for Rocky Brands

How Is Rocky Brands' Growth Trending?

Rocky Brands' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 4.3% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 46% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 12% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Rocky Brands is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Rocky Brands appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Rocky Brands currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Rocky Brands (2 don't sit too well with us!) that you should be aware of before investing here.

If you're unsure about the strength of Rocky Brands' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RCKY

Rocky Brands

Designs, manufactures, and markets footwear and apparel in the United States, Canada, the United Kingdom, and internationally.

Established dividend payer slight.

Market Insights

Community Narratives