- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Peloton (PTON) Valuation in Focus After AI Coaching Launch and Cross-Training Revamp

Reviewed by Kshitija Bhandaru

Peloton Interactive (PTON) just announced a sweeping relaunch of its lineup, introducing its AI-powered Peloton IQ coaching system along with the Cross Training Series of connected fitness equipment. The company is also raising hardware and membership prices.

See our latest analysis for Peloton Interactive.

Peloton’s bold relaunch, featuring AI-powered coaching and upgraded cross-training equipment, arrived after a challenging run for both the company and its stock. Despite a recent lift in premarket trading when the revamp news hit, Peloton’s one-year total shareholder return of less than 1% underlines how momentum has been muted even as management pivots strategies and product lines. With today’s headline-making innovations and a leadership team signaling a clear growth agenda, investors are watching to see if this marks a real turning point or just another chapter in a volatile story.

If you’re curious to see which other fitness and wellness brands are evolving alongside Peloton, the logical next step is to explore the full list in our fast growing stocks with high insider ownership.

The question now is whether Peloton's AI-driven overhaul and product refresh represent hidden value for long-term investors, or if the market has already factored in these growth ambitions, leaving little room for upside.

Most Popular Narrative: 11.8% Undervalued

Compared to Peloton’s last closing price of $8.68, the most popular narrative sees fair value at $9.84. This suggests some remaining upside if optimistic views hold true. The narrative synthesizes both bullish and bearish assumptions, highlighting a real collision of expectations around future growth and market adoption.

Peloton is leveraging advanced technologies, including AI-powered personalized coaching and human-driven community features, to broaden its offerings from cardio into holistic wellness. This approach aligns with growing global health consciousness and should support future subscription revenue growth and higher engagement while reducing churn.

What’s the secret behind this valuation premium? Analysts are betting on a financial transformation powered by rising margins, lucrative new revenue streams, and a potential profitability inflection point that could catch many by surprise. Want to see what assumptions drive these expectations? Uncover the full narrative and spot the projections that justify the bulls’ target.

Result: Fair Value of $9.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining hardware sales and fierce competition from lower-cost digital fitness rivals could quickly undermine Peloton’s bullish growth outlook.

Find out about the key risks to this Peloton Interactive narrative.

Another View: Looking Beyond Analyst Consensus

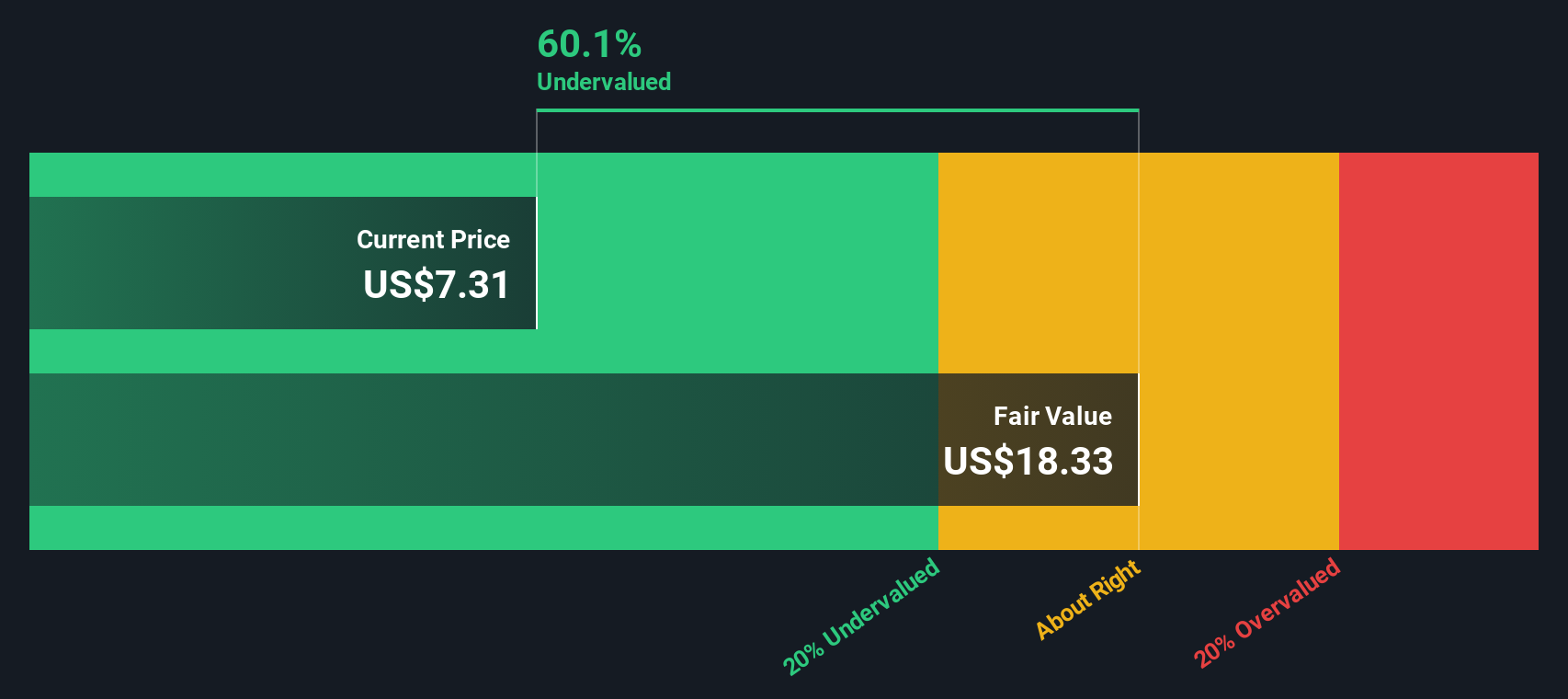

While analysts see upside based on future earnings, our SWS DCF model paints an even more optimistic picture. The DCF approach suggests Peloton’s shares trade at a substantial 52.8% discount to its fair value, signaling even greater long-term opportunity than multiples-based views imply. Could this model be flagging what the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Peloton Interactive Narrative

If you have your own perspective on Peloton, or like diving into the numbers yourself, you can craft a personalized narrative in just minutes. Do it your way.

A great starting point for your Peloton Interactive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Take control and uncover fresh stocks that could shape your next market move with these handpicked ideas:

- Unlock opportunities in the digital asset space and analyze real businesses paving the way by checking out these 78 cryptocurrency and blockchain stocks.

- Boost your portfolio’s growth potential as you spot companies spearheading advances in artificial intelligence with these 24 AI penny stocks.

- Position yourself ahead of the crowd and search for undervalued stocks where cash flows signal untapped upside using these 909 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives