- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Peloton (PTON): Exploring Valuation After Recent Subtle Shifts in Investor Sentiment

Reviewed by Simply Wall St

The recent movement in Peloton Interactive (PTON) stock might have left many investors pausing to reconsider their strategy. With no single event driving headlines, it is easy to overlook the subtle shifts that could signal the start of something bigger or simply reflect ongoing uncertainty in the connected fitness market. For those sitting on the fence, these quiet periods can be just as revealing as the headline-grabbing surges.

Over the past year, Peloton Interactive has actually gained 84%, building solid momentum despite a loss of over 90% from its five-year peak and some continued swings in sentiment. This past month, the stock added 3%, with most of the recent climb clustering in the past week. While no dramatic events have catalyzed the latest uptick, even modest improvements in revenue and a sharp swing in net income have caught investors’ attention. Last year’s performance stood in stark contrast to the company’s longer-term returns, reflecting both shifting investor attitudes and the volatile world of fitness tech.

After this year’s run-up, is Peloton Interactive simply catching up to fair value, or is the market already pricing in its possible rebound story?

Most Popular Narrative: 17.7% Undervalued

The dominant narrative sees Peloton Interactive as trading well below its calculated fair value, suggesting significant upside potential if key assumptions play out.

Peloton is leveraging advanced technologies, including AI-powered personalized coaching and human-driven community features, to broaden its offerings from cardio into holistic wellness (strength, sleep, stress, nutrition). This aligns with growing global health consciousness and should support future subscription revenue growth and higher engagement with reduced churn.

Can Peloton really transform the fitness experience and beat market expectations? The story behind this valuation is about radical technological bets, new recurring revenue streams, and a profit turnaround forecasted to outpace today's industry leaders. Curious which financial milestones on revenue, earnings, and profitability are baked into this optimistic price estimate? The numbers behind the narrative may surprise you.

Result: Fair Value of $9.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, declining hardware demand and increasing competition from digital and in-person fitness options could quickly derail Peloton’s ambitious rebound story.

Find out about the key risks to this Peloton Interactive narrative.Another View: Market-Based Valuation

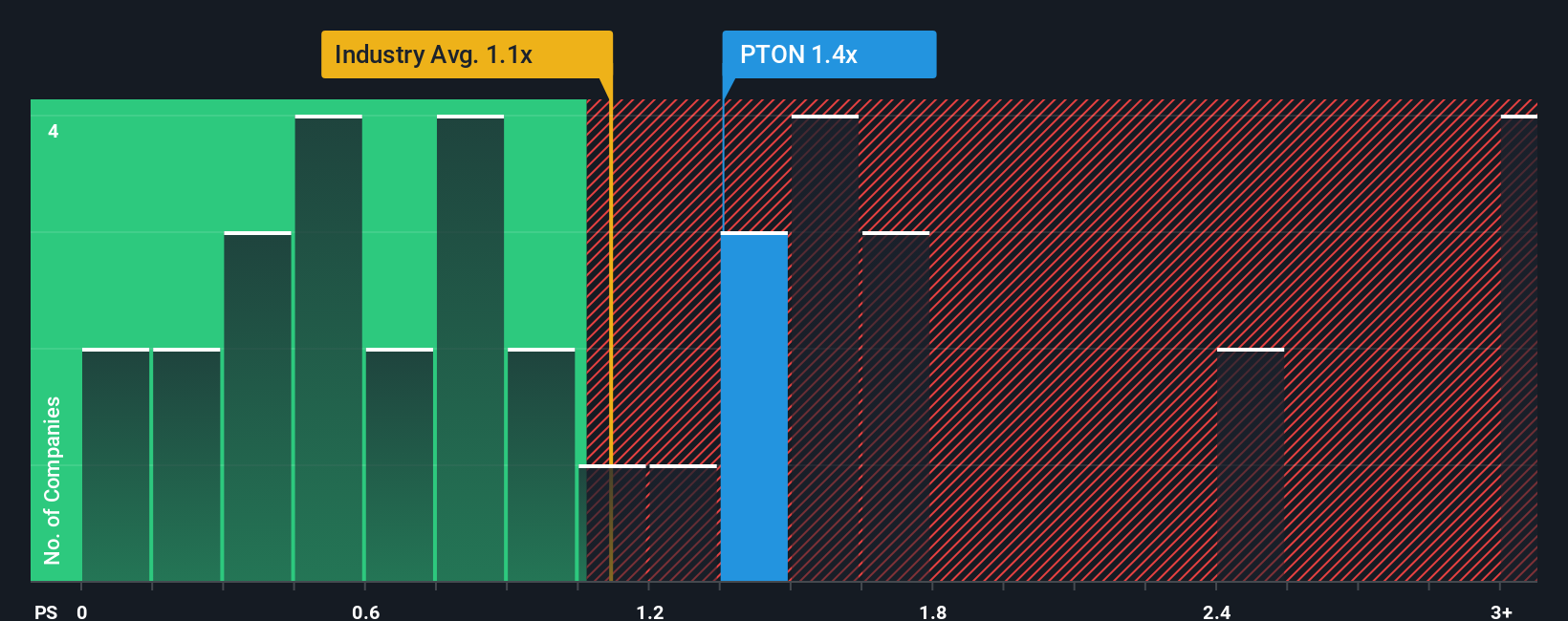

Taking a different approach, some investors look at how Peloton Interactive's price compares to revenue in its industry. By this measure, the stock currently appears expensive versus most leisure peers, which challenges the optimism of the forecast-based valuation and casts doubt on how much upside is really left. Could market caution be telling us something analysts are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Peloton Interactive to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Peloton Interactive Narrative

If you want to challenge these narratives or dig deeper into Peloton Interactive’s numbers, you can shape your own interpretation in minutes using Do it your way

A great starting point for your Peloton Interactive research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors never limit themselves to just one story. Take the next step and expand your watchlist with handpicked ideas designed to help you stay ahead of the market.

- Uncover potential in tech by tracking emerging companies shaping tomorrow’s digital landscape using AI penny stocks.

- Maximize your portfolio’s cash flow by targeting reliable companies that offer stronger-than-average yields with dividend stocks with yields > 3%.

- Spot hidden gems trading below fair value and find opportunities others might miss with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives