- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Evaluating Peloton Interactive (PTON) Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

Short term moves and recent performance snapshot

Peloton Interactive (PTON) has seen mixed recent returns, with the share price down about 5.5% over the past day and 7.5% over the past week, while showing a small gain over the past month.

Over the past 3 months, the stock is down roughly 15.6%, and the past year shows a total return decline of about 23.5%. This sets the context for how investors may be reassessing the story today.

See our latest analysis for Peloton Interactive.

At a share price of US$6.33, Peloton’s recent moves show fading momentum, with short term share price pressure and a 1 year total shareholder return decline of about 23%, which points to an ongoing reassessment of its risk profile.

If Peloton’s volatility has you rethinking your watchlist, it could be a good time to broaden your research and check out high growth tech and AI stocks for other ideas in the tech and AI space.

With Peloton trading at US$6.33 per share, a value score of 3, recent revenue and net income growth, plus a sizeable gap to analyst targets, you might ask: is this a reset entry point, or is the market already pricing in future growth?

Most Popular Narrative: 39.3% Undervalued

Peloton Interactive's most followed narrative puts fair value at about US$10.43 per share, versus the last close of US$6.33, implying a sizeable gap that hinges on future execution.

Ongoing operational improvements, including cost reduction efforts, optimizing indirect spend, and a strategic shift toward higher margin, asset light models, are expected to drive continued gross and net margin expansion, as reflected in recent and forecasted improvements in adjusted EBITDA and free cash flow. The long term proliferation of connected devices and IoT, coupled with increased remote/hybrid work, creates continued tailwinds for at home and digitally connected fitness solutions, enhancing Peloton's total addressable market and supporting a return to sustainable revenue and earnings growth if the company executes effectively.

Curious how modest top line growth assumptions can still support a higher value? This narrative leans heavily on margin rebuild, earnings inflection, and a rich future P/E multiple. The full story is in the details.

Result: Fair Value of $10.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story can crack if hardware and subscription demand softens further, or if competitive pressure and higher churn make margin rebuilding much tougher than expected.

Find out about the key risks to this Peloton Interactive narrative.

Another angle on valuation

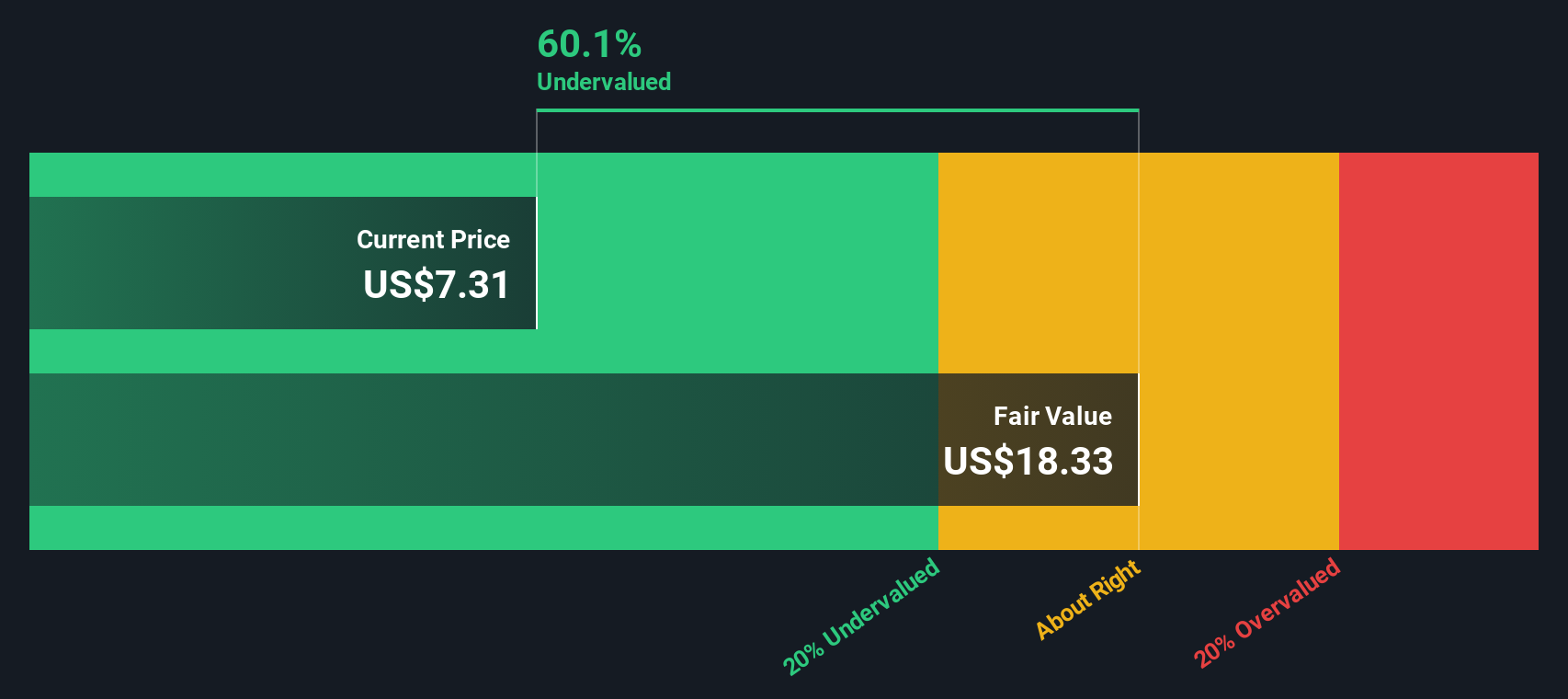

Our SWS DCF model for Peloton points to a fair value of about US$19.66 per share, compared with the current price of US$6.33. That gap suggests the market is heavily discounting the long term cash flow story. Is this a warning sign or an opportunity if the forecasts hold up?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Peloton Interactive Narrative

If you see Peloton’s story differently, or simply prefer to work from the raw numbers yourself, you can build a fresh view in minutes with Do it your way.

A great starting point for your Peloton Interactive research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Peloton is on your radar but you do not want to rely on a single story, you can cast a wider net with a few focused stock screens today.

- Target potential bargains by checking out these 863 undervalued stocks based on cash flows that currently screen as cheap based on their cash flows and might fit a value driven watchlist.

- Zero in on growth themes by scanning these 24 AI penny stocks that are tied to artificial intelligence and could bring a different risk and reward mix.

- Add some diversity by reviewing these 80 cryptocurrency and blockchain stocks that give you exposure to cryptocurrency and blockchain related business models alongside more traditional holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Is Global Payments (NYSE:GPN) The Undervalued Cash Cow Your Portfolio Needs?

Broadcom - A Fundamental and Historical Valuation

Hims & Hers Health aims for three dimensional revenue expansion

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026